White House economic report slams digital assets, blockchain – Ledger Insights

Yesterday, the White House published the president’s economic report, which contained a 30-page chapter on digital assets that presents a very critical view of the sector and technology. This applies in particular to cryptocurrencies, but also to the use of blockchain technology in general. Unsurprisingly, there was more optimism about the central bank’s digital currency (CBDC), but especially the new FedNow payment system that will be launched soon.

The paper presents the “claimed” benefits of digital assets and blockchain technology, but goes on to debunk each one. It went far beyond painting cryptocurrencies as speculative.

The conclusion states, “it is possible that their underlying technology may still find productive use in the future as companies and governments continue to experiment with DLT.” While that sounds like a guarded but optimistic assessment, the bulk of the chapter is anything but. There are statements like “many prominent technologists have noted that distributed ledgers are either not particularly new or useful, or they are used in applications where existing alternatives are far superior.”

It picks out specific examples, such as an enterprise blockchain use case by Walmart Canada. A case study claims the solution uses 600 virtual machines, but the White House questions why it needs blockchain at all, claiming it can run on a centralized two-server solution. At least it mentions that invoice disputes fell from 70% to 1%.

The authors attempt to add a qualified balance by acknowledging potential use cases such as bank settlement and clearing and the New York Federal Reserve’s work with the Regulated Liability Network. However, it considers this “experimentation”. It prefaces the positive with “proponents still argue that this technology can find productive uses,” with wording that gives the impression the authors are dubious.

As for stablecoins, those that lack stability are manufactured. While the Treasury recently floated the idea that a wholesale CBDC could in the future return stablecoins, the above chart accompanying the White House report does not support that stance. Partly because there is concern that this will result in a shift from bank accounts to stablecoins during a crisis.

The authors grudgingly acknowledge that “encryptions appear to be here to stay.”

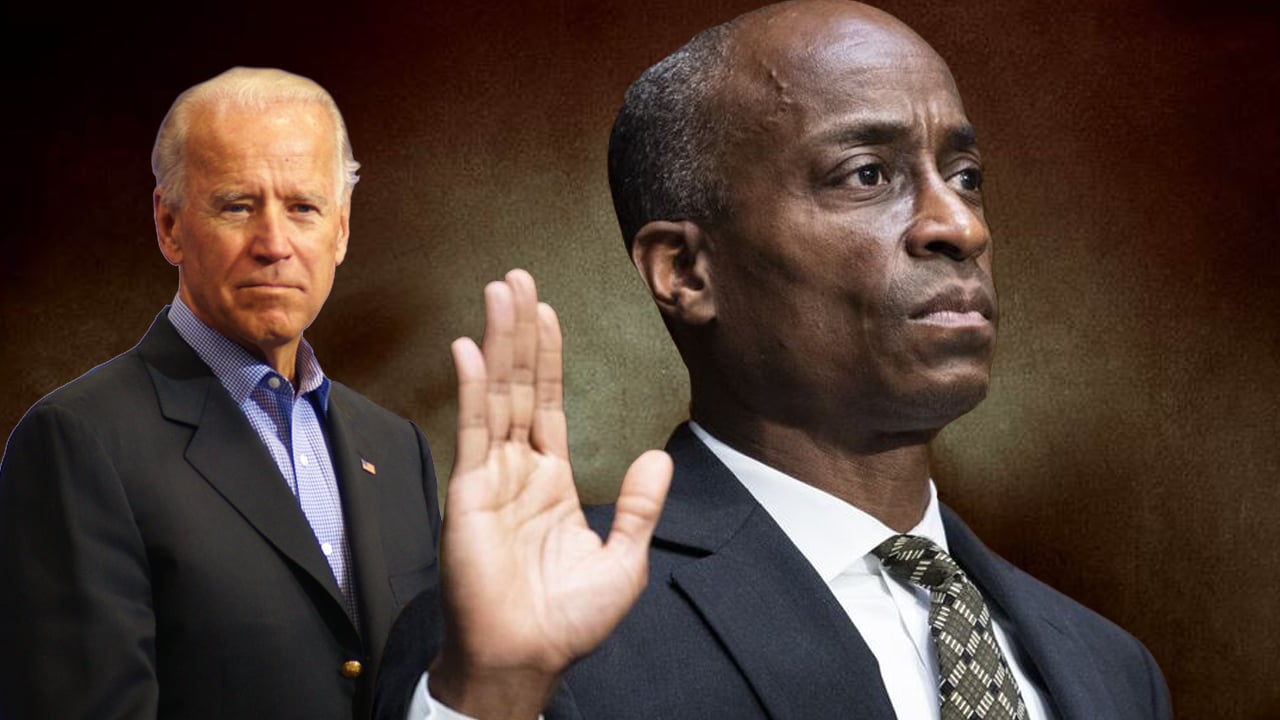

Overall, the paper strongly contributes to the perception that the democratic government is anti-blockchain and digital assets. On the other hand, Republicans are pushing back on the CBDC and want limited regulation of crypto.

A handful of lawmakers have taken a middle ground and can hopefully produce constructive results with balanced regulations that still support innovation.