Ethereum Blockchain Validator Revenue Soars After FTX Collapse

- FTX, the third largest crypto exchange, filed for bankruptcy on November 11, 2022.

- How did FTX Crash help Ethereum Blockchain Validator?

The FTX exchange collapsed in the second week of November and went bankrupt the same week.

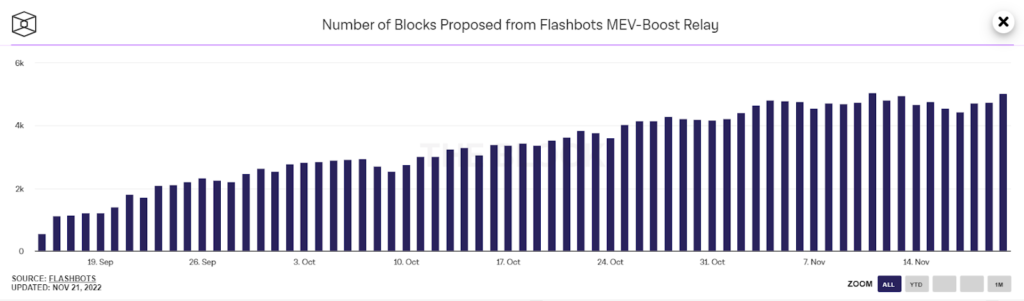

According to data from Flashbots, Ethereum validators who followed the historical merger responsible for the operation of the blockchain have made an impressive profit from the MEV (Maximal Extractable value) increase as FTX crashed.

What is MEV and why is it important?

When the transactions of some users are initiated, they are stored in the mempool and the miners task is to pick a bunch of transactions from the pool, arrange them in order and start validating the transactions according to the order.

After the transaction’s validations, miners add them to the blockchain. Nevertheless, occasionally, if the miner uses arbitrage to earn an additional amount other than the gas fees for validation, it is termed as maximum recoverable value.

Many crypto specialists believe that using this technique to earn extra ETH is unfair to the ecosystem.

The most common tool that Ethereum validators can use is MEV-Boost that Flashbots developed; the boost allows validators to request blocks from a network of builder validators that connect to MEV-Boots through relays like the one Flashbots run to serve MEV.

According to data, users of MEV-Boost of Flashbots earned about 3203 ETH rewards on November 9, 2022.

Although MEV-Boost is the first tool and Flashbots currently dominates with around 79 percent of relay blocks, their data set shows the majority of data showing MEV activity.

Chris Piatt, co-founder of Eden Network, said, “Volatility is MEV fuel,” and “Any big news like the FTX stock market collapse that moves markets correlates with strong builder/applicant performance.”

MEV’s surge in activity came as the market was under a lot of fear, with one of the biggest crypto exchanges threatening to dump over two million worth of FTT tokens.

After this threat, users and investors of FTX started saving their deposits from FTX and large withdrawals led to FTX crash.

Toni Wahrstatter, an Ethereum researcher who developed his MEV-Boost monitoring dashboard, said: “The more action in the market, whether it’s up or down, the more MEV,” he added “Theoretically, if it’s not someone who acts, then there is no MEV either.”

According to media sources, earlier in October, Robert Miller, an employee of the research company Flashbots posted on Twitter how a Maximal Extractable Value (MEV) bot with the prefix 0xbadc0de was able to obtain 800 Ether (ETH), valued at around $1 million , by arbitrage trading.

In line with Miller, the bot capitalized on a huge arbitrage opportunity when a trader tried to sell $1.8 million in cUSDC of the decentralized exchange (DEX) Uniswap v2 and only received assets valued at $500 in return.