Is Ethereum price at risk of falling with falling NFT volume?

- NFT trading volume on Ethereum fell 28.5% week-on-week, $22.34 million in digital assets were traded on the ETH network.

- Analysts claim that the decline in NFT trading volume is an indicator of a fall in Ethereum prices.

- Analysts predict that a pullback to $1,500 is likely, but Ethereum’s bullish wave is not over yet.

NFT trading volume fell rapidly on the Ethereum network, with digital art’s contribution to activity on ETH shrinking. Analysts believe NFTs are dominant gas consumers on Ethereum and a decrease in volume could lead to bearish sentiment among ETH holders.

Also read: Three Reasons Why Proof-of-Work ETH1 Will Survive Ethereum Merge

Why the NFT activity decline on Ethereum is significant

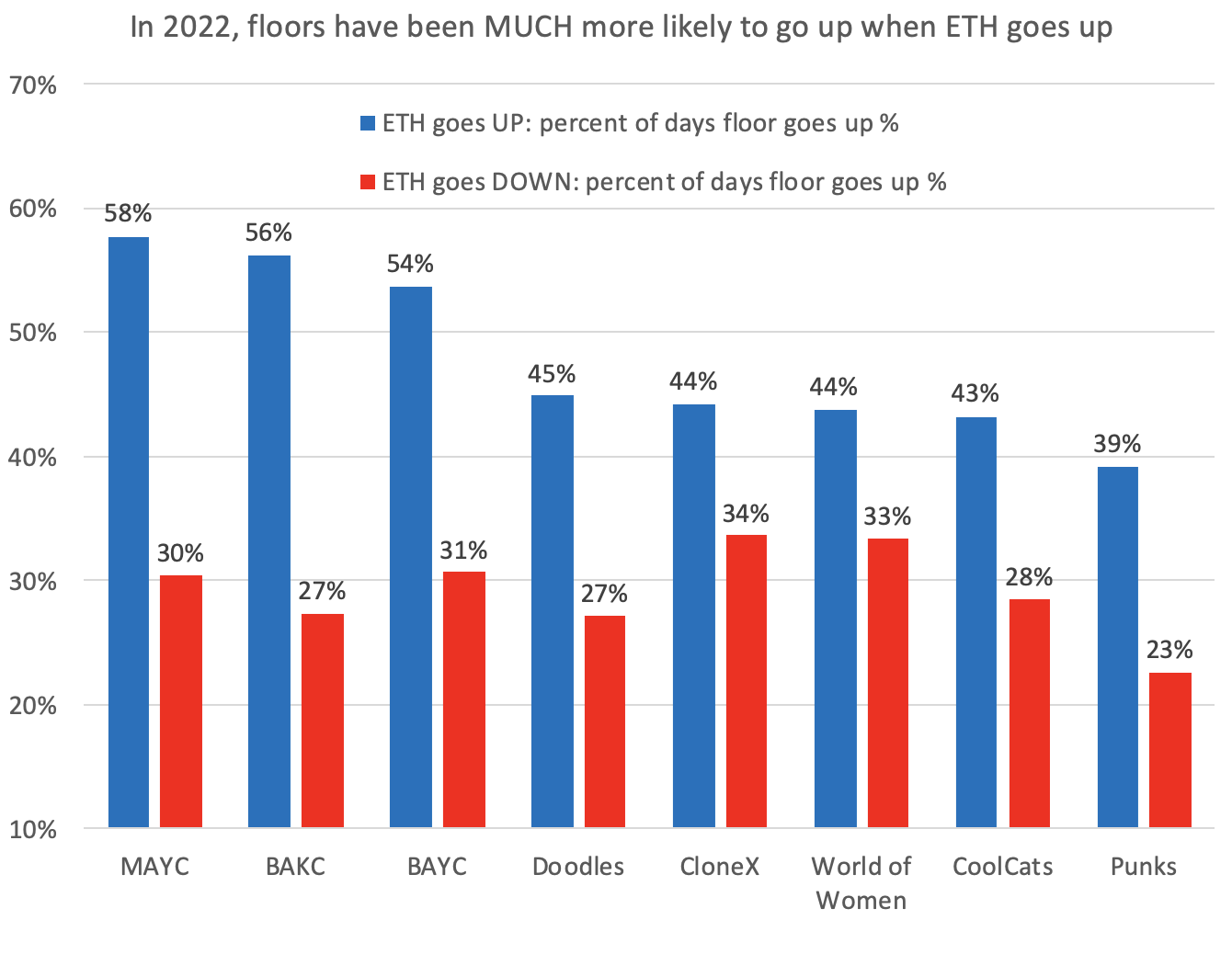

The STACKS podcast recently explored the relationship between Ethereum and NFT floor price. Punk9059, leading influencer and authority on NFT Twitter joined the podcast to share his thoughts on the relationship between the second largest cryptocurrency and NFT floor prices.

When Ethereum is rising, which has historically been positive for NFT prices, although most investors price their digital art and collectibles in ETH. Punk9059 believes Ethereum price and NFT floor prices have one direct correlation.

Relationship between Ethereum and NFT floor prices

ONE decline in Ethereum price resulted in capital outflow from NFTs, as investors pulled cash out of volatile assets including jpegs. Therefore, higher Ethereum prices are the dream scenario for NFT holders as it drives floor prices higher.

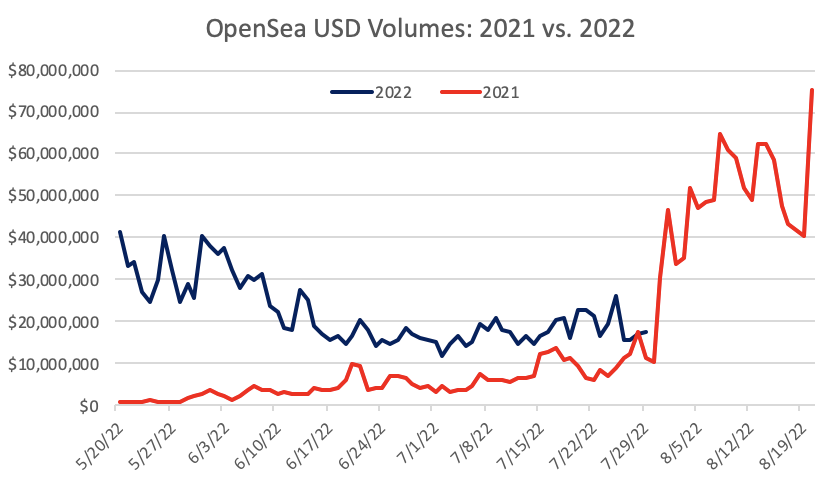

From and including 30 July monthly volume for NFT marketplaces is $626.11 million, down 41% from June 2022. An interesting insight is that July is the first month when there were more unique sellers than buyers. Unique buyer and seller wallets outperformed volumes.

30 July 2022 was the first time NFT volumes fell year-on-year.

OpenSea USD volume: 2021 v. 2022

Ethereum’s dominant gas consumer, NFTs suffering from a decline in trading volume. Checkmate, a leading analyst, considers this a sign of declining demand. Therefore, Ethereum price may fallin line with reduced demand.

NFTs are the dominant gas consumer on Ethereum, and have been for some time.

This is low demand.

Be careful with prices folks, don’t see demand growth to support it.

— _Checkɱate ⚡ (@_Checkmatey_) 31 July 2022

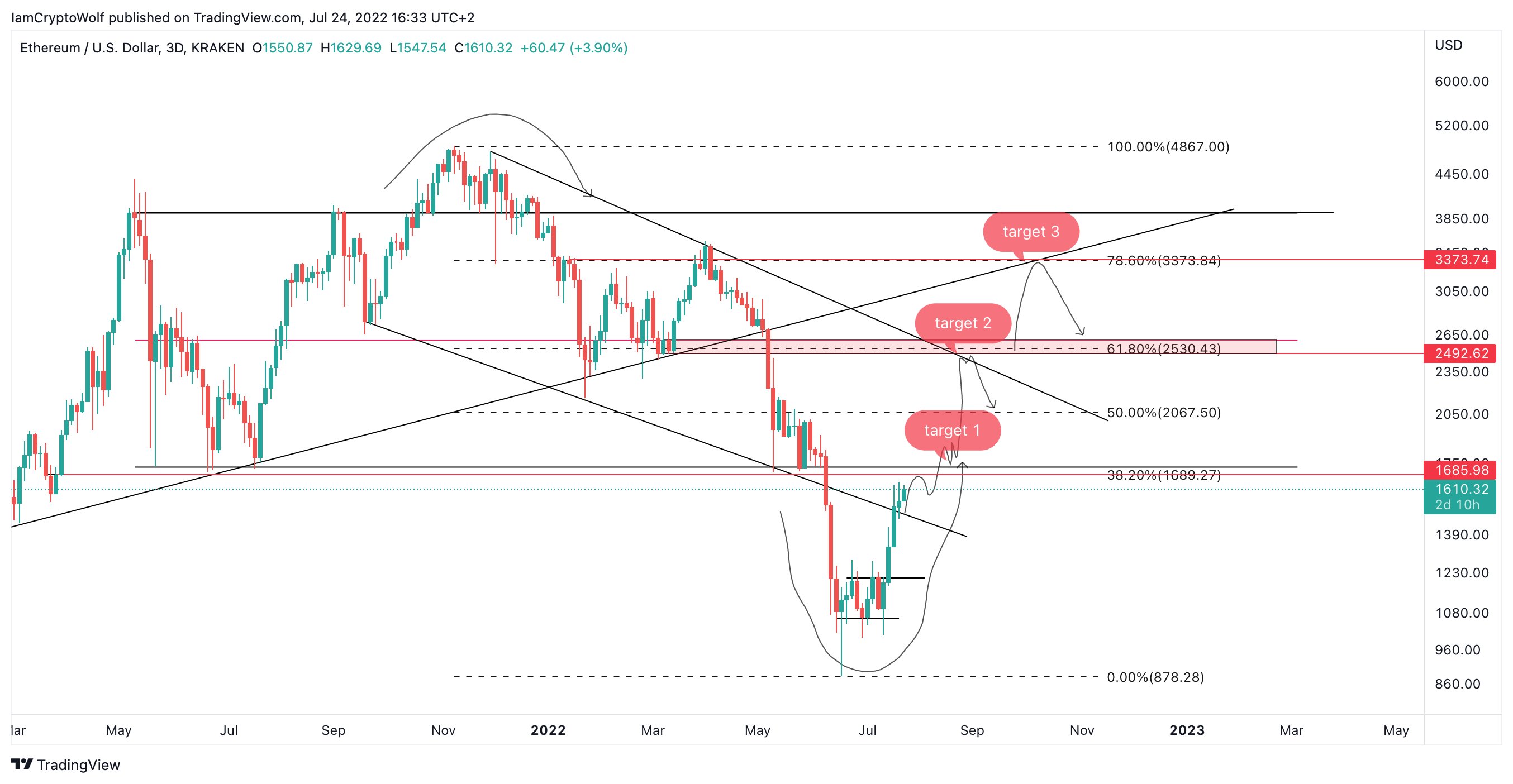

Analysts predict Ethereum price to fall back to $1,500

Wolf, a pseudonymous cryptoanalyst, sees Ethereum’s mining that started on July 22, 2022 as a V-shaped. The first target of $1,685 was hit, and the analyst’s next two targets for ETH are $2,492 and the third is $3,373. The analyst claims that Ethereum price pullback to $1,500 is justified, given that it completes the V-shaped recovery predicted in his roadmap for the altcoin.

ETH-USD price chart

Analysts at FXStreet, meanwhile, examine the possibility of the Ethereum price falling to $300 in their recent video. For more information, check out the video below: