Web3 for good, blockchain construction, rising VC and more: Here are our 5 trends in #CryptoCapital

By Riley Kaminer and Nancy Dahlberg

There may be crypto winters in some parts of the world. But in Miami, many corners of the crypto community are (almost) as hot as our August weather.

We’ve been busy covering Miami’s best web3 stories. Did you miss someone? Don’t worry – here’s a rundown of 5 don’t-go trends in #cryptocapital.

1. Web3 as a force for good

Increasingly, we see founders using web3 as a tool to create positive social change. These companies are doing well while doing well, no doubt – all with Miami in the background.

One company that encapsulates this trend is The Giving Block, which brings philanthropy into the web3 space by enabling nonprofits to accept crypto donations. The company has already begun to make an impact on this $471 billion industry, having accepted about $70 million in donations last year alone.

“We started to realize what a big donor demographic crypto users would become, and how very few nonprofits at the time were even thinking about crypto—much less accepting it,” said co-founder Alex Wilson Update Miami in May. The Giving Block’s infrastructure has enabled over 2,000 charities to accept crypto.

The Miami entrepreneurs are also harnessing the power of the blockchain to create positive social outcomes.

Take, for example, BH Compliance. The Chilean-born startup, led by Susana Sierra, has developed a blockchain-based platform to monitor and measure compliance programs for companies. Meanwhile, Spanish startup ClimateTrade moved its headquarters to Miami amid plans to expand its decarbonization platform in the state. ClimateTrade uses blockchain technology to power its carbon offset marketplace.

The international focus of these web3-for-good companies does not stop there. Wayru raised a seed round of $1.96 million to deploy a decentralized network of internet providers in areas of developing countries such as Ecuador that currently lack internet connectivity.

2. “Building” on the blockchain goes physical with construction startups

Construction is a constant in life in South Florida. So it is only natural that a smattering of startups have started to develop web3 tools for the construction industry.

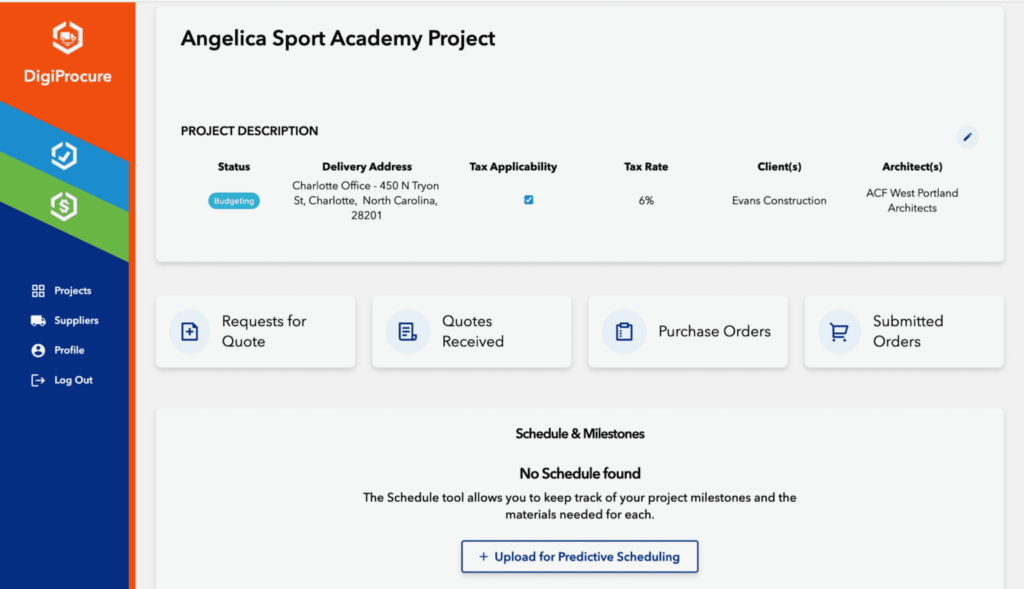

DigiBuild in July landed $4 million in seed funding for its blockchain-based construction management platform. The startup’s main product, DigiProcure, is a materials management and procurement tool that automates administrative processes for contractors.

The blockchain aspect of DigiBuild’s platform facilitates communication between the dozens of companies involved in each construction project. “Every business party has a different version of the same paperwork,” said co-founder and CEO Robert Salvador Update Miami. Moving all of this to the blockchain will create a single source of truth – streamlining and digitizing this mountain of paperwork.

A month earlier, Rigor landed a $3.5 million seed round to develop their platform for community lending and instant payments for new construction. They utilize the blockchain to simplify loan origination and administrative processes, and provide increased transparency along the way.

3. The NFT market shows signs of cooling down

Compared to the amount of news we saw earlier this year, the Miami NFT scene seems to be experiencing a bit of a summer slump. (Or maybe the NFT founders just escaped the heat of South Florida?) That said, there have still been some notable movements in the NFT space.

OneOf recently announced an $8 million fundraise to bring more musicians, athletes and brands to their NFT marketplace. This infusion of capital will ultimately help the startup play its part in bringing 100 million users into the NFT and blockchain space. In addition to signing deals with influential figures such as Wayne Gretzky and Doja Cat, OneOf has made a name for itself by developing a platform that is both more environmentally and user friendly than its rivals.

In June, Only Gems launched its front-end marketplace where consumers can buy, sell, trade and create NFT trading cards. Collectors can hand over their physical cards to the Fort Lauderdale-based startup and then create an NFT version, creating a digital asset on the Ethereum blockchain.

Update Miami caught up with RECUR co-founder and CEO Zach Bruch at Permissionless in Palm Beach. The upscaling is helping big brands like Paramount and Nickelodeon launch their very own NFT experiences. Now RECUR has expanded access to their platform, sharing their special sauce for NFT success with smaller brands and creators.

4. Miami’s metaverse scene is maturing

Two trends emerge from Miami’s maturing metaverse scene.

Trend #1: The Metaverse is fun.

Chilean VR startup InBattle set up shop in Miami to launch a free roaming gaming experience in Wynwood’s newest VR arena [pictured at top of post]. The company has also set up an office for its development team right next to the arena to maximize opportunities for user feedback.

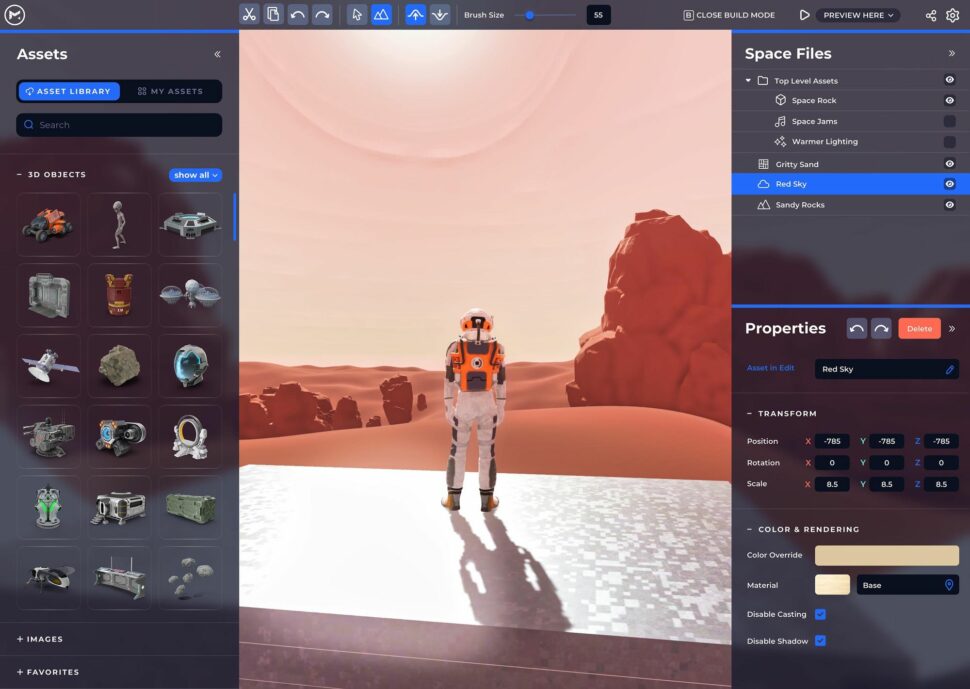

Meanwhile, The Mirror has developed a platform for users to build, learn and play in the metaverse. Founder Jared McCluskey, an OpenStore alum, highlighted the interoperability of the platform as a key differentiator. “This creates opportunities that have never existed before,” McCluskey said Update Miami.

Trend #2: The Metaverse is functional.

Take YUPIX, which brings the high-end real estate game into the 21st century by building immersive virtual experiences for real estate buyers. They have already helped Property Markets Group close a $700 million sale for E11EVEN Hotel & Residences.

Mytaverse has also built immersive digital environments – but this time for companies that, for example, want to showcase a product or hold a virtual event. The platform is hardware agnostic, meaning users can launch it on any device they already have, including their computer or mobile phone. The startup has raised $10.3 million so far and counts companies such as Pepsi and architect Zaha Hadid as clients.

5. SoFla funding rounds bring warmth to crypto winter

Venture capital rounds for South Florida startups focused on blockchain, crypto and/or NFTs are scorching hot, even with the recent cryptocurrency market crashes ushering in the so-called crypto winter. So far this year, at least $836 million in funding rounds across 24 deals have been announced — about a quarter of all VC dollars flowing to South Florida companies. Sleepy summer? No way: $105 million of that came in just in the last month. Notably, activity to date is already ahead of the pace of 2021, when $859 million was raised by 23 companies in the Miami metropolitan area.

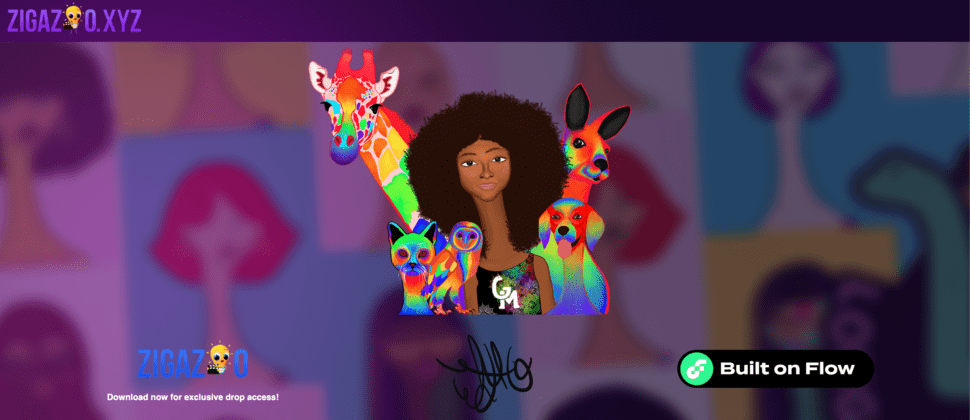

Of course, 2022 got off to a strong start, and we can thank our favorite monkeys for bringing in a good chunk of it: Yuga Labs raised the biggest round of the year, raising $450 million led by a16z. Major funding this summer included Miami startups OnChain Studios’ $23M Series A, also led by a16z, to bring these adorable Cryptoys to digital life, as well as beloved Mattel brands; Zigazoo’s $17M celebrity-studded A round to expand its safe, positive social media network for kids; and Halborn’s $90 million round to keep the blockchain secure. We hear there are several big rounds on the runway.

On the money side, there has also been big news this summer. Andreessen Horowitz, which launched a record $4.5 billion crypto fund in May, said it would open an office in Miami Beach, taking over an entire floor with a private terrace at the new Starwood Capital Group headquarters at 2340 Collins Avenue by year. end. “Establishing a long-term presence in Miami Beach helps us expand our work in the area to collaborate with founders in new ways, build lasting relationships and support the area’s already thriving tech community,” Phil Hathaway, a16z’s COO, said last month. Protagonist, a crypto fund and incubation lab, also announced the launch of its $100 million fund dedicated to investing in web3 protocols.

Will #CryptoCapital continue to turn up the funding heat or cool down? Watch.

READ MORE NEW #CRYPTOCAPITAL NEWS AT REFRESH MIAMI: