As bitcoin races below the $20,000 region, the network’s hash rate remains high at 250.04 exahash per second (EH/s) after the all-time high (ATH) hash rate hit on October 5th. At the time of writing, the current rate at which blocks are processed is faster than the typical ten-minute average block intervals between the current block height (757,531) and the last difficulty adjustment. Statistics show that because block times have been much faster, the network could see the largest difficulty level this year, as estimates show a possible jump between 9% to 13.2% higher.

Block times and hash rate suggest a notable increase in Bitcoin mining difficulty in the cards

Bitcoin mining looks set to become much more difficult on the next retarget date which will take place on October 10, 2022. Two days ago, on October 5, the network’s total hash rate reached an ATH of 321 EH/s at block height 757,214. While the price of BTC is lower and the difficulty is approaching the final ATH, miners are relentlessly dedicating computational power to the BTC chain. Currently, the hash rate is raging at 250 EH/s after the ATH was reached on Wednesday.

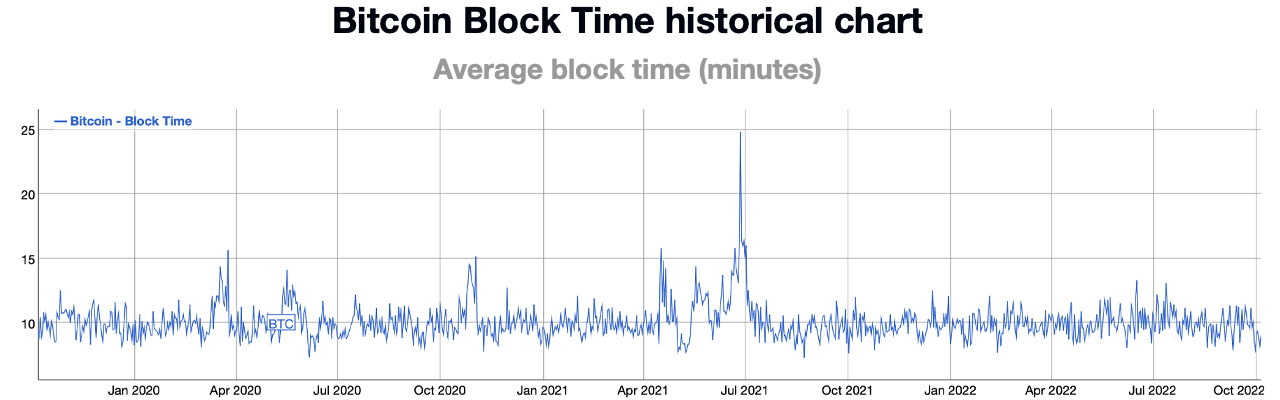

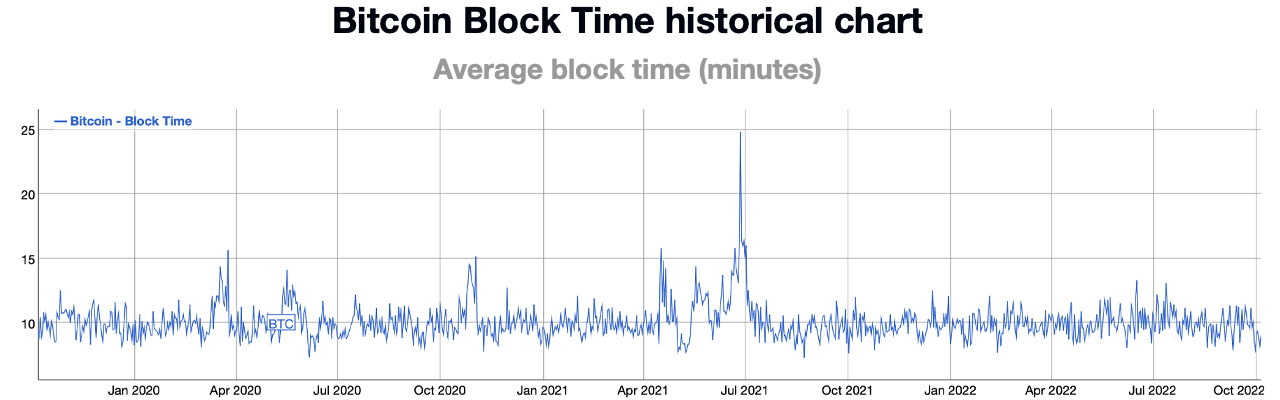

Currently, block times (the interval between each mined block) are faster than the average of ten minutes, bitinfocharts.com data shows. Currently, at 9:00 a.m. (ET), calculations show blocking times around 9:05 minutes, but other dashboards show a much faster rate at 8:49 minutes. With the average bitcoin block interval between the current high (757,471) and the last difficulty epoch (756,000) at 8:49 minutes, it means that BTC’s network difficulty is due for a notable increase. There is a chance that the October 10th difficulty jump could be the network’s highest difficulty this year.

Data from btc.com shows an increase of around 9.34%, which will surpass the network’s second largest increase in 2022. If btc.com’s estimate is correct, BTC’s network difficulty will rise from 31.36 trillion to 34.29 trillion. Calculations from Clark Moody’s Bitcoin Dashboard show that the difficulty change could be much higher, and at the time of writing, Moody’s Dashboard indicates that it could be around 13.2% higher than it is today. The Bitcoin network has about 400+ blocks left until the next retarget.

It is quite possible that the hash rate will decrease and the block times will increase back to ten minutes. If so, the difficulty percentage increase could be much lower than even Btc.com’s 9% increase estimate. Every other week or when 2016 blocks are discovered, the network difficulty is adjusted to make it either harder or easier to find a BTC block depending on how quickly the 2016 blocks were discovered.

If the 2016 blocks were found too quickly, the network’s algorithm adjusts the difficulty higher, and if the blocks are found at a much slower pace, the difficulty may decrease. The last significant difficulty reduction took place on July 3, 2021, when the difficulty dropped by 27.94% at block height 689,472. This means that it was 27% easier to find a BTC block grant than it was before block 689,472.

Tags in this story

13.2%, 2016 blocks, 34.29 trillion, 9, All time high, ATH, Bitcoin mining, Bitcoin network, block intervals, block times, Blocks, BTC Mining, BTC.com, Clark Moody’s Bitcoin dashboard, computational power, discovery rate, Hashpower , Hashrate, hashrate ATH, July 3, 2021, biggest jump, miners, mining, October 10, 2022, October 5, 2022, speed

What do you think about the possibility that Bitcoin’s mining difficulty could see the biggest jump this year? Let us know what you think about this topic in the comments section below.

Jamie Redman

Jamie Redman is the news editor at Bitcoin.com News and a financial technology journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open source and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is directly or indirectly responsible for damages or losses caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.