Bitcoin Accumulation Trend Score shows shrimps buying and whales selling

The accumulation trend score is an on-chain indicator used to determine whether entities are actively accumulating coins. It is a much better indicator of overall market sentiment towards buying and selling, as one can apply it to any cohort to determine the behavior of a particular group.

The indicator consists of two calculations – a unit’s participation score and balance change score. An entity’s participation score represents its overall coin balance, while its balance change score represents the number of new coins bought or sold over a month.

An accumulation trend score closer to 1 shows that the largest part of the network is accumulating, while a score closer to 0 shows that the network is mainly distributing its coins.

When applied to Bitcoin, the Accumulation Trend Score provides good insight into market participants’ balance size and behavior over a month. Exchanges and miners are excluded from the calculation to make the data more representative of market conditions,

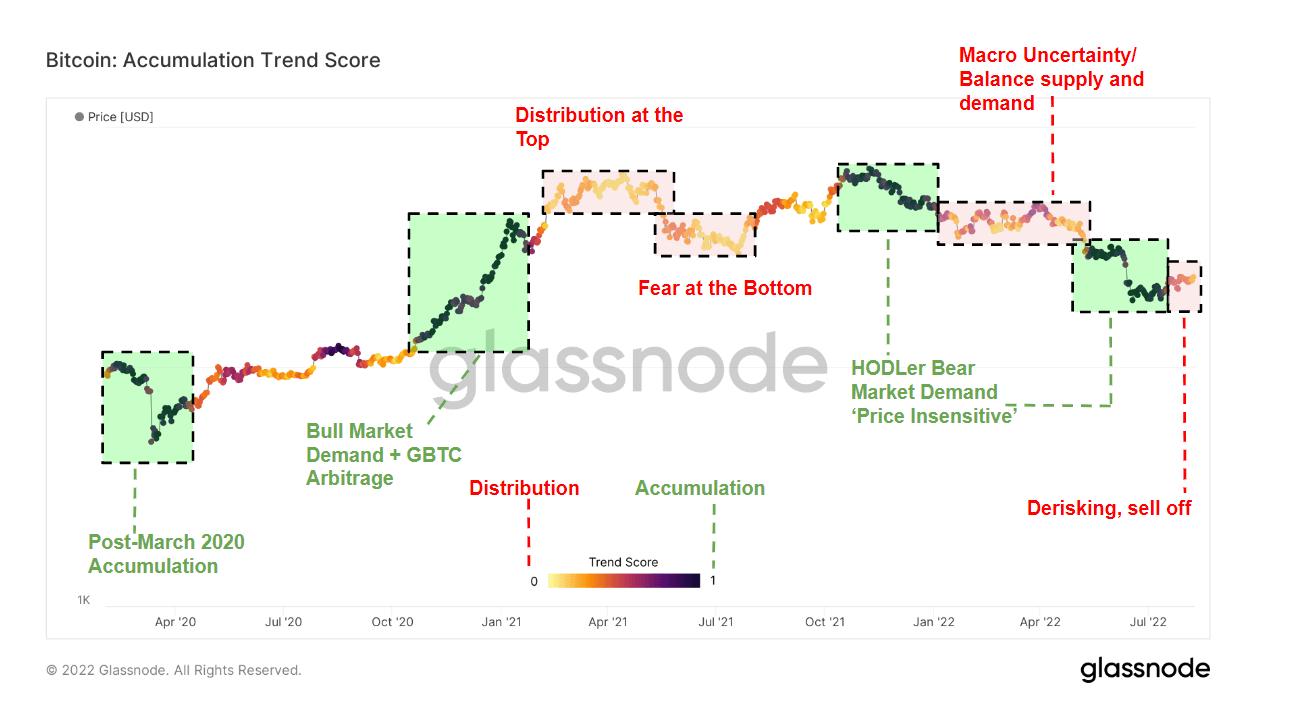

Bitcoin’s Accumulation Trend Score from April 2020 to August 2022 shows four distinct accumulation periods. Highlighted in green on the chart above, the periods of accumulation occurred in March 2020, early 2021, early 2022 and late May 2022. The most significant rate of accumulation was seen in March 2020 as the outbreak of the COVID-19 pandemic shattered global markets. The large selloff we’ve seen in the wake of the Terra (LUNA) crash in late May and early July triggered a major accumulation run.

Highlighted in red and yellow, periods of coin distribution followed all periods of accumulation. Some of the highest coin distribution rates were seen during the exodus of miners from China in the summer of 2021 and the start of Russia’s invasion of Ukraine in February 2022. This summer has also seen many addresses sell their BTC as macro uncertainty pushes more investors to de-risk their portfolios.

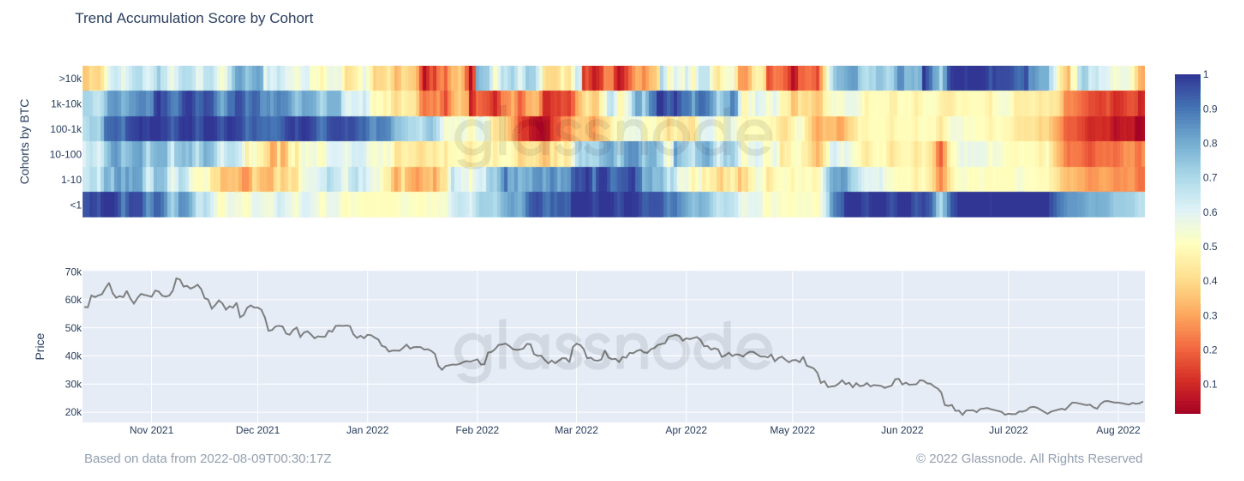

Breaking down the accumulation trend score by cohorts reveals the behavior of two large groups on the Bitcoin network – whales and shrimps. Whales are defined as addresses that own more than 1000 BTC, while shrimps are addresses with less than 1 BTC.

Throughout July, both whales and shrimp have been aggressively accumulating BTC. The chart below shows the rate of accumulation by cohort, with whales, shrimp and everyone in between accumulating for the entire month.

However, as August progresses, the rate of accumulation among whales begins to slow. The general macro uncertainty has pushed many large holders to reduce risk and sell their BTC holdings. Many investors expect a harsh winter and want to get as much liquidity as possible.

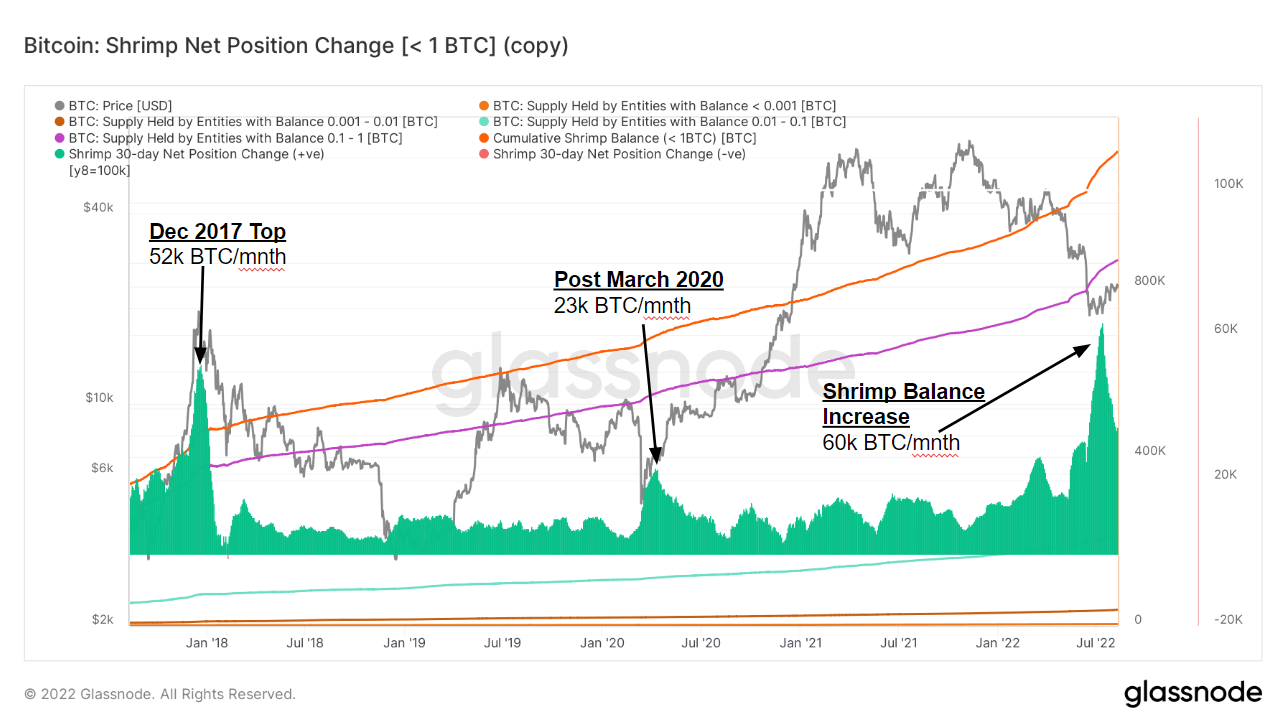

The only entities still stacking BTC are shrimp, which have remained accumulated even as the majority of large holders began to sell out. July was the most significant accumulation month for smallholders since 2018, with shrimp increasing their balance by over 60,000 BTC in a single month. The second largest accumulation was in December 2017 when Bitcoin reached its all-time high when shrimp accumulated 52,000 BTC in one month.

This shows that small holders view Bitcoin’s price of around $20,000 as very attractive and continue to acquire coins for long-term investments, even if the price remains flat.