Bitcoin funds record $20 million in outflows. What’s up?

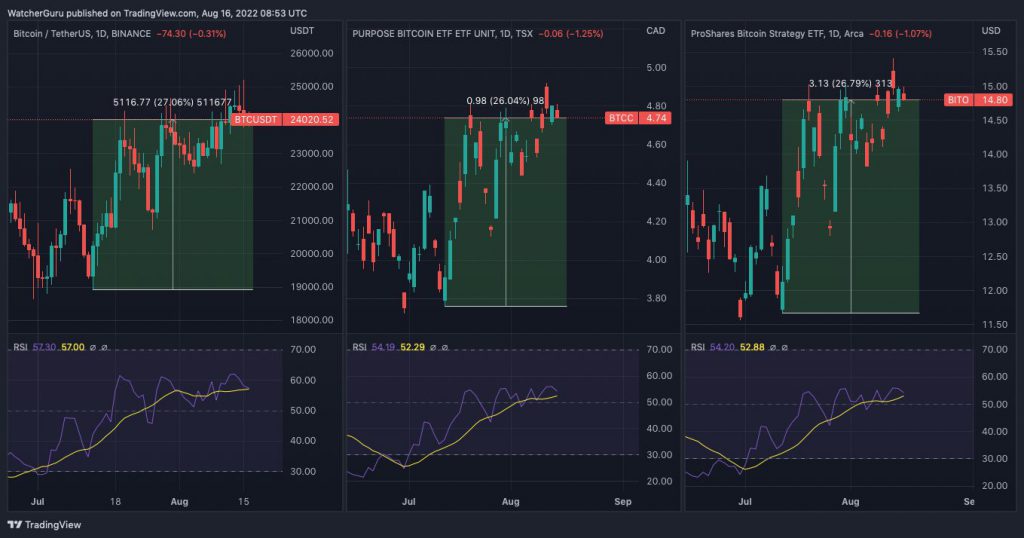

Bitcoin has recovered recently. In addition, funds that provide exposure to the asset have also started to do well. Take the case of Canada’s Purpose ETF itself, for example. In mid-July, BTCC was trading at its local lows around CAD 3.7. However, the price is now 4.7 CAD.

The US ProShares Bitcoin ETF has also increased from $11.6 to $14.8 over the same period. Put in context, BTC, BTCC and BITO have all fallen by the same 26%-27% in the last month.

Bitcoin institutional flows revisit negative territory

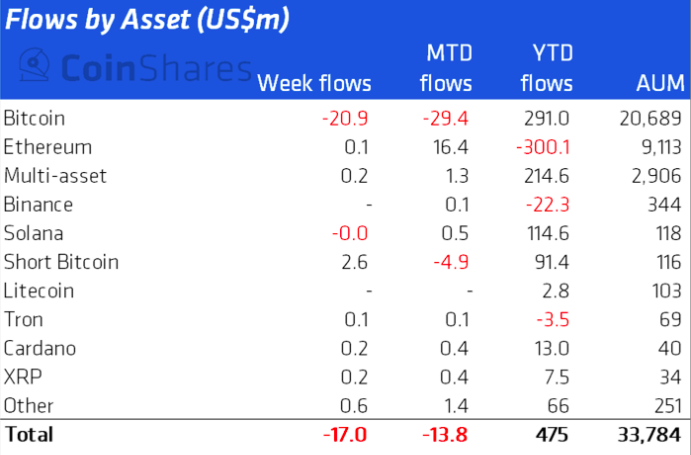

Although the price landscape looks encouraging, it should be noted that institutions – on the whole – have separated their assets. The latest data from CoinShares revealed that Canada recorded the most significant outflow of institutional investment products last week [$25.7 million]. And Purpose single-handedly contributed $7 million to the same. ProShares also shed nearly $10 million worth of assets last week.

In terms of asset allocation, Bitcoin-related investment products had the most negative flows. The report noted the same,

“Bitcoin carried the brunt of the outflows totaling USD 21 million last week, this is the second week in a row of outflows bringing monthly outflows to USD 29 million. Short bitcoin saw small inflows totaling USD 2.6 million.

The role of the institutions

Well, all hope is not lost. Despite the negative flows recorded, Bitcoin’s fundamentals remain “pretty good.” The same will “create a demand shock” in the long term, according to Skybridge Capital’s Anthony Scaramucci.

In an interview with CNBC, the executive said he is optimistic because “two big things have happened on the institutional side,” which are likely to generate demand for Bitcoin. He outlined the first incident, he said

“Fidelity allows their 401k products to offer Bitcoin.”

In particular, FinServ company Fidelity Investments now allows companies to offer employees the opportunity to invest up to 20% of their pension and savings plan. in Bitcoin. The same is a progressive sign and brings to light the increasing adoption. A recent WSJ article also claimed that pension funds across North America remain bullish on crypto, despite the losses in the macro bear market.

Furthermore, Scaramucci cited Blackrock’s offering of a private trust for clients to invest in Bitcoin as the second reason for playing a rotating role. Notably, the investment management firm, which holds around $8.5 trillion worth of AuM, recently announced a partnership with Coinbase that allows its institutional clients to buy Bitcoin.

Read more: BlackRock Launches Private Trust Offering Spot Bitcoin Exposure

So yes, over time, as the demand for these Bitcoin-linked investment products increases, the companies will be triggered to increase their AuMs. And when that happens, of course, fund flows will hover comfortably in positive territory, and Bitcoin’s price will also be driven forward. In the short term, however, the institutional mood will continue to be indecisive.