Ether overturns Bitcoin in the options market for the first time

Ether (ETH), the original token of Ethereum’s blockchain, has surpassed industry leader bitcoin (BTC) in the options market for the first time on record.

At the time of writing, the cumulative dollar value of ether options contracts opened on dominant exchange Deribit was $5.7 billion, or 32% higher, than the $4.3 billion locked in open bitcoin options trades. Deribit is the world’s largest crypto options exchange, accounting for more than 90% of global total trading volume and open interest.

Open option trades or open interest refers to the number of option contracts (call and put) that have been traded, but not offset by an offsetting position. The theoretical open rate is calculated by multiplying the number of open contracts by the current spot market price of the underlying asset.

Ether’s historic first lead over bitcoin in the options market comes as traders pile into ETH calls, or bullish bets, in hopes that Ethereum’s impending merger will lead to a 90% reduction in ETH issuance and bring a store of value to the cryptocurrency. The merge, likely to happen in September, will combine Ethereum’s current proof-of-work blockchain with a proof-of-stake blockchain called the Beacon Chain, which has been in operation since 2020.

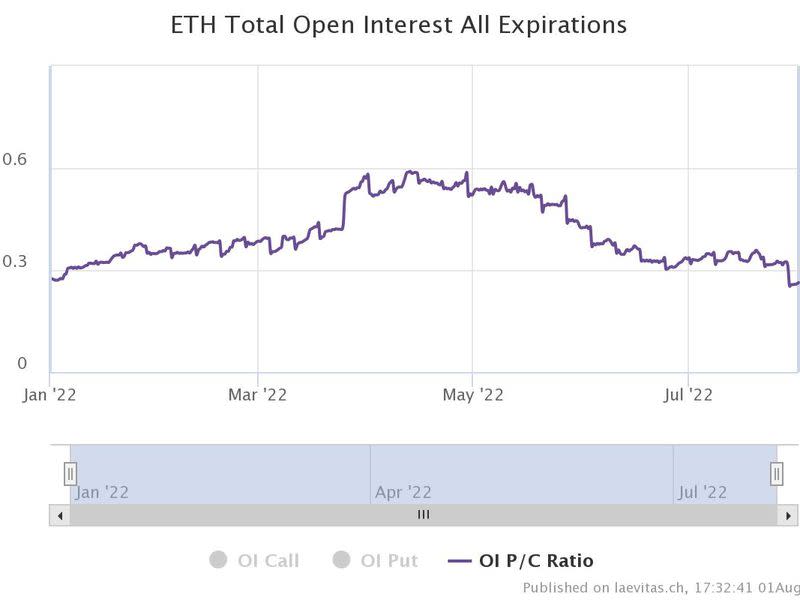

The increased demand for calls is evident from the sliding put-call open interest ratio, a measure of the number of open put positions relative to open call positions. Call options offer insurance against bullish moves, while put options provide protection against price declines.

“While some may be uncertain about the outcome of the merger, at Deribit we see a lot of post-merger open interest being created. Overall, the one-year put-call ratio is low, indicating bullish momentum,” Deribit Chief Commercial Officer Luuk Strijers told CoinDesk.

“The BTC put-call ratio is at 0.5, while the ETH put-call ratio is half that at 0.26, and year-end even again 50% lower at 0.12. The biggest ETH open interest is created in the December expiration call option at $3000 strike.” Strijers added.

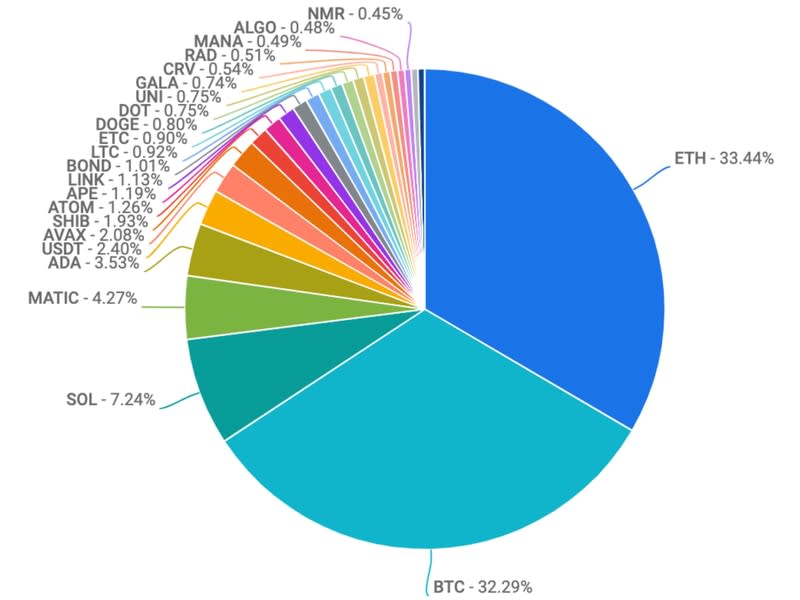

Activity in the ether spot market has also picked up, with the cryptocurrency recently toppling bitcoin as the most traded coin on Nasdaq-listed crypto exchange Coinbase (COIN). While ether trading volume accounted for 33.4% of the total turnover recorded in the week ending July 29, bitcoin trading volume accounted for 32%, with SOL in a distant third place.

“Investors have appeared to buy BTC as it has not kept up with ETH and the broader complex. Additionally, we have seen renewed interest in SOL, MATIC and AVAX,” according to Coinbase’s weekly market commentary published Friday.

That said, in terms of market cap, ether, at $199 billion, is still half that of bitcoin, whose market cap was $443 billion at press time. Some observers are sure that ether will soon replace bitcoin as the world’s largest cryptocurrency by market value.

Furthermore, ether continues to play second fiddle to bitcoin in terms of daily trading volume in the futures and options markets and open interest in the futures market. Per data provided by Skew, theoretical open interest in ether futures was around $6 billion at the time of writing. That’s half of the $12 billion in bitcoin futures.