How Bitcoin Price May React as Institutional Interest Fades

Bitcoin (BTC) drop to the $18,500 level has surprised the market as retail and institutional investor interest takes a strange turn.

Bitcoin has maintained its price movement below the psychological barrier of the $20,000 mark. As long-term trends painted a rather skewed picture of the larger cryptocurrency market, certain trends pointed toward higher volatility and market skepticism in the near term.

Over the past few weeks, anticipation of the Ethereum merger has largely overshadowed waning institutional interest in the top crypto asset as significant price swings became the norm.

Institutional investors are cautious

On September 19, BTC traded at a daily low of $18,232, but managed to break above the $19,000 mark. However, a worrying sight was that the market volume of the Grayscale Bitcoin Trust (GBTC) fund received very low interest from institutional investors.

GBTC is the leading player in the Bitcoin market among similar institutions. GBTC’s fund market volume shows almost no interest among corporate (institutional) players. Usually, such falling interest trends highlight that BTC’s price is prone to falling or is in a distribution phase.

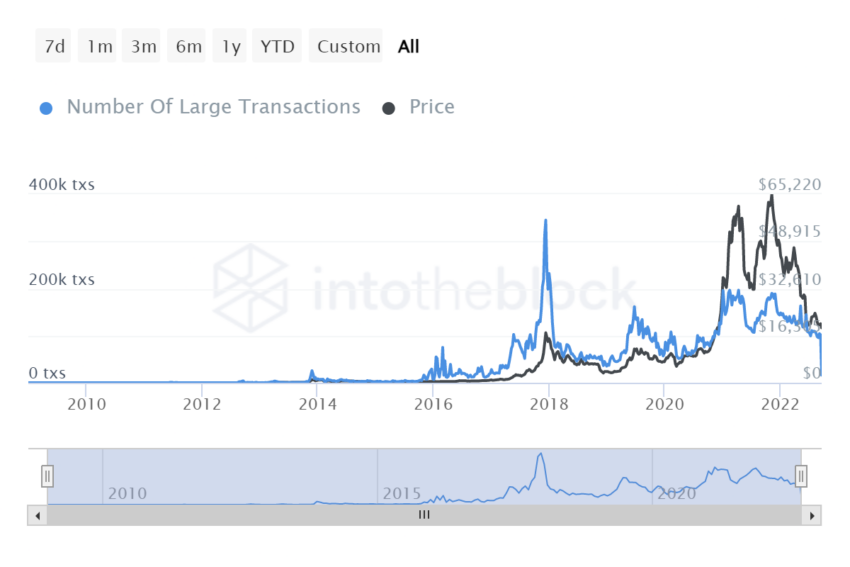

On the contrary, a sudden increase in fund market volume can lead to a parabolic rise in prices. For now, however, the number of large transactions, according to data from IntoTheBlock, has also made a downward slope highlighting that large units and larger transactions were on the way down along with the BTC price.

Fewer large transactions taking place on the network further point to lower activity from institutional investors or large market entities.

Bitcoin struggles with $20,000

Bitcoin charted a price rally towards the upper $22,700 price level on September 13 as investors and traders anticipated further gains. However, a quick u-turn amid lower retail volumes brought BTC’s price back to the $19,000 range.

At press time, BTC’s next solid resistance levels stand at $20,000 and $21,500. Bitcoin’s price will need a quick push from bulls to establish itself comfortably above these key resistance levels.

Nevertheless, a positive view in the eyes of investors is the high trading volumes on exchanges, indicating continued retail interest in BTC. However, for long-term price growth, BTC will need additional support from institutions which is currently lacking.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.