Bitcoin Price Prediction As $40 Billion Trading Volume Comes In – Here Are Key Levels To Watch

Bitcoin’s price has been on the rise, with a trading volume of $40 billion in the market. The BTC/USD pair has fallen less than 1% in the last 24 hours and is currently trading at $24,372.00. Despite this latest decline, its value has seen a noticeable increase of over 11% over the past seven days.

This surge has brought renewed attention to the world’s most famous cryptocurrency, and investors are eagerly looking for the next key levels to watch.

Let’s take a closer look at the main fundamentals of the cryptocurrency market that can affect the overall price movement.

SEC Regulatory Guidelines for Cryptocurrency

Chinese journalist Colin Wu shared an article on his official Twitter account on February 19, written by Bloomberg Opinion Columnist Matt Levine, which sheds light on the Securities and Exchange Commission’s (SEC) regulations regarding cryptocurrencies.

Wu drew attention to Levine’s perspective on the SEC’s ability to identify tokens as securities, thereby highlighting the regulator’s authority to create and control the regulatory framework for the cryptocurrency industry. Levine also discussed the possibility that “regulatory investment advisers” could have an indirect role in regulating cryptocurrencies.

Matt Levine, a Bloomberg Opinion Columnist, highlighted the Securities and Exchange Commission’s (SEC) use of financial advisors to indirectly make rules for the cryptocurrency sector.

In addition, the SEC regulates investment funds, which means that cryptocurrencies also fall under its purview. In light of regulatory reassurances about the cryptocurrency sector, investors have re-entered the volatile digital asset market, leading to BTC/USD strengthening.

Bitcoin Ordinals

Ordinal Inscriptions are a new type of digital asset launched in January 2023. They are unique in that they are printed on a satoshi, which is the smallest unit of value in the Bitcoin currency, and they are similar to non-fungible tokens (NFTs) .

Since the end of January there has been a considerable increase in the demand for Ordinal inscriptions. As of 19 February, there were over 150,000 inscriptions in circulation.

The Ordinals protocol provides a new use for the Bitcoin blockchain by enabling users to print references to digital art in small payments, creating Bitcoin-based non-fungible tokens (NFTs). This protocol has already gained considerable popularity since its launch in January 2023, with over 150,000 inscriptions made by February 19.

By promoting the creation of Bitcoin NFTs, the Ordinals protocol has the potential to improve the network security of the cryptocurrency, while incentivizing developers to add innovative features. In addition, it is noteworthy that the launch of the Ordinals protocol coincided with a noticeable increase in the BTC/USD price.

Hong Kong allows retail to trade major cryptocurrencies, including Bitcoin

Hong Kong’s financial watchdog, the Securities and Futures Commission (SFC), has announced that it will allow retail to trade major cryptocurrencies such as Bitcoin. Previously, only professional investors were allowed to trade these types of cryptocurrencies due to their higher risk and volatility.

Under the new guidelines, licensed virtual asset exchanges in Hong Kong can offer cryptocurrency trading services to retail investors who meet the SFC’s suitability requirements. However, the SFC has also stated that virtual asset platforms must adopt more stringent investor protection measures for retail clients, such as enhanced disclosure and risk warnings.

This move is expected to boost the growth of the cryptocurrency market in Hong Kong, which has seen an increase in interest from both private and institutional investors in recent years.

FOMC meeting minutes Wednesday

The unveiling of the FOMC minutes on Wednesday could affect Bitcoin’s price as it sets monetary policy in the United States, and any indication of a shift in policy could affect financial markets, including the cryptocurrency market.

Speaking at the Economic Club of Washington recently, Federal Reserve Chairman Jerome Powell discussed the continuing process of disinflation and expressed optimism in the Fed’s ability to reduce inflation to its 2% target rate.

While Federal Reserve Chairman Jerome Powell’s comments on January’s strong jobs report did not reveal a change in the central bank’s future approach to rate hikes, he did offer a warning that continued robust jobs data could result in a higher terminal level for Fed funds.

At its February 2023 meeting, the Fed raised the target range for the Fed Funds rate by 25 basis points, which is now between 4.5% and 4.75%. Although borrowing costs are at their highest level since 2007, this is the second meeting in a row where the size of the increase has been reduced.

Bitcoin traders and investors will monitor the FOMC minutes for indications of inflation concerns or changes in interest rates, which could potentially affect the price of Bitcoin.

Bitcoin price

Bitcoin is currently trading sideways, and the price range has been limited to $23,700 to $25,200, from a technical perspective. The immediate resistance level for the BTC/USD pair is set at $25,200 and a breakout beyond this could take the BTC price to $26,000.

Nevertheless, the best technical indicators, such as RSI and MACD, indicate divergence. The RSI is currently above 50, which is a buy zone, while the MACD forms histograms below 0, which indicates a sell zone. This divergence usually occurs when investors are uncertain.

If Bitcoin’s price falls below the current support level of $23,750, the next support level will be at $22,850, which is determined by the 50% Fibonacci retracement mark.

Investors will be closely watching the FOMC meeting minutes due to be released on Wednesday. These minutes could potentially affect the price action of Bitcoin in the coming week.

Buy BTC now

Bitcoin Alternatives

CryptoNews has published a detailed review of the top 15 cryptocurrencies that investors should consider for 2023. The report is designed to help investors make informed investment decisions.

In addition to cryptocurrencies, there are other investment opportunities with the potential for high returns that investors may want to consider exploring.

Disclaimer: The Industry Talk section contains insights from crypto industry players and is not part of the editorial content of Cryptonews.com.

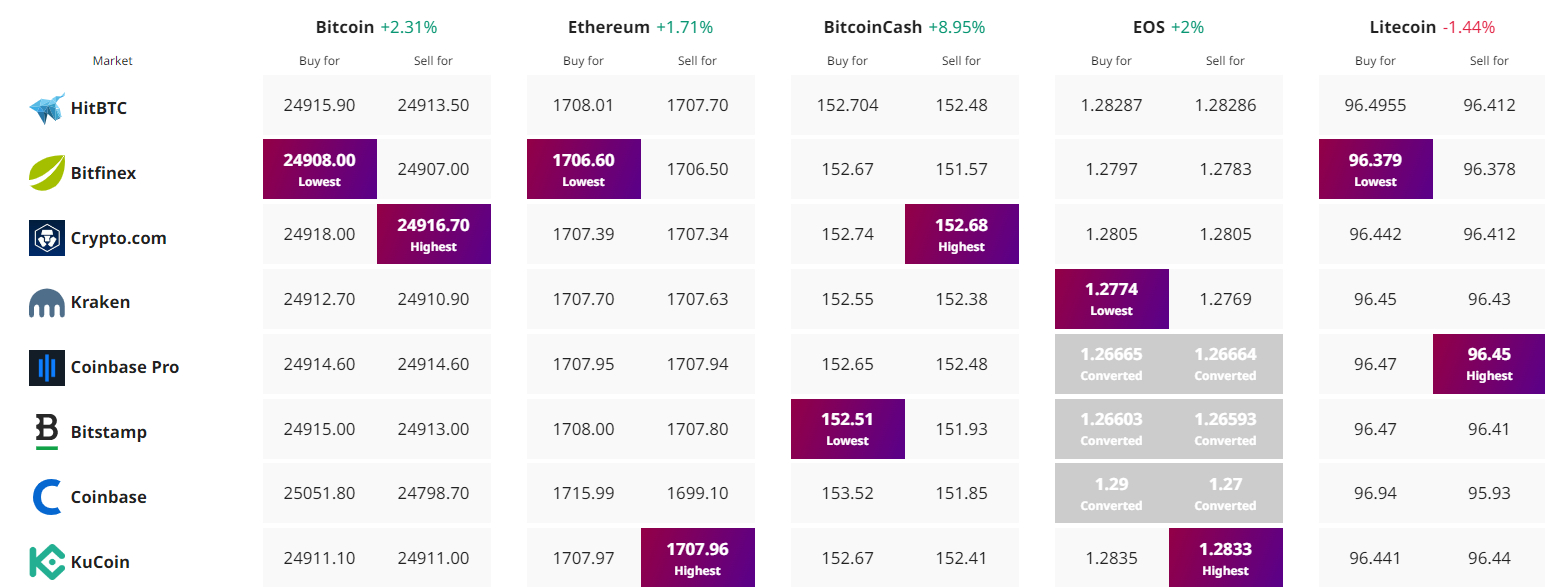

Find the best price to buy/sell cryptocurrency