‘Weapons of war’ in the ongoing Israeli-Palestinian conflict

Could Bitcoin become a weapon of war? First Russia-Ukraine and now Palestinians in the Gaza Strip are showing interest in Bitcoin and other cryptocurrencies. While the answers may become obvious, there are still some practical problems with crypto usage before and after the war.

How does a war, whether at a state or national level, affect cryptocurrencies?

Geopolitical tensions are at an all-time high, while the threat of a potential world war continues to rage, most recently triggered by the unfortunate conflicts between Russia and Ukraine. These cases show that cryptocurrencies such as Bitcoin play an important role in the fight for survival.

Battles in Russia and Ukraine

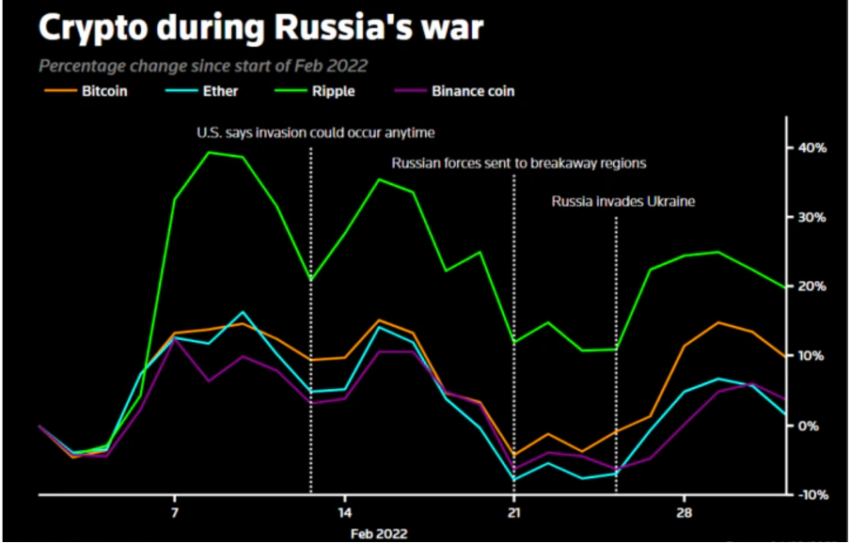

Russia invading Ukraine touched the globe as the war continued. These digital assets have made headlines since the invasion. Here’s how cryptos performed during the most horrific attack since World War II.

Bitcoin fell after Russia launched its first attack on Ukraine as investors dumped riskier assets.

Although the Russian soldiers were marching in the Ukrainian territory, crypto generally experienced a sense of unity. This is evident in the graph above, given the slope.

One of the main reasons behind the increase in digital assets was crypto-donations, since the way comes without border restrictions. Ukraine managed to collect millions of dollars only through these financing initiatives, reported Reuters.

Crypto Helping Hands

The data provided by blockchain analytics firm Elliptic showed crypto donations worth $19.80 million in Q1. The donations started pouring in when the government of Ukraine officially asked for Bitcoin (BTC), Ethereum (ETH) and Tether (USDT).

The unprecedented call for donations using digital tokens is something very new. These donations were made directly to Ukraine and pro-Ukraine group organizations such as the hacktivist collective Anonymous. Funds came in from individuals, organizations and crypto institutes. Even the now bankrupt stock exchange FTX participated.

This demonstrates crypto’s wartime potential at work. Crypto donations that would otherwise have been given to other charities now ended up directly in the wallets where they are needed.

Crypto has the potential to flourish as a post-war currency. But has that been the case for every war that continues even today? One such example is the ongoing conflicts between Israel and Palestine.

A brief history

Over the past few years, violent face-to-face clashes between Israelis and Palestinians have escalated into full-scale war. It is a conflict that has been going on for generations.

Jerusalem is one of the holiest lands for Christians, Jews and Muslims. Israel claims the entire city as its capital, but Palestine proclaims East Jerusalem as the capital of its future state. For the past 50 years, Israel has built settlements in Jerusalem.

More than 600,000 Jews live there now, but the Palestinians say it is illegal under international law. There have been many attempts at peace over the decades, starting in 1979, but tensions have remained high in East Jerusalem, Gaza and the West Bank.

Bitcoin: A Weapon of War

Numerous individuals, mostly Palestinians, suffered a significant blow from the conflict – especially Palestinians in the blockaded enclave of Gaza. The disruption in everyday life also affects the financial network.

Enter Bitcoin

The National news surveyed some individuals along the Gaza Strip and highlighted their interest in crypto assets. “With Israel restricting trade and access, a growing number of citizens are turning to cryptocurrencies to make a living – despite the risks,” it said.

Gaza resident Noor had nothing to do with Bitcoin until her makeup shop was destroyed during the war with Israel in 2021. Later, she started investing in cryptocurrencies to survive.

“My fortunes changed when I learned how to invest in Bitcoin and started selling makeup online,” she said.

Dr. Tariq Dana, a policy advisor for Al-Shabaka, the Palestinian Policy Network, believes a growing number of locals have jumped on the crypto bandwagon as a way to gain independence from Israel’s economic regulations.

“I think the decentralized banking status of crypto is encouraging enough for us [Palestinians] to have an income through a safe and freelance platform,” said Kareem, a resident of Gaza who also invests in Bitcoin.

Additionally, the survey also incorporated insights from Haitham Zuhair – a Palestinian businessman and crypto investor. Speaking on the matter, he said: “I am sure that the drop in Bitcoin price has cost many traders in Gaza so much because their initial investments and capital are not as high as one would think.

“Education and experience are essential to continue with crypto as a space for online income and a symbolic tool for financial steadfastness in Palestine. It only takes one wrong call to lose an earth’s worth of profit in crypto.”

Despite these encouraging visions and data sets, concerns are always there.

Trouble just around the corner

While cryptocurrencies have opened the door for many Palestinians to profit from global trade, it is not a viable path for the Palestinian Authority, warns Mohammed Khaled, a business journalist in Gaza City.

“It is impossible to create procedures at the state level with Bitcoin … the crypto exchange system in Palestine is centralized, which means that Israel can stop deposits and withdrawals,” he added.

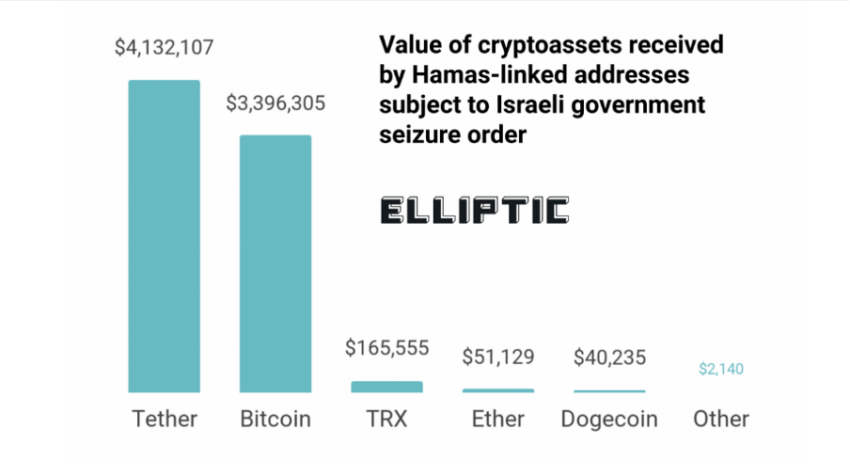

These concerns may be real. Authorities in Israel seized $7.70 million in Bitcoin (BTC), and Dogecoin (DOGE) believed to be used by Hamas, a Gaza-supporting group.

A practical scenario

Fiat money has always taken a beating during wartime. ATMs stop working and the authorities prohibit banks from allowing easy withdrawals, selling international currencies or accepting payments of various kinds, leaving individuals cashless and unable to shop.

In extreme circumstances such as an invasion, local banks holding currency will become unavailable. Cash surrogates such as grocery or fuel cards are likely to be used to buy everything needed. Expected outcomes are increasing uncertainty and high inflation risk, similar to what happened to Ukraine, making something as basic as bread a luxury item.

Crypto can potentially be seen as a solution to these problems. Peer-to-peer payments without third-party involvement can be seen as an independent, control-free solution. It cannot be regulated or stopped by any military organization or state government. A stable and secure decentralized payment method can theoretically withstand any political regime.

In conclusion, crypto and other digital assets have already started to show promising signs in the conflict between Ukraine and Russia, with millions of dollars in anonymous donations using the limitless power of blockchains. So it is only reasonable to imagine that they would play a significant role if the conflict was the start of WW3.

Cryptocurrency has the potential to become the global currency of the post-global era, but this will also attract the attention of hackers. Therefore, even in the post-war era, cyber security will be a top priority.