Which Fintech stock is the best to buy?

Fintech stocks were one of the canaries in the coal mine in 2021, as euphoria quickly turned to fear. It was the fear of higher interest rates that knocked fintech darlings off the podium. The rest of the overpriced tech scene quickly followed suit, with losses accelerating this year. In this article, we will compare two downbeat fintech stocks, Block (NYSE: SQ) and PayPal (NASDAQ: PYPL), to see which is the best Buy. Based on upside potential from analyst estimates, SQ comes out on top, but let’s dig deeper.

It’s easy to look back on the best fintech stocks as obvious bubbles. Price-to-earnings (P/E) and price-to-sales (P/S) multiples were stretched as euphoric investors became increasingly willing to pay more for innovation and exciting growth stories. Ark Invest’s Cathie Wood was one of the most exciting money managers, focusing on the most innovative and disruptive forces in technology.

By focusing on huge total addressable markets and forward-looking technologies, one can justify paying a bit of a premium. Such a premium quickly swelled as investors saw the technology sector as a critical industry to navigate out of lockdowns from the pandemic. While the pandemic may have accelerated various tech trends, including fintech, it soon became clear that the post-2020 tech boom extended to the upside, setting the stage for a harrowing crash in many of the “story-driven” stocks.

As the Federal Reserve continues to raise interest rates, it has become more difficult to value fintech based on its hazy growth stories. Just over a year ago, it seemed that the fintech leaders would put the traditional banks on notice.

The old banks have been wildly profitable for hundreds of years, and fintech was seen as the disruptive force to bring them to their knees. Fast forward to today and it’s now clear that fintech investor ambitions were a bit over the top. Strong balance sheets matter more than ever now that credit is harder to come by. With deep pockets and their own innovative capabilities, banks now have a head start on the fallen fintech companies.

In the long term, the fintechs will probably be able to cut further into the turf of the big banks. But don’t expect the big banks to go down without a fight. The banks are going nowhere. If anything, today’s hot fintechs may evolve to become just another bank as they look to expand their financial services.

Now that expectations have been reset, it might be a good idea to give the downtrodden fintechs a second look. Block and PayPal stock collapsed 78% and 76% respectively from top to bottom. Every company had unrealistically high expectations just over a year ago. Today, expectations can be unrealistically low.

Block (SQ)

Block, formerly Square, underwent a name change as the firm looked to move beyond payments. Without a doubt, CEO Jack Dorsey is one of the most exciting men to bet on. He is one of the tech entrepreneurs who you could argue is a visionary.

Right now, Dorsey has his sights set on bitcoin (BTC-USD) and cryptocurrencies. With “crypto winter” fast approaching, Dorsey’s blockchain ambitions seem less worth paying for. Either way, Dorsey is focused on the really long term. Block’s secretive blockchain and crypto projects are likely to outlast the upcoming “crypto winter,” potentially fueling the next boom in the asset class.

While I’m no fan of cryptocurrencies, I think there’s no denying the potential behind blockchain technology. It may hold the keys to how a large majority of consumers shop 10 years down the road. It’s okay to be excited about the potential behind new technologies.

However, investors need to be careful how they bet on certain technology trends. Just because blockchain and crypto technology can change the world doesn’t mean that any of today’s cryptocurrencies will make you rich over time. As such, you need to be careful how you choose to bet on forward-looking trends.

In previous pieces, I praised Block as one of my favorite ways to bet on blockchain technology. While Block may be years away from proving itself as more of a blockchain-centric tech company than a payments platform, I think the caliber of its management is more than worth betting on, especially with valuations at multi-year lows.

Although Dorsey is early to the blockchain party, Block has a robust ecosystem of payment offerings that could help the firm pay the bills for its incredibly forward-thinking endeavors.

Square Payments and Cash App are still Block’s two growth drivers today. Each platform has an impressive network of users that Block will be able to easily sell to as new features and services arrive. Cash App is more than just a payment app to transfer money to your friends. It has become a place to buy and sell bitcoin. In time, Cash App may evolve to become the force that helps Block push the big banks.

Ultimately, I see Block as a fintech that could evolve into more of a neobank over time. As Block continues to invest in blockchain projects, there is also a chance that the firm will create the future infrastructure necessary for cryptocurrencies to become more than just a volatile asset to speculate on.

What is SQ Stock’s price target?

Wall Street remains a fan of Block, with a “strong buy” rating, 26 buys, five holds and one sell. The average block price forecast of $112.69 implies about 62% upside potential.

PayPal (PYPL)

PayPal is another fintech firm that has suffered a brutal valuation reset. The digital payments pioneer wants to expand its presence in digital commerce. With a recession ahead, payouts may be on hold. Regardless, PayPal is a company more than capable of adapting to the times, even as the digital payments scene becomes more crowded.

After PayPal’s horrific crash, many investors seem to be discounting the firm’s strong network effects. Although PayPal users will cut back on spending over the next 12-18 months, such users are likely to remain. As the tide turns and spending grows again, PayPal will be in a place to see payment volumes rise again.

Looking ahead, I will look for PayPal to be more acquisitive. Whether that means acquiring a social media firm to lay the groundwork for an expansion of social commerce or taking advantage of smaller tuck-in deals in the latest downturn in the fintech scene, PayPal has plenty of ways to flex its “network effect” muscle .

In a previous piece, I praised PayPal’s earlier acquisition of Honey as a tool that helped PayPal differentiate itself. The honey service added value for users by helping them easily find digital coupons to save money on digital purchases. By giving a large user base the tools to save money, PayPal can continue to expand the digital payments space.

Staying competitive won’t be easy, but I’d look for PayPal to pursue M&A to build on the moat while there are low technical multiples.

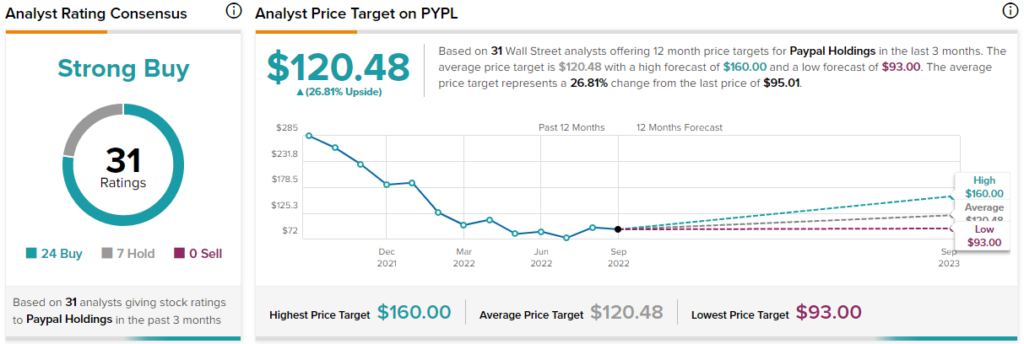

What is the PayPal share price target?

Wall Street loves PayPal stock, with a “strong buy” rating, 24 buys and seven holds. The average PayPal stock price prediction of $120.48 implies about 26.8% upside potential.

Conclusion: PYPL and SQ both look oversold

Fintech is a tough place to be right now, as consumers look to cut spending while investors become less willing to pay for forward-looking growth stories. Regardless, each fintech giant appears oversold, with Wall Street analysts continuing to stand by each name with “Strong Buy” ratings.

Mediation