Bitcoin Price Analysis: Bearish Load Brings Price Below $18,318 As BTC Experiences 3.77 Percent Loss

Bitcoin price analysis for today shows that BTC is currently stuck in a consolidation phase around the $17,400 level. The intraday bias remains slightly bearish as long as prices trade below the $18,318 level. At the time of writing, Bitcoin is trading at $17,426 and is down 3.77 percent. The market cap for BTC is currently $335 billion, while the trading volume is $25 million.

The immediate support is $17,418. A break below this level could see BTC prices retest the $17,400 level. On the other hand, if prices manage to break above the $18,318 level, it could open up a move towards the $18,350 level.

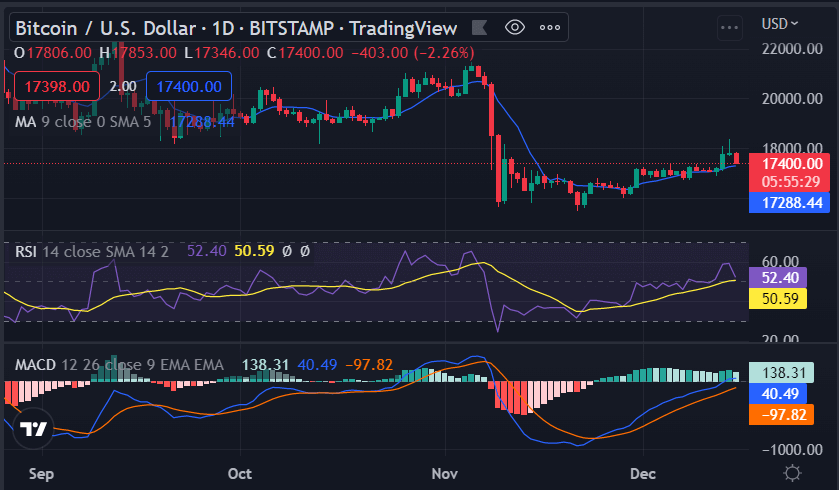

Bitcoin Price Analysis on a Daily Price Chart: Bulls Can’t Push Price Action Higher

The Bitcoin price analysis on a daily chart shows that the bulls are having a hard time pushing the price action higher. Prices have been stuck in a consolidation phase for the past few hours as the market waits for a catalyst that will push prices either up or down. The bulls seem to have been exhausted as the price has fallen to $17,426 after opening the day at $18,318. The technical indicators are giving mixed signals at the moment. The RSI is currently trading at the 50.59 level, showing that there is still some room for prices to fall further before reaching oversold territory. Parabolic SAR gives a bearish signal as the dots are positioned above the price action.

MACD, on the other hand, gives a bearish signal when the histogram is falling and is about to cross below the zero line. The MACD line is clearly below the red signal line and appears to be increasing in strength.

The 200 SMA line is well positioned below the current market price, which is a sign that the path of least resistance is still on the downside. The other key levels to watch out for are $18,318, which is the next resistance level, and $17,418, which is the next support level. The Bitcoin price analysis shows that a move to the downside is more likely at the moment as the bulls seem to be losing steam. However, a breakout to the upside cannot be ruled out as the market awaits a catalyst that will push prices in both directions.

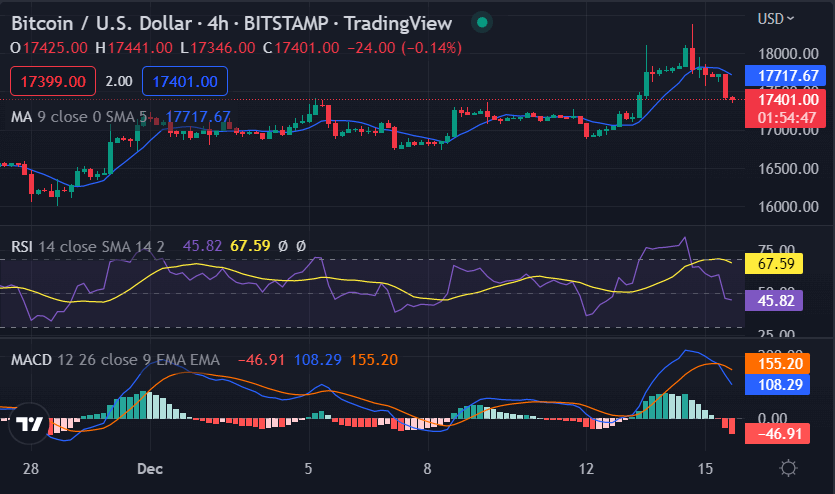

Bitcoin Price Analysis on 4-Hour Chart: Bearish Market Sentiment

The 4-hour Bitcoin price analysis shows that the price function is heading down again as the price levels are continuously decreasing. The bears are pulling down the price levels and currently they have reached the $17,426 level as BTC/USD is still looking for support. The market fell and shifted to the bearish sentiment as indicated by the Relative Strength Index line which is heading below the 70.00 level. The RSI indicator is currently trading at 67.59 and is heading towards oversold territory, which is another sign that prices are likely to fall further in the near term.

The BTC price got stuck in a critical juncture of sideways trading before the bears won the battle and prices succumbed to selling pressure. The MACD indicator is also signaling a further decline as the histogram is falling and is about to cross below the zero line. The moving average lines are also in favor of the bears as the 50 SMA line is well below the 200 SMA line. The 200 SMA line is also trending lower, indicating that prices are likely to follow suit in the near future.

Bitcoin price analysis conclusion

Our Bitcoin price analysis concludes that a move to the downside is more likely in the near term as market conditions remain bearish. Selling pressure is likely to increase and BTC price may fall towards the $17,418 level in the short term.

While you wait for Bitcoin to move forward, check out our price estimates on XDC, Cardano and Curve.