Which US state is best for mining Bitcoin in 2023?

The rising electricity prices in the US have increased Bitcoin mining costs. As demand for electricity grows and expenses increase, Bitcoin miners face higher operating costs, reducing their profit margins.

Electricity is a crucial factor in the process of Bitcoin mining, which is the process of verifying transactions and adding them to the blockchain. As the Bitcoin network grows, so does the demand for electricity to power the mining process. The rising electricity prices in the US have contributed to the rising mining costs for Bitcoin, making it less profitable for miners.

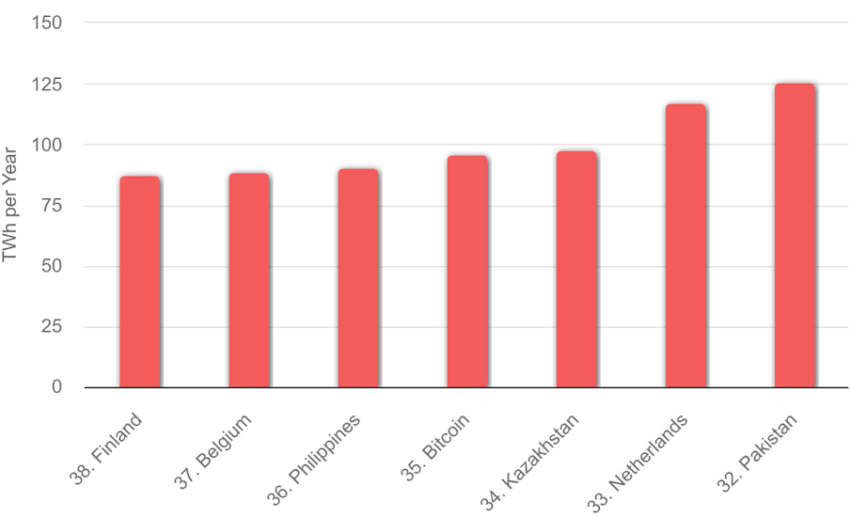

Energy use worldwide

The cost of electricity is a leading expense for Bitcoin miners, as the mining process requires a huge amount of energy. The Bitcoin Energy Consumption Index estimates that the Bitcoin network consumes more energy than the entire country of the Philippines. Electricity consumption is primarily driven by the need to power the specialized computing equipment used in the mining process, which requires enormous amounts of energy.

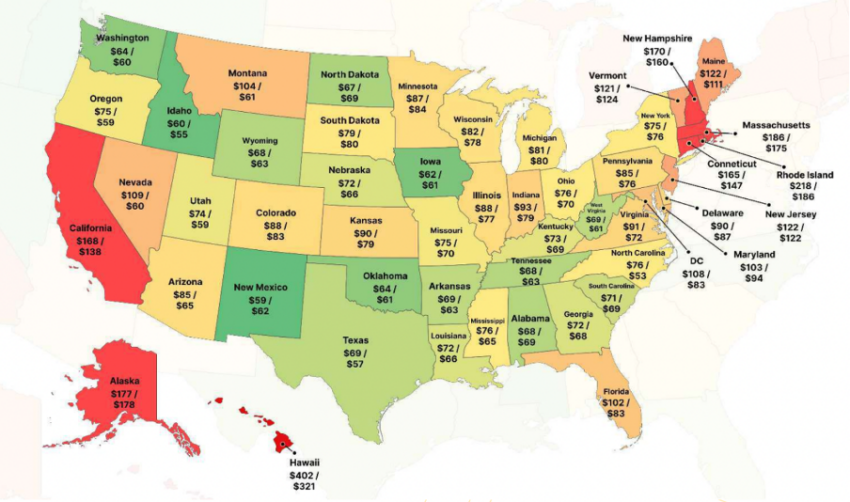

The cost of electricity varies markedly between different states in the United States, with some having significantly higher electricity rates than others. For example, in Hawaii, the average residential electricity price is about 30 cents per kilowatt hour, more than double the national average of about 13 cents per kilowatt hour. In contrast, states like Washington and Louisiana have some of the lowest rates in the country, with average rates around 8 cents per kilowatt hour.

The higher electricity prices in some states have made it less profitable for Bitcoin miners to operate there. This is because the higher electricity costs increase the total mining costs, eating into miners’ profits. As a result, some miners have had to shut down operations or move to areas with lower electricity prices to stay profitable.

Another factor contributing to the rising electricity prices is the increase in demand for electricity. As the population grows and more people use electricity, demand increases, which increases costs. This increased demand has been particularly evident in places like California, where the population has spread, putting a strain on the state’s power grid and causing rolling blackouts.

Questioning the sustainability approach

The rising electricity prices have also raised concerns about the environmental impact of Bitcoin mining. As the Bitcoin network’s energy consumption grows, so does the carbon footprint of the mining process. This has led to criticism of Bitcoin mining as an environmentally unsustainable practice, with some calling for more sustainable mining or a shift to alternative cryptocurrencies that are less energy intensive.

To address these concerns, some Bitcoin miners have explored alternative energy sources, such as solar and wind power. By using renewable energy sources, miners can reduce their carbon footprint and potentially reduce their overall electricity costs in areas where renewable energy is cheaper than traditional sources. However, the use of renewable sources for Bitcoin mining is still rare, and most miners rely on conventional energy sources such as coal and natural gas.

In addition to the rising electricity prices, other factors are driving the rising Bitcoin mining costs. These include the cost of specialized computing equipment, the difficulty of the mining process and the price of Bitcoin itself. As prices fluctuate, so does the profitability of mining, and miners must continually adapt to changing market conditions to stay profitable.

Where things stand

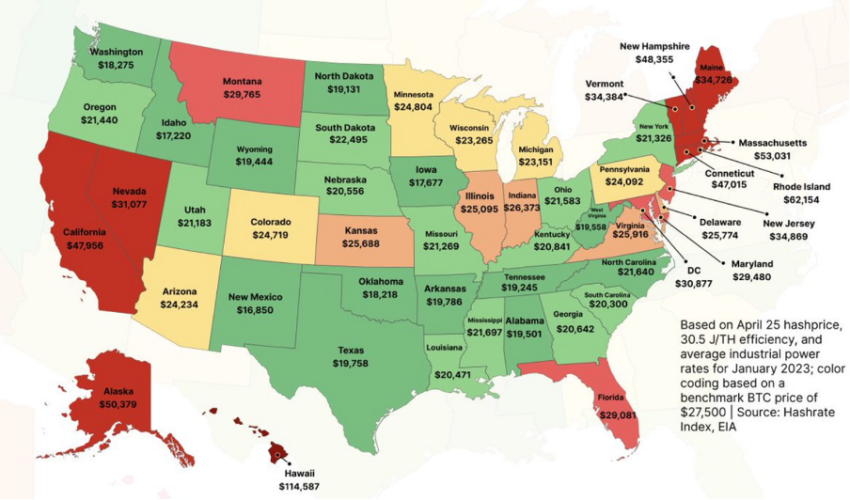

In 2023, electricity prices continue to reach new heights, which does not come as a surprise. Bitcoin miners charge at least $17,000 to produce a BTC in the US compared to $5,000 to $10,000 a year ago. This is according to Bitcoin mining data resource Hashrate Index and Luxor.

From January 2022 to January 2023, commercial electricity rates increased by an average of 10.71% per state in the United States. This is higher than the average increase in the consumer price index of 6.40%.

In addition, a relatively poor performance by the most prominent digital asset last year led to miners taking heavy losses. Mainly due to increased operating costs and lower returns.

Although Q1 2023 saw a change in the scenario. Bitcoin hashrate has been trending upwards from lows in 2022. According to data from CoinWarz, the latest BTC hashrate is 382.16 EH/s. This year, it recorded a new peak of 296.8 EH/s on May 1. Mining companies also saw a rise in their shares as the market tried to recover.

Best to worst state to mine Bitcoin

Gathering all the insights from above, different geographic regions of the United States have different outcomes.

New Mexico has relatively cheap electricity rates, making it one of the more affordable states for Bitcoin mining. According to the Hashrate Index Report, New Mexico emerged as the most affordable and, in turn, more profitable state for Bitcoin miners in Q1 at $16,850 to make one BTC.

On the other hand, Hawaii has some of the highest electricity prices in the United States due to its isolated location and reliance on imported oil for power generation. Thus, Hawaii was the most expensive with around 114,590 dollars.

Some states took steps to protect miners from criticism over the energy use critics have faced over the years. Nevertheless, mining has taken a greener path to offset its carbon footprint. In fact, the World Economic Forum (WEF) praised Bitcoin mining as one of the ways to reduce emissions.

Increase profitability

Overall, miners have witnessed ups and downs during their journey to mine Bitcoin. Energy deflation, or a reduction in energy costs, can increase miners’ profitability in the short term by reducing one of the most important costs of Bitcoin mining: electricity. If energy prices drop, miners can use the same amount of energy to mine more Bitcoin, increasing their profit margins.

However, it is important to note that energy deflation can also lead to increased competition in the mining industry. Lower energy costs make it more affordable for more people to mine Bitcoin. This can increase the hash rate, making it harder and more expensive for individual miners to compete.

Furthermore, energy prices can be volatile and subject to geopolitical and market factors. While energy deflation may benefit miners in the short term, it is important to consider the long-term sustainability and viability of Bitcoin mining in the face of potential fluctuations in energy costs.

Disclaimer

In accordance with Trust Project guidelines, this feature article presents the opinions and perspectives of industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect the views of BeInCrypto or its employees. Readers should verify information independently and consult with a professional before making decisions based on this content.