Bitcoin Mining Profitability Returns to 2020 Levels, But Why?

Data shows that Bitcoin mining profitability has dropped to just 2020 levels, here are some reasons behind this trend.

Bitcoin Daily Miner earnings fell almost 10% last week alone

According to the latest weekly report from Arcane Research, BTC miners are now earning just $17.9 million per day, the lowest since November 2020.

A relevant indicator here is the “hashrate”, which is a measure of the total amount of computing power connected to the Bitcoin network.

When the value of this metric goes up, it means that miners are bringing more rigs online on the blockchain right now.

One feature of the BTC network is that it tries to maintain a constant “block production rate” (number of blocks hashed by miners per hour). But when the hashrate changes, so does the rate at which miners produce new blocks.

To correct such discrepancies, the blockchain increases what is known as the mining difficulty. For example, increases in the hash rate cause miners to hash blocks faster, and to counter that, the network difficulty increases in the next scheduled difficulty adjustment.

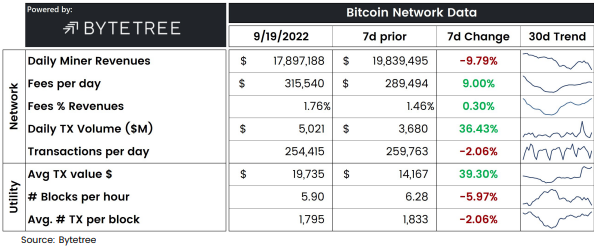

Now, here’s a table showing how some Bitcoin miner-related metrics have changed in value over the past week:

The fees per day seems to have gone up by 9% during the period | Source: Arcane Research's The Weekly Update - Week 37, 2022

As you can see above, daily Bitcoin miner earnings have dropped 10% in the past week from $19.8 million to just $17.9 million.

The last time miners observed such a low income was in November 2020, before the previous bull run began.

The report points out that there are two main reasons behind this trend. First and foremost is the difficult price of the crypto.

Since miners typically pay their operating costs as energy bills in fiat, the USD value of the rewards is the more relevant metric for them. A low BTC price directly leads to a reduction in their earnings.

The second factor is the mining difficulty rising to a new all-time high as a result of an increase in the hashrate. The block production rate is sitting at 5.9 right now, less than the 6 required by the network, which means there will be a difficulty reduction in the next tweak. But for now, miners hash more slowly and therefore earn less amount.

BTC price

At the time of writing, Bitcoin’s price is hovering around $19.3k, down 5% in the last week.

Looks like the value of the crypto has gone down during the last few days | Source: BTCUSD on TradingView

Featured image from Dmitry Demidko on Unsplash.com, charts from TradingView.com, Arcane Research