GLD: $5,000 Bitcoin Could Be a 2023 Black Swan

advent tree

Thesis

In investing, linear thinking is easy and pretty useless. It just lets you see what others are seeing too. The key is about non-linear thinking and seeing 2n.d order effects. And that is thesis in this paper to investigate both the linear and non-linear catalysts around gold. In particular, I will use the SPDR Gold Trust ETF (NYSEARCA:GLD) and the iShares Gold Trust ETF (IAU) as examples to illustrate the role of these catalysts.

Most gold investors are familiar with the linear catalysts for a gold bull thesis such as a weakening dollar and negative real interest rates. And I will briefly summarize them later in this article. However, the core thesis of this paper is built around a 2n.d order and nonlinear catalyst: the price of Bitcoin (BTC-USD).

Eric Robertsen, head of research at Standard Chartered Bank, laid out some possible black swans for 2023. The best black swan event in his mind involves Bitcoin. He sees the possibility of Bitcoin prices crashing to $5,000 from today’s levels. As a 2n.d order effect, such a collapse could push gold prices to $2,250 per ounce for the reasons he explained below (emphasis added by me):

Eric Robertsen stated in the note that considering a number of factors such as insufficient funds or bankruptcies resulting in several crypto service providers packing up, more investors are likely to start developing cold feet and will continue to withdraw their assets. This he said, will most likely lead to investors’ attention being directed towards the good old gold. Robertson predicted that the price of gold could rise to around $2,250 an ounce, which is about a 30% increase.

I see his reasoning as highly plausible, as detailed below.

GLD, IAU and gold: the basics

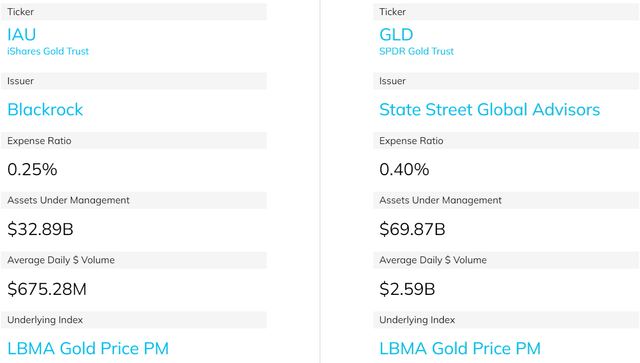

Before I go any further, let me quickly introduce the gold ETFs (GLD and IAU) that I will use interchangeably as gold in the rest of this article. As you can see from the following chart, both GLD and IAU are indexed to the same LBMA gold price, and investments in both funds are backed by physical gold bullion.

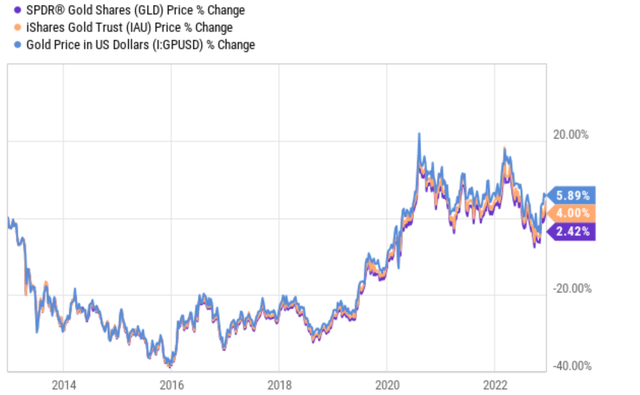

As you can see from the second chart below, both the GLD and the IAU’s price actions have followed gold prices closely. Although in the long term some deviations can be observed mainly due to the fees charged by the ETFs. Over the past ten years, gold prices have risen overall by 5.8%. In contrast, the IAU’s price has risen by 4.0%, 1.89% below the price of gold itself. The price of GLD has risen by approx. 2.42%, approx. 3.4% below the gold price itself. The main reason for this discrepancy is that IAU takes a lower expense share of 0.25% while GLD takes a higher expense share of 0.4%. And such divergence caused by the fees is the main reason why we actually hold IAU itself instead of GLD.

However, for a shorter time frame (which is the time frame with which this article is mainly concerned), the deviations between IAU, GLD and gold prices are negligible. And that is why in the rest of this article I will treat them as interchangeable.

Source: ETF.com Source: Seeking Alpha data.

GLD and Bitcoin

Now back to GLD and Bitcoin. There are a few important reasons that led me to believe that Eric Robertsen’s thinking above was very plausible. Fundamentally, Bitcoin is considered a separate asset class, meaning separate from other traditional assets such as gold, stocks, bonds and et al. And as a result, with Bitcoin prices collapsing due to various reasons (such as the FTX scandal), investors will have to look for other assets. And the “good old gold” that Robertson mentioned is quite attractive. It has actually been an attractive asset for thousands of years, but there are several reasons why gold is extra attractive in current conditions to be deepened later.

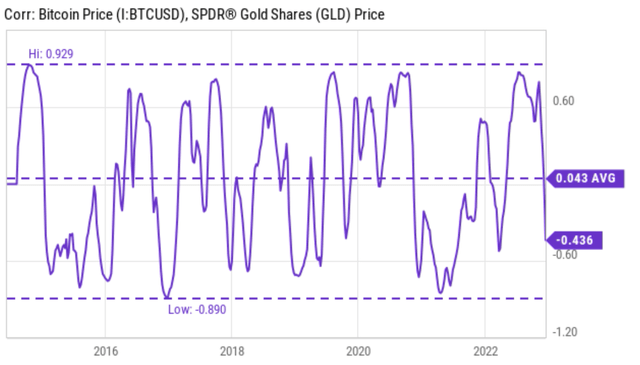

To support the reasoning above, the next chart shows that GLD and Bitcoin were weakly correlated historically and are negatively correlated now. As seen, the correlation between GLD and Bitcoin prices has fluctuated over the past 10 years between 0.929 and -0.89. And the average is a very small 0.043. Currently, the correlation is at 0.436, a fairly strong negative correlation.

Source: Seeking Alpha data.

$2250 Gold is not that expensive

Also, a gold price of $2,250 is not that high at all the way I see things. Currently, gold prices are at $1,792.7 at the time of writing. So a gold price of $2,250 represents an increase of about 25% from today’s level. Assuming GLD prices track gold prices exactly in the short term (as established earlier), this will also lead to a 25% increase in GLD prices.

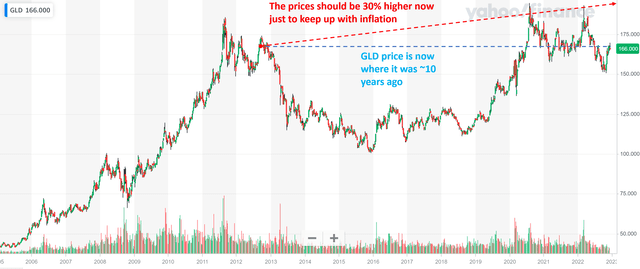

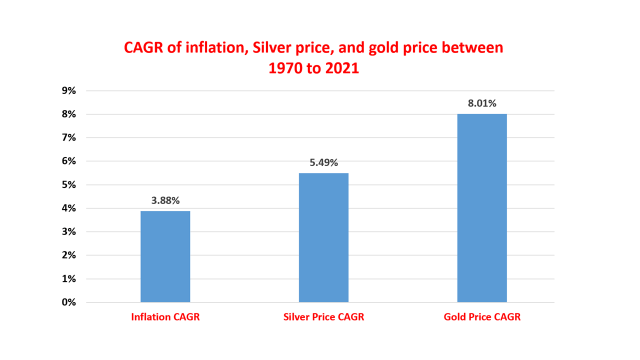

As you can see from the chart below, GLD’s current price of $166 is about the same as it was in 2012. The cumulative inflation since 2012 is about 30%. So the GLD price should have been 30% higher than today’s level if it had only kept up with inflation, let alone the fact that gold price appreciation has outpaced inflation over the longer term historically, as you can see from the second chart below.

Source: author based on Yahoo data. Source: author based on data from Seeking Alpha

Risks and final thoughts

The main risks associated with GLD (or IAU or gold ETFs) in general have been described in my previous writings and are briefly summarized here:

- Gold prices are subject to great volatility, greater than the S&P500 index by a wide margin.

- Neither IAU nor GLD pay dividends.

- IAU’s expense ratio is relatively lower than GLD’s, but the operative word here is relative. An expense ratio of 0.25% is still high compared to other asset classes. For example, it is about 10 times higher than our other core funds such as VTI (whose expense is 0.03%).

- And finally, winnings from both IAU and GLD are taxed at the same maximum tax rate as collectibles.

To summarize, most gold investors are familiar with the linear catalysts for a gold bull assignment under current conditions. These catalysts include the end of the dollar strengthening, negative real interest rates, and also a hedge against further escalation of geopolitical risks such as the Russia/Ukraine situation.

The core thesis of this paper is built around a 2nd order and non-linear catalyst: the price of Bitcoin. I see Eric Robertsen’s thinking about Bitcoin as a black swan in 2023 is very plausible given the Bitcoin crash so far and the unfolding FTX scandal. I see such events creating a 2nd order catalyst to push the gold price to $2,250, about 25% above today’s level.

And a gold price of $2,250 is not that high at all the way I see things. A 25% increase from today’s level doesn’t even account for the inflation accumulated over the past 10 years, and remember that gold price appreciation has far outpaced inflation over the long term.