Why the Bitcoin price floor is between these two levels and it’s time to DCA in

$20,000 is considered an important psychological level for Bitcoin as it places BTC above the 2017 high and a clear level to defend.

By identifying Bitcoin’s price floor, investors can maximize their capital efficiency and tilt the risk-reward balance in their favor – achieving the maximum possible upside with the least possible downside risk.

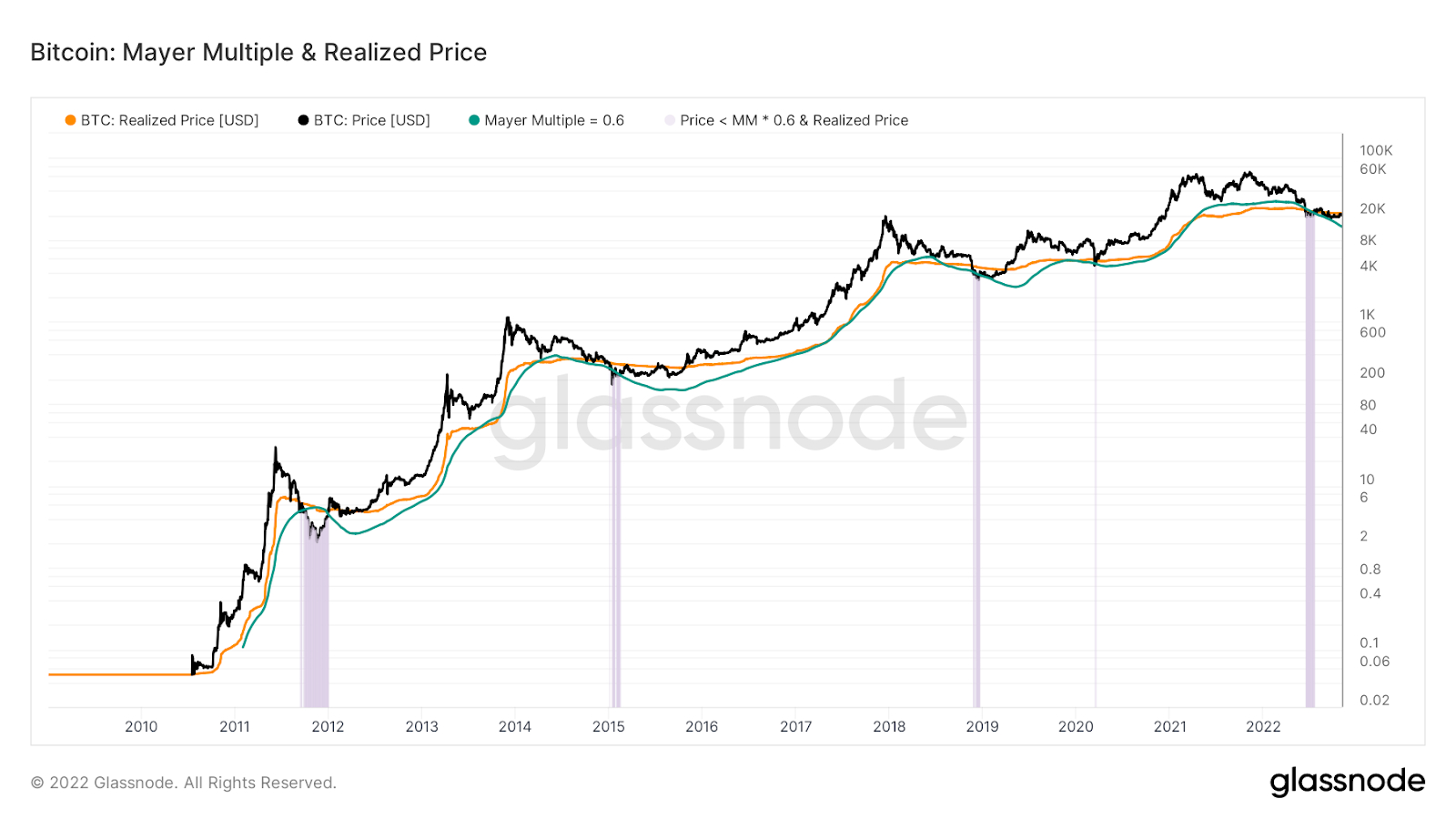

Glassnode, the prominent market intelligence platform on the chain, recently released a report where it attempts to identify the upper and lower limits of Bitcoin’s bottom using a series of floor indicators.

The data indicates that the bottom is close, very close – and that it may be found before February 2022.

Realized price

A cryptocurrency’s realized price is the average price that holders paid for their coins/tokens at the time of purchase – the average of the sum of these values produces the realized price.

If the realized price is above the prevailing spot price, the community of holders is in an aggregate profit, while if it is below, they are in an aggregate unrealized loss.

The former situation means that there are still players with a profit who can exit their positions and drive the market down, while the latter indicates that selling activity is likely to be minimal – as few owners want to sell at a loss.

According to Glassnode’s live workbenchBitcoin’s realized price is currently hovering around $21,100.

Historically, Bitcoin’s spot price has only traded at or below the realized price on rare occasions, and usually for less than six months. Bitcoin has currently been trading below its realized price since mid-August – or for about 2.5 months.

It is important to note that the realized price is an overall calculation, within the range of different entry prices. There will almost always be a subset of holders who are in profit, even while the aggregate is in loss – and vice versa when the aggregate is winning.

Nonetheless, studies have shown that investors can be pressured to sell at a large loss if market conditions are severe enough.

Although not a direct measure of the severity of market conditions, the Crypto Fear & Greed Index can be used to measure the level of fear in the market – and thus the odds of a panic sale.

The fear and greed index, currently sitting at 30, indicates a general bearish sentiment, but nothing like what was seen during the recent flash crashes. In comparison, the index sat at just 10 at the beginning of January 2022 – after Bitcoin collapsed by 50% in 2 months.

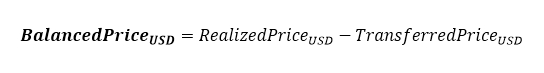

Balanced price

The balanced price is another indicator that is often used to identify the lower limits of a market.

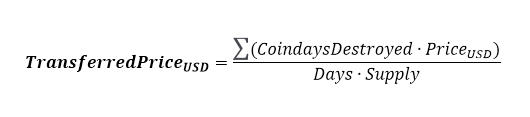

This is defined as the difference between the realized price and the transferred price (calculation shown below). The realized price is also known as its coin day weighted price. Glassnode claims that the transferred price represents an appropriate lower bound for the Bitcoin price.

The transferred price uses Coin Days Destroyed metric and the Bitcoin supply to look at the spending behavior of Bitcoin holders. By looking at the delta between the realized price and the transferred price, we can find the true valuation of Bitcoin and establish it as a potential bottom.

The balanced price is currently around $16,500.

What’s Next for Bitcoin?

As we have previously discussed, the realized price establishes the upper limit of Bitcoin’s bottom at $21,100, while the balanced price sets the lower limit at $16,500.

At its current price of $20,280, Bitcoin is near the upper end of the limits and could be due to fall by as much as 18.7% to reach its lower limit. Should history repeat itself, this will likely happen within the next 3 months.

With the US Federal Reserve and other central banks now raising interest rates in an attempt to curb spending and put the breaks on the economy the current recession may be short-lived. And when the price of energy falls (including natural gas, crude oil and diesel), the macroeconomic situation appears to be improving.

Given that Bitcoin (and most other digital assets) remain weakly correlated to the stock market, which in turn is heavily driven by the macroeconomic climate, the odds are both at or near the bottom—and due for a turnaround.

For those using a weighted or standard dollar cost averaging (DCA) strategy, it may be time to start scaling back, given that the risk-reward ratio is starting to tip in your favor.