Wild West or Space Race? The insurance industry meets the crypto world

At his previous posting at a boutique agency in Minnesota, in common with the rest of the country, “I became heavily involved in cyber risk.” But he saw how many companies “don’t understand what they’re buying” when it comes to the cyber world.

Now he is on the inside looking out into the cyber world.

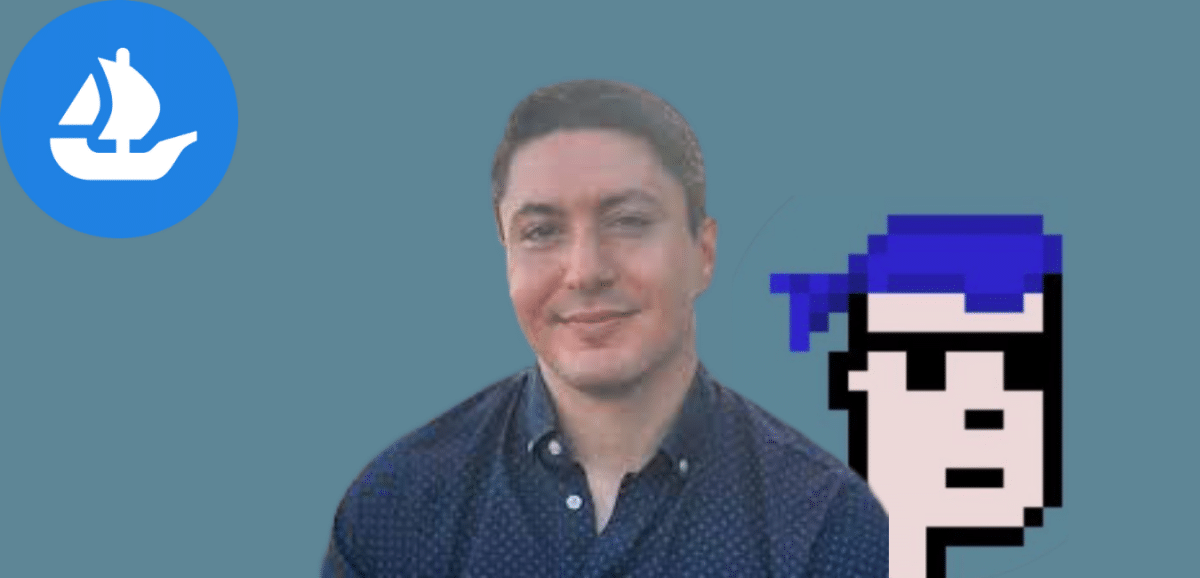

He joked that in his new role, as head of insurance for Evertas, a crypto-insurance specialty that underwrites MGA, surrounded by crypto experts, he’s “learning as fast as the hamsters in his brain can step.” He’s used to thinking outside the box, but he can still feel like Alice in Wonderland at times.

In crypto, “the guarantee is very precise”, and in his new venture there is a lot of meshing going on. The crypto and insurance worlds “don’t need to collide,” he said. “You’ve got people who’ve spent the last six years of their lives doing nothing but looking at cryptonative stuff. And they you’ve got a bunch of insurance guys. There’s a couple of us—that’s all we know how to do. Everybody’s trying to find the right lane to run in.”

Like a relay team on track and field day, once they find that track, they have to run in it as a team.

“We’re the only crypto-native group where the insurance industry and the crypto guys are actually sitting across the table hammering out how the heck we’re going to issue a policy,” he said. Laying the groundwork now will lead to future success, he predicted.

“We’ve had a lot of inquiries from the crypto community,” he said, which is encouraging. Now it’s a process of “how do we get the genie out of the bottle. If we fail in crypto, or the crypto world fails, we fail. If the crypto world takes off, we will have done enough ground breaking where people will want to come in and underwrite risks which we guarantee or guarantee in connection with us or offer new cover which we would not.”

Crypto markets – why should the insurance industry care?

Of course, the question must be asked – why enter this bumpy market?

“Because my career has gone into places that no one else wants to be,” he said. In the 1980s, he ventured into the London market to place risk, and later the higher education industry, as well as the pharmaceutical and medical industries. He ventured into energy risks, from mining to offshore and onshore drilling.

“A lot of people were uncomfortable coming into that room,” he said. “You had to teach the technology at the time how they weren’t going to have these massive claims.”

He remembers that insurers don’t want to underwrite an oil platform in the North Sea, or underwrite human testing for drugs, or underwrite a chemical industry risk to make nitroparaffin in Louisiana.

Even now, he can tell younger members of the insurance industry to survive the dark days of the Great Recession, so volatile economic times are nothing new.

“I knew back in 2007 that the credit market was going to freeze,” he said.

Wild West?

The crypto world has been on a wild ride lately, with trading swings and high-profile legal cases, so there’s a lot of misunderstanding surrounding it.

“It’s very easy for people to paint with a broad brush about a particular industry,” he said. “People have compared crypto to the Wild West, haven’t they? I actually think it’s a bit more structured than that.”

He pointed to the coal mining industry in Victorian times. Compare that to today’s coal mining industry. Two very different images appear in the mind’s eye, much of it to do with safety and equipment.

“Immensely different,” he said. “And the insurance industry had a lot to do with it.”

He admits there is a learning curve and one has to “check your ego at any risk.” There are challenges, such as finding more energy efficient ways to mine cryptocurrency.

For insurance, there are different models that are “across the board”, in how people are paid, risk issued and how they will deal with a loss.

“The challenge for the insurance community is not to homogenize it,” he said. “It’s taking the time to really delve into exactly how they do it.”

What matters now is being “flexible, both from an insurance broker perspective, and then from an insurance broker perspective and jumping out of their comfort zones,” he explained. “And you know, I really don’t want to write you an omnibus form, because then we’ll be arguing at the time you need it most, whether it’s covered enough. Let’s go make sure we know what we want to cover.”

He compares today’s crypto world to the early days of the space race – from Sputnik orbiting our planet in 1957, to Neil Armstrong setting foot on the moon in 1969, a lot happened in a short 12-year period. And there were disasters along the way and near-disasters after (see Apollo 13).

“My comment to the industry and to the brokers involved in the industry, and the underwriters: we’re talking about getting to the moon,” he said. “There are going to be bumps along the way.”

Success will depend on “being open and flexible, being curious” and getting outside the “insurance paradigm”.

New beginning, new market

At a time when others are thinking of retiring, Burkhardt decided to take the leap into this new field.

Not that he hasn’t moved to Florida—he has—and he still enjoys fishing, but his rod is still reserved for vacations and weekends as he takes on a new role as insurance manager at Evertas.

He was approached to join this new firm after several years in the insurance industry in various positions and locations (Vice President at Kraus-Anderson Insurance, Regional Managing Director at Wells Fargo, Senior Vice President at Sedgwick, among others).

“We’re looking for someone who really has an understanding of what goes on within the distribution side of insurance,” he recalled of the pitch from Raymond Zenkich, Evertas’ president and founder. “With your background, I thought you might be interested.”

From sales, to production, to leading insurance companies as a principal, “you get into every nook and cranny of what goes on in an insurance agency,” he said. “You’re going to be a badass.”

He enjoyed getting his “hands dirty”, he said, “because there was a lot of money to be had, depending on what you had to say.”