Bitcoin briefly fell to a two-year low on Monday after Bloomberg News reported that Genesis, the digital asset brokerage and lender, has told investors it may be forced to file for bankruptcy if its current fundraiser is unsuccessful.

The price of bitcoin BTCUSD,

fell to $15,615 on Monday after Bloomberg published its report, the lowest level since November 2020, according to CoinDesk.

A representative for Genesis downplayed the Bloomberg report in a statement shared with MarketWatch, claiming the company continues to have “constructive” talks with creditors.

“We have no plans to go bankrupt immediately. Our goal is to resolve the current situation consensually without the need for any bankruptcy filing. Genesis continues to have constructive conversations with creditors,” Genesis said.

Speculation has increased in recent days about financial problems facing Genesis, which halted redemptions and new lending last week. After the shutdown, the Wall Street Journal reported that Genesis had until Monday morning to secure $1 billion in financing. Genesis has also announced that it had 175 million dollars in exposure to the now bankrupt FTX.

Genesis has several businesses, including lending, custody and trading in spot cryptocurrency and over-the-counter derivatives markets.

In recent days there has been a lot of talk in social media about several bankruptcies in the cryptocurrency area after the collapse of FTX. Some insiders in the crypto industry have been focused on Genesis’ ability to weather the crypto storm, several sources tell MarketWatch.

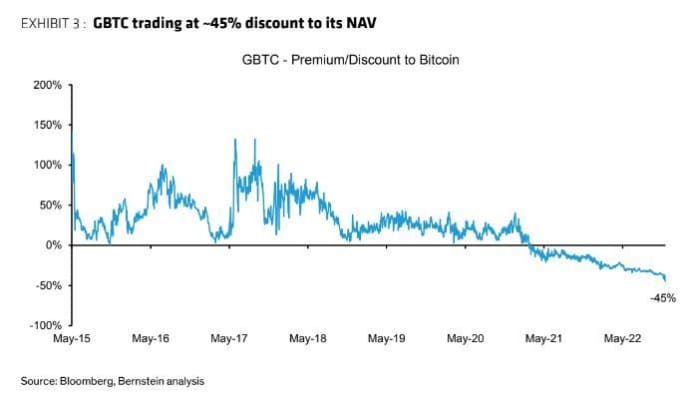

A result of this has been reflected in one of the more popular bitcoin related products, Grayscale Bitcoin Trust GBTC,

The trust, which is the only exchange-traded product in the US with direct exposure to bitcoin (although an exchange-traded fund with exposure to bitcoin futures also trades), has sold out, causing the discount to the net asset value of bitcoin. holdings for a short time expand to more than 50%.

BERNSTEIN

The widening discount reflects traders’ concerns that the problems at Genesis could spill over and affect its parent company, Digital Currency Group, according to Charles Hayter, CEO of CryptoCompare, a company that provides data on digital asset markets. DCG is also the parent company of Grayscale, the asset manager of the Grayscale Bitcoin Trust.

Bernstein analysts Gautam Chhugani and Manas Agrawal wrote in a Monday note that “crypto investors continue to speculate on a Genesis spin-off of DCG and thus potential strategic options on Grayscale, its most valuable business. Crypto investors also fear indirect reputational damage to GBTC from the recent influence between Genesis, Three arrows and Alameda.”

DCG is considered one of the crypto world’s “blue chip” companies, along with being one of the most valuable firms in the space, multiple sources told MarketWatch.

Still, the Bernstein team, along with analysts at Bloomberg Intelligence, have said a Genesis bankruptcy is unlikely to affect GBTC or DCG more broadly.

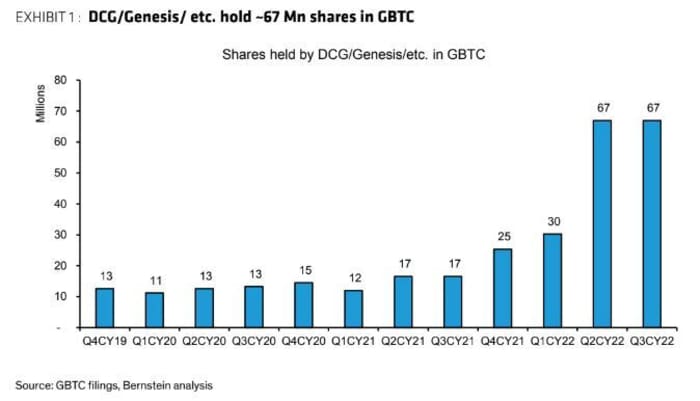

According to Bernstein, Digital Currency Group and Genesis own approximately 10% of all outstanding GBTC shares, and the company may choose to sell these holdings to meet liquidity needs. That equated to roughly $560 million as of early Monday, the analysts said, although the market value of bitcoin and GBTC fluctuates.

BERNSTEIN

CoinDesk, which is also owned by DCG, reported over the summer that DCG had assumed the burden of more than $1 billion that Genesis had lent to Three Arrows Capital Ltd. Genesis was reported to be among 3AC’s largest creditors.

For years, GBTC traded at a significant premium to the value of its bitcoin as it was one of the only channels for accredited and institutional investors to gain direct exposure to bitcoin.