What is the Ultimate Blue-chip Crypto Asset: BTC, NFTs or Land?

One of the biggest changes in the crypto market today compared to the last bear market is the different types of assets that exist.

Instead of choosing between Dash, Litecoin, Ethereum, Bitcoin, etc., people can invest in NFTs and plots of digital land in the metaverse.

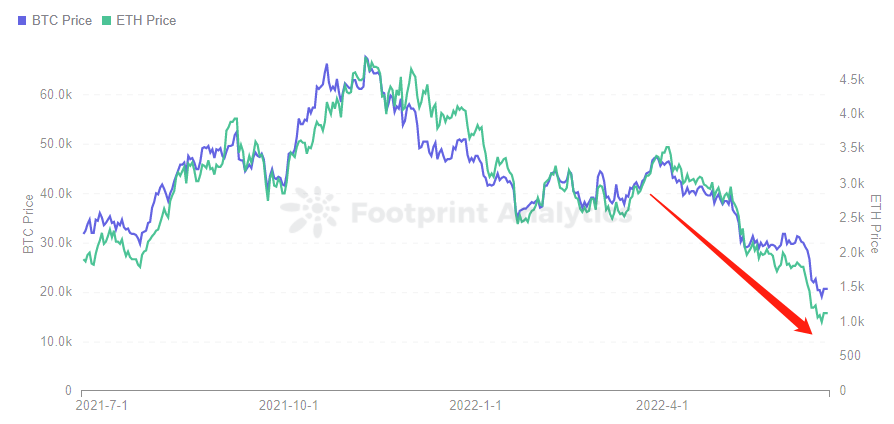

Common sense indicates that these new, experimental assets are riskier compared to BTC and ETH. Although it is difficult to objectively measure risk, we can use data on the chain to assess price volatility.

With the bear market in full swing, now is the perfect time to compare these assets and see what the ultimate blue-chip assets could be going forward: Crypto, NFTsor meta worst country.

Here we will compare three hypothetical investors: Abe, Bob and Cathy. A year ago, each put their money in a different asset class within the crypto space.

Abe’s portfolio: 50% BTC and 50% ETH.

Bob’s portfolio: 50% BAYC and 50% CryptoPunks.

Cathy’s portfolio: 50% Decentraland Land & 50% Sandbox Packs.

These comparisons are not 1-to-1 (buying 3 Bored Apes at $6,000 each a year ago is a very different move than investing $6,000 in a long-term “safe” token like ETH.) So we’ve created 3 “reasonable” portfolios together these 50/50 lines that are not exact the same. To be explained later.

In this article, we will track how each of these investors’ portfolios performed and explore why some of these investments are more volatile than others.

Abe’s token portfolio

One of the advantages of investing in tokens instead of NFTs is liquidity and severability. We are able to set an exact USD dollar value of BTC and ETH on any given day, buy any amount we want and receive a fair market rate.

On this day a year ago, June 28, 2021, BTC cost $35,867. For ease of calculation, we’ll round this to the nearest hundred—$35,900. ETH was $2,160—rounded to $2,200.

Our token investor picked an excellent time to jump in. Following the enthusiasm of the Coinbase IPO on April 13, 2021, and the Federal Reserve cutting interest rates to 0.25% to stimulate the economy, the market roared. However, it was temporarily sent crashing, primarily due to a wave of strict regulations in China, and it was around here that Abe intervened.

Afterward, Abe bought the bottom of the cycle, putting $50,000 in BTC and $50,000 in ETH (got about 1.39 BTC and 22.7 ETH.)

The insane upward climb continued until November 8, 2021, when Abe’s original investment was worth $203,767.52.

But then speculative enthusiasm for cryptocurrencies began to wane as retail and investors cut back on risky assets.

From January to June, the Federal Reserve raised interest rates by 75 basis points in quick succession, the largest margin in 28 years.

In February, the war in Ukraine triggered a slowdown in macroeconomic conditions, resulting in a bearish environment for the crypto market.

To top it off, flash crashes Terra Luna in May looked like the beginning of a series of car wrecks in the blockchain industry.

All of these events have driven down the prices of BTC and ETH – assets that, for the vast majority of the non-crypto crowd, are stand-ins for the “price of crypto” itself.

On June 28, 2022, Abe’s 1.39 BTC and 22.7 ETH portfolio was worth $54,197.7, down 45.8%. The decline from the all-time high was 73.4%.

The NFT portfolio

Although NFTs are not as liquid as BTC or ETH, they are unique and collectable. And when the market is in a better state, holders can also get a specific dollar value from it.

What did the NFT market look like in June 2021?

- Germination and construction period:

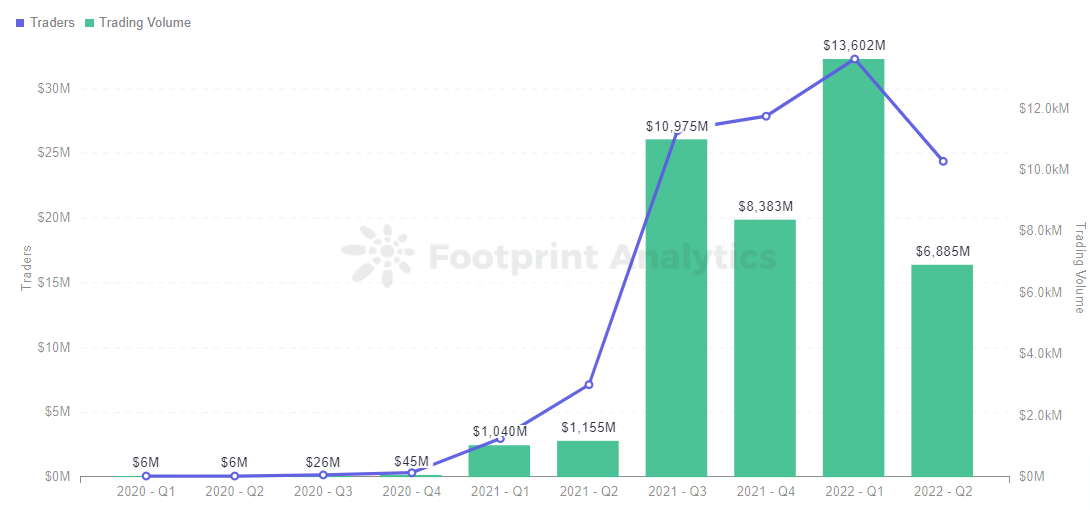

In June 2017, CrytoPunks, the world’s first NFT project, was officially born, bringing the NFT concept to a climax. Led by OpenSea, NFT trading has become more convenient and perfect, which makes NFT application areas gradually expand from games and artworks.

By 2021, Axie Infinity sales increased rapidly, driving growth in the NFT market. In the same year, BAYC was also established and entered the public domain.

This is the perfect time for Bob to enter the market when NFTs are in their infancy. Because NFT follows a rule, the faster the attributes are rarer, the higher the value and the lower the price is more balanced (the NFT trading market is immature, and the transaction frequency is low).

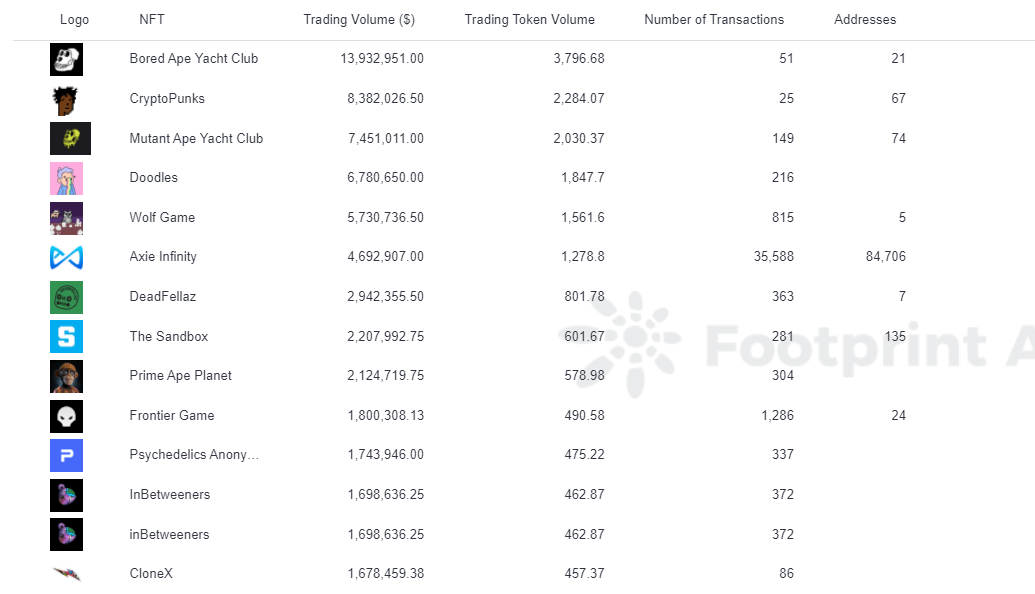

BAYC and CryptoPunks rank among the top NFTs when it comes to that trade volume in 2021.

Assuming Bob buys 1 BAYC (3.5713 ETH) and 1 CryptoPunk (28.9191 ETH) on June 28, 2021, at an average price, his initial investment is worth $71,478.88 at that time.

In 2021, the world’s economic development was severely affected by the epidemic, and fiscal easing in major economies led to inflation and currency devaluation, driving users to crypto markets such as artwork, NFT, and BTC. Trading activity in the NFT market continued to increase from August to March 2021.

If Bob had followed ETH and sold it at the peak on November 8th (ETH at $4,826.25), when the average prices of BAYC and CryptoPunk were 43.8835 ETH and 98.5848 ETH respectively, his portfolio would have been worth $687,587.63 , an increase of 95%81. .

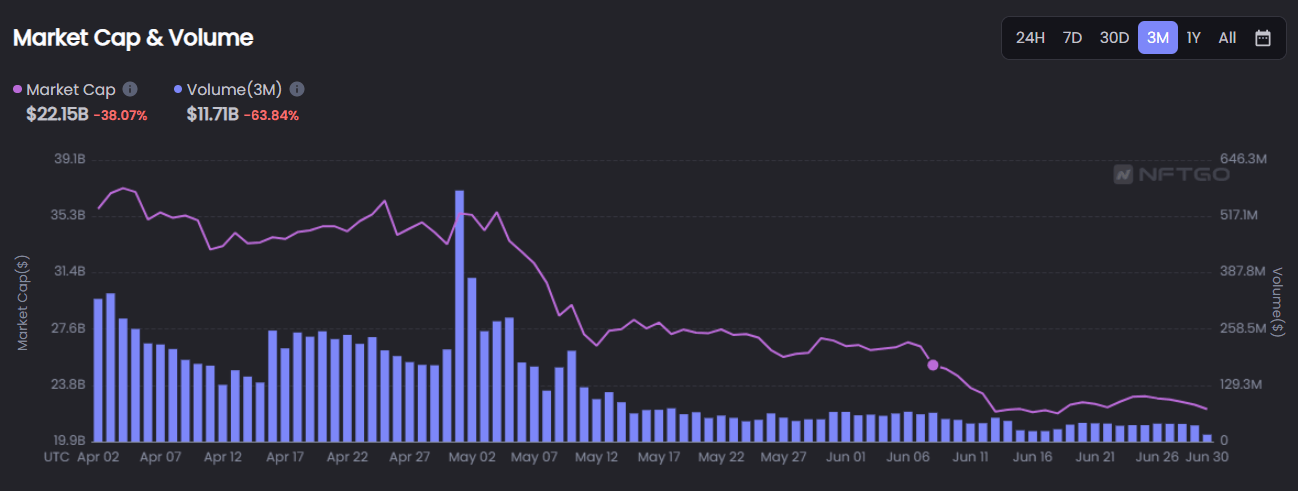

The crypto market crash led to a decline in investor interest in NFT, significantly affecting its overall trading volume and the decline in market capitalization. Over the past 90 days, total trading volume has fallen by 63.84% and total market capitalization by 38.07%.

As of June 28, 2022, ETH is trading at $1,144, BAYC at 113.5035 ETH, and CryptoPunk at 77.6991 ETH. Bob’s portfolio is worth $218,735.77, up 206.01% year over year. It is down 68.19% from the record high.

It is clear that blue-chip NFTs, as of early summer 2022, are not as volatile as many think compared to the so-called “safe” crypto investments BTC and ETH.

*Since investing half of your portfolio in BAYC NFTs would have been pretty insane in June 2021, we are taking a different approach to 50/50 in this portfolio. Bob bought 1 Punk and 1 Monkey.

The country portfolio

By being interested in the June 2021 metaverse, Cathy can be considered an early adopter. At the time, the word “metaverse” had not yet become a household name.

Facebook’s rebranding to Meta was still four months away.

Was the metaverse a new version of Second Life? Do you need a VR headset to access it? Almost no one who wasn’t deep in the crypto-tomb already knew that.

But the rumblings were there. On June 4, Sotheby’s opened a virtual gallery in Decentraland, and the game made waves as the first to break 1 million in a record-breaking land sale.

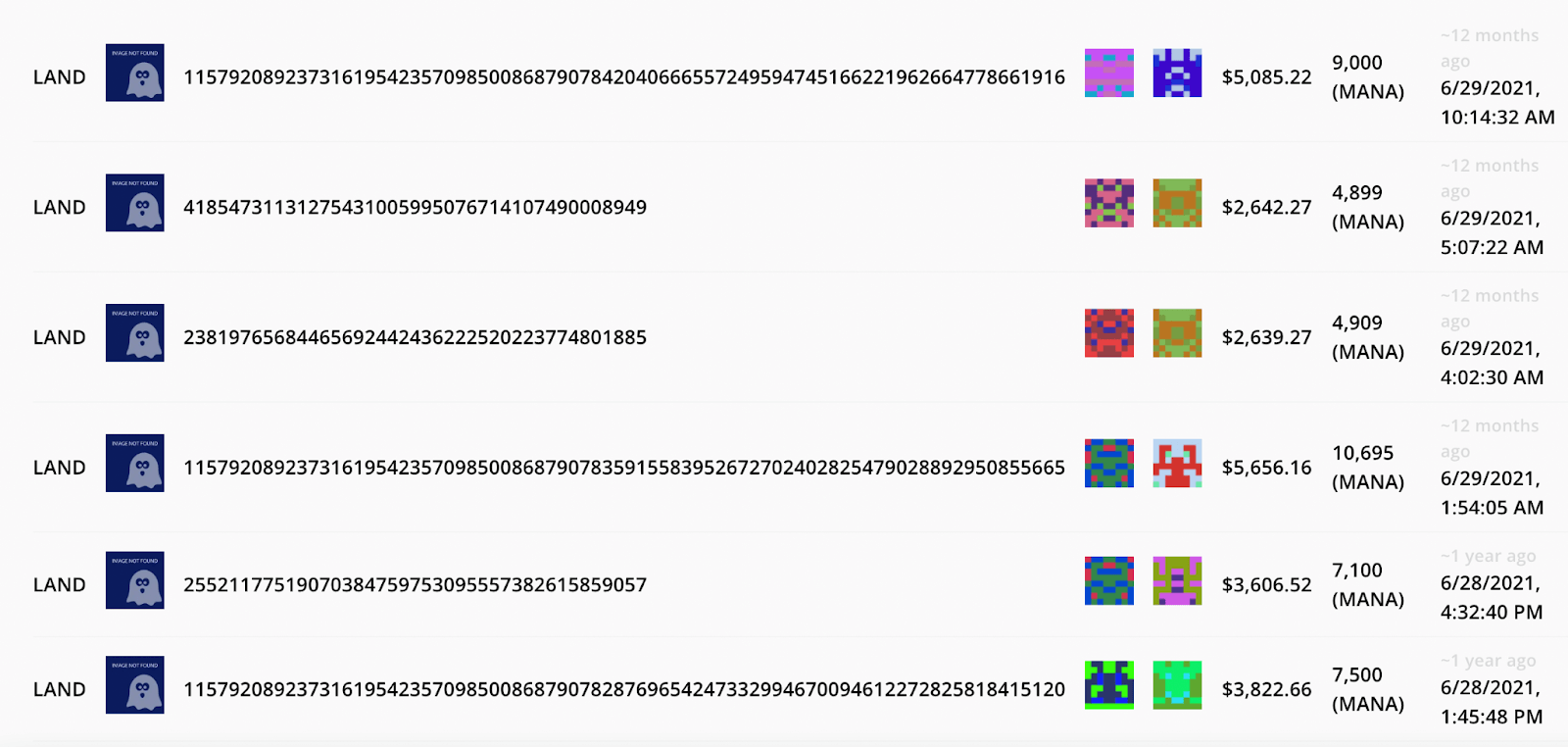

On June 28, 2021, Cathy became a metaverse landlord. Her purchase was one of 37 NFT sales in Decentraland, which collectively generated $148,500.

Because all the transactions on the blockchain are on a public ledger, we can actually see and analyze all the LAND sold on this date.

The average sale price on June 28 was around $4,000, which seems like a reasonable valuation when you look at these sales. (That is, if it was a single sale at an astronomical price, that would make the average a poor measure of how much Cathy could have paid.)

Then, dipping her toes in the metaverse, Cathy bought a $4,000 plot of land—maybe this one:

She also added a package to The Sandbox. At the time, the search term “Sandbox” hardly brought to mind the metaverse title that would take over the headlines in just a few months for the 3842% jump in the token price.

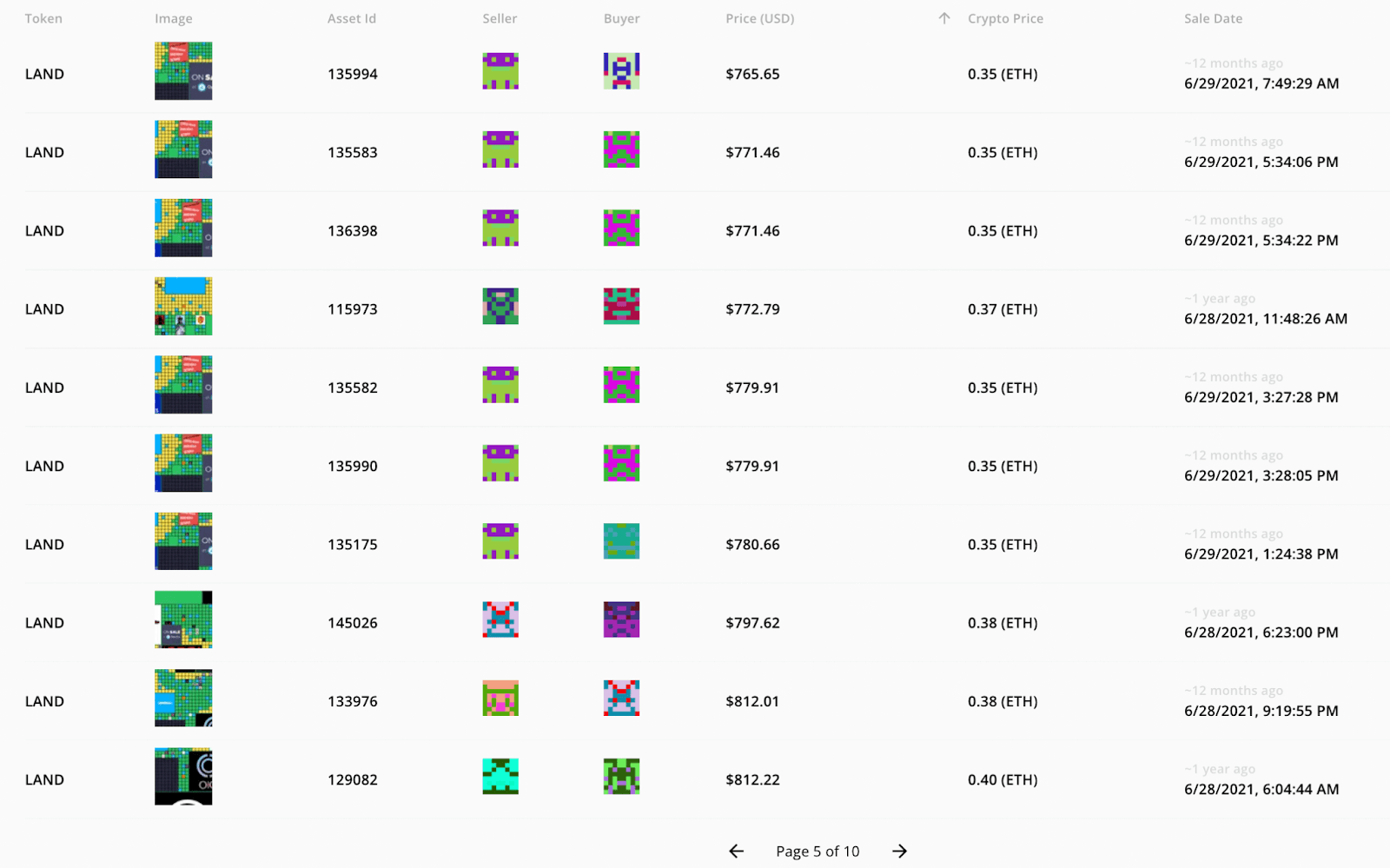

On June 28, 46 NFTs were sold, bringing in $43,500, an average price of $945. This is a few hundred higher than the median price for the day, but is still accurate enough to make a general analysis.

So, to maintain an almost 50/50 allocation in the two biggest name products in the asset category, Cathy bought a plot of Decentraland at $4000 and 4 Sandbox lands at $945 each – a total metaverse land portfolio of $7780.

Her judgment would prove visionary. By November 8, 2021, when ETH BTC peaked, the average sale price in Decentraland increased by 3.0469 ETH to $14,705. The average price of The Sandbox land skyrocketed to $6,096, an increase of 734.62 percent.

If we just go by average, her 1 Decentraland plot and 4 Sandbox packs would be worth $39,089.

If we instead look at the real asset shown above that cost just under $4,000 on June 28, 2021, it increased by $59,135. It changed hands for $55,313 on the 15th. November 2021, the closest sell-off to the ETH peak.

Over the next year, metaverse land prices fell sharply as volume in Decentraland and The Sandbox dropped to ATLs by 76.81% and 79.03% respectively.

June 28, 2022, Cathy’s the portfolio decreased by $14,811 from ATH (-62%). A big hit, but still way up from the original investment. Metaverse land is clearly extremely volatile and can still be called a Hail Mary play rather than a safe blue-chip.

Summary

While the bull market saw huge gains for NFTs and metaverse lands, the on-chain data for top projects indicates that prices are not as volatile as many believe compared to “safe” assets like BTC and ETH.

In this article, we created three hypothetical portfolios and found that the safe crypto game had a steeper fall from ATH (as of June 28) than investments in NFTs and metaverse countries. The gains over the bull market would also have been significantly higher for the latter two “risky” assets.

While there are several possible explanations for this (e.g., more difficult for institutions to push down the prices of NFTs and land), this data supports the idea that the best NFTs and metaverse land projects have performed exceptionally well throughout the past year — Bumps, busts, crashes and all.

Date and author: July 7, 2022, Vincy

Data source: Footprint Analytics – BTC & ETH trend analysis

This piece was contributed by the Footprint Analytics community.

Footprint Community is a place where data and crypto enthusiasts around the world help each other to understand and gain insights about Web3, the metaverse, DeFi, GameFi or any other area of the new world of blockchain. Here you will find active, diverse voices that support each other and drive society forward.

What is Footprint Analytics?

Footprint Analytics is an all-in-one analytics platform for visualizing blockchain data and discovering insights. It cleans and integrates chain data so users of all experience levels can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own custom charts in minutes. Uncover blockchain data and invest smarter with Footprint.