Cryptologgers: 2 questions about correlation

Olemedia

Although correlations are only one factor to consider when investing in Bitcoin (BTC-USD) and Bitcoin-related stocks, it remains a much-discussed topic, especially given the state of the current market. There are two separate debates we often see regarding Bitcoin Correlations: 1) how much is Bitcoin correlated to stocks and what does that mean? and 2) how well do various indirect crypto investments correlate with Bitcoin?

Question 1: How much is Bitcoin correlated to stocks and what does that mean?

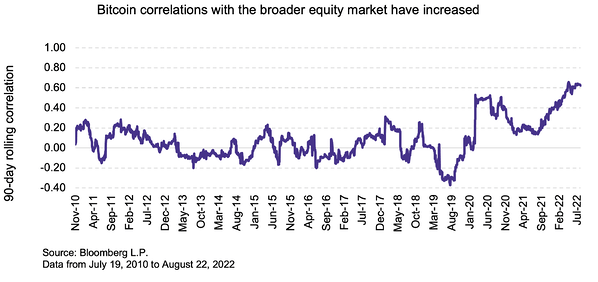

For most of Bitcoin’s lifetime, it showed low or even negative correlation to broader stocks. Due to Bitcoin’s negative correlation, it was often seen as a portfolio diversifier/inflation hedge. Over the years, correlations with stocks have increased, leading investors to wonder whether the link between Bitcoin and stocks is a long-term trend or a short-term occurrence. There are two main explanations. First and most obviously, asset classes show increased correlation in times of market volatility and uncertainty. Even the bond market, which usually shows a negative correlation with stocks, has shown an increasing positive correlation through 2022. On the other hand, some of the correlation can be attributed to the maturity of the cryptocurrency market. Since its inception less than 15 years ago, cryptocurrency’s penetration of mainstream investments has accelerated in recent years. The most high-profile IPO – Coinbase (COIN) – took place recently in April 2021, with the first US futures-based Bitcoin ETF – ProShares Bitcoin Strategy ETF (BITO) – launching six months later in October 2021. In addition, the SEC , The Fed and other financial bodies are beginning to treat crypto like any other exchange-traded security, and institutional adoption continues to grow. With limited data and no precedent, it’s hard to say what Bitcoin correlations will look like in the future. It is likely that correlations may decouple slightly as markets normalize, but correlations may still be high given market maturity. But higher correlation with stocks is not necessarily bad, especially since many investors have started using Bitcoin and Bitcoin-related stocks as a yield enhancer or as part of a larger technology allocation at levels around 1-5% of the total portfolio. With Bitcoin prices hovering above the $20,000 level, investors may see this as a good entry point to establish or add to allocations.

Bloomberg

Question 2: How well do indirect crypto investments correlate with Bitcoin?

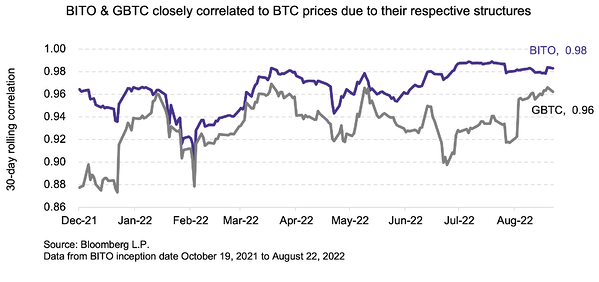

In a previous note, we discussed different ways to invest in Bitcoin, including index-based ETFs that are used to provide thematic or sector-specific exposure to crypto/blockchain companies and Bitcoin futures ETFs that track the price of Bitcoin. ProShares Bitcoin Strategy ETF (BITO) is the first and largest US futures-based ETF with $706.3 million AUM. It shares an almost perfect correlation with BTC (currently 0.98). The difference is due to rolling costs from future contracts, which create a small drag over time. YTD, the ETF has fallen over 55.3%, compared to BTC which fell 54.4% in the same time period. The Grayscale Bitcoin Trust (OTC:GBTC) also shares a high correlation with Bitcoin prices; however, the trust price differs from Bitcoin prices due to its premium/discount mechanism. Right now, GBTC is currently trading at a 32.5% discount to its underlying assets, and its price has fallen 62.2% YTD.

Bloomberg

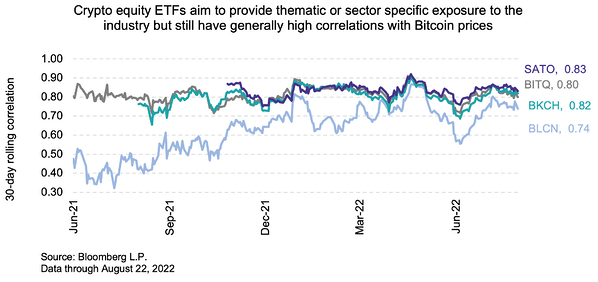

Although index-based crypto ETFs do not aim to directly track the price of crypto, most of these ETFs share relatively high correlations with the price of Bitcoin depending on their holdings (discussed in more detail in the table below). Those that hold mostly pure crypto stocks like the Bitwise Crypto Industry Innovators ETF (BITQ) and the Global X Blockchain ETF (BKCH) have correlations closer to 0.80. Thematic ETFs that have more diversified holdings such as the Siren Nasdaq NexGen Economy ETF (BLCN) may have slightly lower correlations. Although the Invesco Alerian Galaxy Crypto Economy ETF (SATO) also has some diversified holdings, it has around a 0.83 correlation with BTC because it has an approximate 15% allocation to GBTC.

Bloomberg

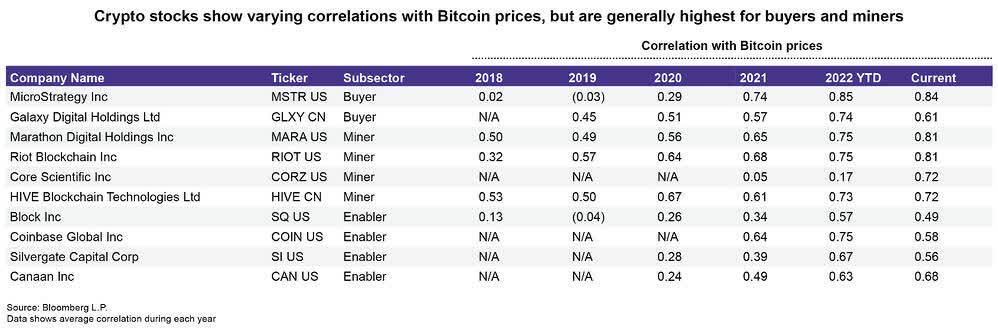

The table below provides a further look at crypto ETFs and indices by examining correlations between individual crypto stocks and Bitcoin prices. These currently range from about 0.60 to 0.85. The correlations are highest for companies such as Microstrategy (MSTR) that have a large amount of Bitcoin on their balance sheet as an “acquire and hold” strategy (as of June 30, 2022, the company had 129,699 bitcoins on their balance sheet). Crypto miners also share high correlations with Bitcoin as they derive most of their profits based on the price of Bitcoin mined, but can vary based on how well they manage power costs and overheads. Correlations for exchanges and banks are still relatively high, but lower than other parts of the crypto ecosystem, as their profits also come from volumes, fees and commissions.

Bottom line:

While Bitcoin’s correlation with broader stocks remains high, it is difficult to separate short-term from long-term trends given continued market uncertainty and a relatively short historical data set. Higher correlations with stocks are not necessarily bad, especially for investors who use Bitcoin and Bitcoin-related stocks as part of a larger allocation to the technology sector or as a yield enhancer.

The Alerian Galaxy Global Cryptocurrency-Focused Blockchain Equity, Trusts and ETPs Index (CRYPTO) is the underlying index of the Invesco Alerian Galaxy Crypto Economy ETF (SATO).

© Alerian 2022. All rights reserved. This material is reproduced with the prior permission of Alerian. It is provided as general information only and should not be taken as investment advice. Employees of Alerian are prohibited from owning individual MLPs. For more information about Alerian and to view our full disclaimer, visit Disclaimers | Alerian.

Original post

Editor’s note: The summary points for this article were selected by the Seeking Alpha editors.