Recent headlines about Bank of America ( BAC ) customers and their Zelle woes got me thinking about the state of financial technology in America. For anyone unfamiliar with Zelle, my Gen-X blunt opinion is that it’s just another bunch of tape and string laid over old existing banking infrastructure.

While Europe has IBANCanada has Interac, and much of sub-Saharan Africa has been funding flip phone startups for well over a decade, we’re stuck with daily and monthly transfer limits, fees for electronic money transfers in less than three days, and general frustration in the banking industry’s death grip about our deposits. Believe it or not, I’ve found that the fastest and cheapest way to transfer money from one financial institution to another is to write a physical check to myself from the first bank and deposit it into the second using my mobile app.

I thought in this article I would take a look at the state of some financial services and fintech exchange-traded funds.

The funds

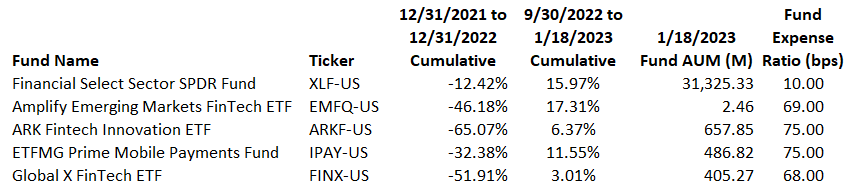

As you can see in the table below, 2022 was not kind to fintech. However, the fourth quarter into the first half of January saw this sector see a bit of an uptick, so let’s take a look at what drove some of those returns.

Source: Factset, All You Can ETF

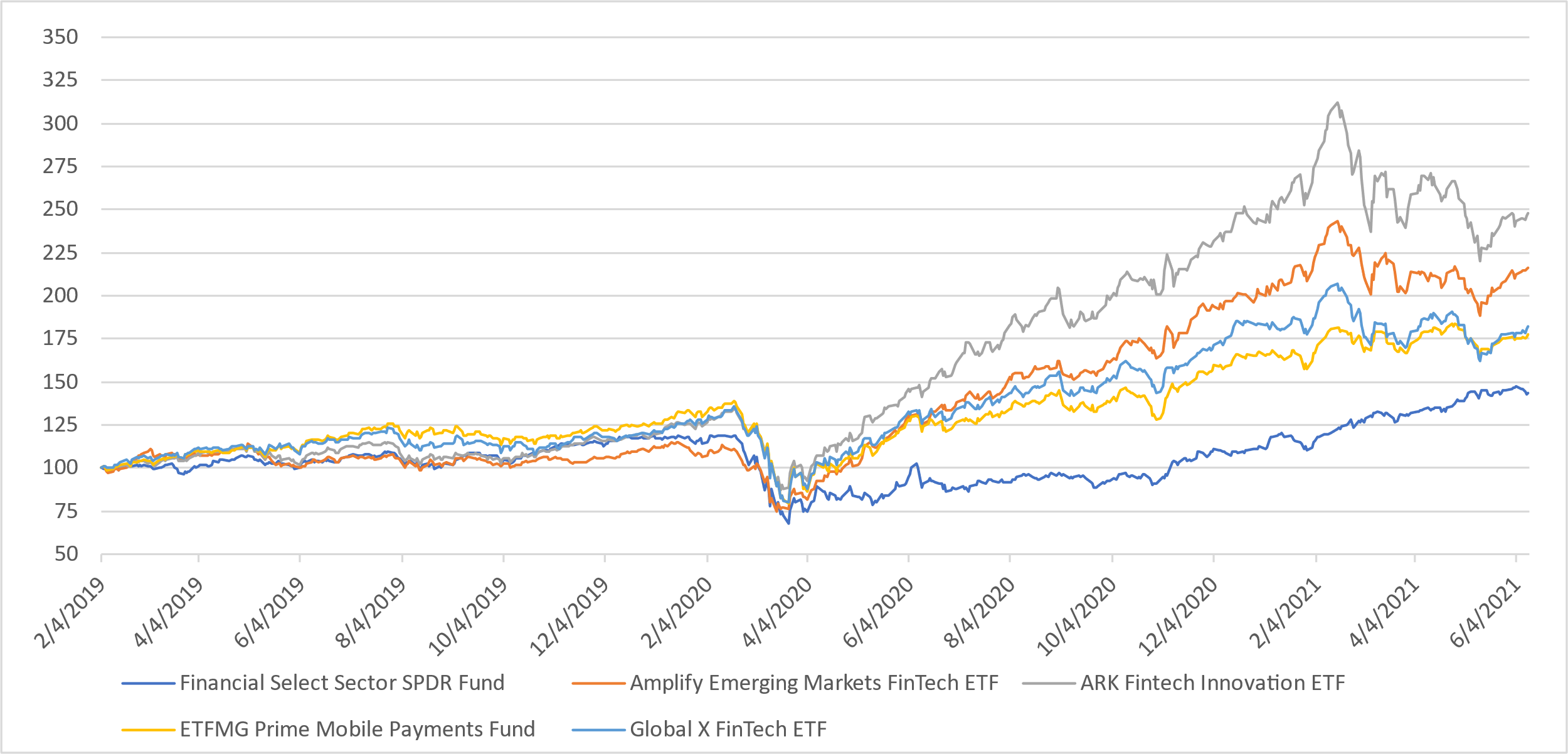

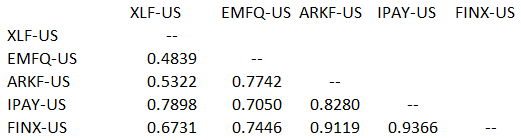

I pulled down the holdings for the funds (except the Financial Select Sector SPDR Fund (XLF)) and ran some attribution from September to Wednesday. From the performance chart below, it is clear that although these funds appear to cover the same space, each fund does something The correlation table below the graph is there for further proof.

Source: Factset, All You Can ETF

3Source: Fact Sheet, All You Can ETF

Overall, these funds generally stayed away from crypto and digital assets, although the Ark Fintech Innovation ETF (ARKF) has a position in Coinbase, which was down about 22% in the observed period.

The overlap between the four funds was quite easy. From IPAY’s perspective, it shares three holdings with ARKF, nine with Amplify Emerging Markets FinTech ETF (EMFQ) and 21 with FINX for 6%, 17% and 40% overlap respectively.

FINX and ARKF did not participate in the comeback rally, but for different reasons. ARKF is still looking at names that may have good prospects, but from my perspective have little to do with fintech, such as Roku Inc (ROKU), Nvidia Corp. (NVDA), Zillow Group (Z) and JD.com (JD). FINX suffered from the exposure to digital assets mentioned above.

What worked

When I look at all these funds, what worked was any exposure to companies and technologies that are already in use and have wide adoption in the market. An example of this is the top contributors to returns for ETFMG Prime Mobile Payments ETF (IPAY), which include Mastercard Inc. (MA), Visa (V), Block (SQ), Adyen NV (local ticker ADYEN-NL) and Kakaopay Corp (local ticker 377300-KR), which together contributed to just under 50% of IPAY’s returns between September 30, 2022 and Wednesday. Similarly, EMFQ had established foreign payment facilitation names that were the top 5 contributors to results that returned anywhere from 40% to 71% for the observed period.

Finish

As we move through this part of the economic cycle, funds like IPAY and EMFQ makes more sense to me than ARKF and FINX, if only because the companies in these two funds are the ones that are established, have scale and make money from being the plumber behind both consumer and commercial spending. IPAY for established US exposure and EMFG for the growth potential in the rest of the world.