US Crypto Users Trust Intermediaries Despite 2022 Fallout

Throughout 2022, the collapse and fallout of major crypto institutions triggered a massive selloff. Despite this, a recent Paxos report shows that most crypto users in the US have no qualms about continuing to let intermediaries hold their money.

2022 was a turbulent year for the crypto industry, characterized by volatility and uncertainty. However, despite the challenges, the industry continued to grow and develop. More and more people around the world are embracing cryptocurrencies and blockchain technology.

Despite a volatile year for cryptocurrency, enthusiasm for this asset class has continued to grow. The price of cryptocurrencies such as Bitcoin, Ethereum and others have experienced significant fluctuations. But many factors contribute to the ongoing enthusiasm for these digital assets.

Investor Outlook on Cryptocurrencies

One of the main drivers of this enthusiasm is the increasing use of cryptocurrency by mainstream institutions and investors. For example, major corporations have invested heavily in Bitcoin, while financial institutions such as JPMorgan and Goldman Sachs offer cryptocurrency services to their clients. This growing acceptance of cryptocurrency by established players in the financial world has helped to legitimize this asset class in the eyes of many investors.

In addition, individuals around the world have a growing awareness of cryptocurrency’s potential benefits, such as decentralization, security and privacy. Many people are excited about the possibilities that blockchain technology and cryptocurrencies can offer, such as enabling faster and cheaper cross-border transactions and enabling access to financial services for the unbanked.

Finally, the pandemic also played a role in driving interest in cryptocurrency, as many people have looked for alternative investment opportunities in the face of economic uncertainty. While the volatility of cryptocurrency prices may cause concern for some investors, the ongoing enthusiasm for this asset class suggests that it is likely to continue to play an important role in the global financial landscape.

2022 Tested the resilience of the crypto space

The United States is one of the most popular geographic landscapes in the crypto space. This is evident in a recent Paxos survey shared with BeInCrypto. The main purpose of the survey was to understand how the fallout in 2022 affected US-based crypto holders. Indeed, it was a volatile and potentially confidence-testing year for the ecosystem.

Here, the respondents lived in the United States, represented over 18 years of age, and had a cumulative household income in excess of $50,000. In addition, the candidates have purchased crypto within the last three years. In total, the survey recruited 5,000 participants.

Crypto Enthusiasm in the US

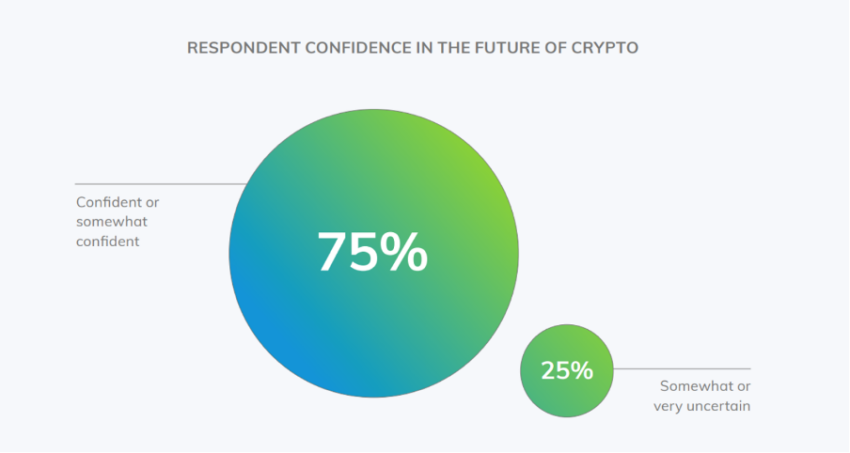

Surprisingly or not, consumers remained undeterred in their optimism regarding crypto investments. The cohort represented 75% of those polled by the firm – “confident or somewhat confident” about the future of the crypto space.

About a third of the candidates surveyed bought their first crypto despite last year’s black-swan events. Meanwhile, 72% of respondents were “somewhat concerned or not at all concerned” about the volatility of crypto markets over the past year.

Overall, the fact that most respondents expressed confidence in the future of cryptocurrency suggests that many people see potential value in this new technology. However, it is important to continue to monitor the development and use of cryptocurrency to better understand the long-term outlook.

To understand and record more user opinions, BeInCrypto created a small survey on Reddit, asking about the reasons behind their crypto enthusiasm. Many Redditors voiced their opinion about the platforms. For example, one of the answers reads:

“I’m quite confident. Volatility is only part of the market, but I’ve looked beyond that. Interest is growing and we are seeing large mainstream companies embracing blockchain technology. Innovative solutions from Polygon, Ocean, Algorand, etc., continue to push adoption forward, opening the opportunity for web2 companies to join web3.”

Another user reiterated or instead reinforced crypto’s role as a payment gateway. The Redditor added, “I’m pretty confident about the future of crypto, mainly because I can see adoption growing exponentially as we now have more options to pay for goods and services with crypto via payment platforms.”

Putting faith in intermediaries

The next part of the report may surprise many readers. 89% of respondents still rely on intermediaries such as “banks, crypto exchanges and/or mobile payment apps” to hold their crypto.

“Indeed, despite the high-profile collapses and underlying poor risk management practices seen in several crypto companies, crypto owners still rely on intermediaries to hold crypto on their behalf.”

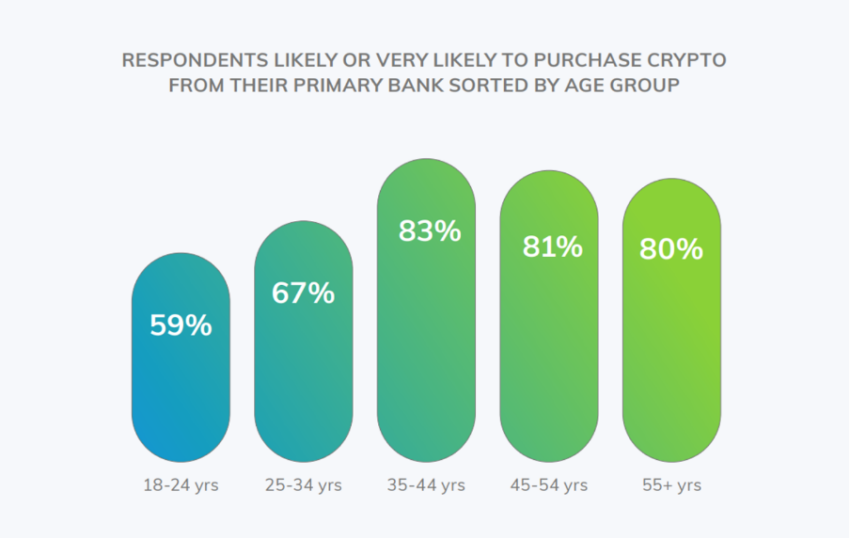

Additionally, more than 70% of candidates said they are “likely or very likely” to buy crypto from their primary bank if offered. This represented an increase of 12% from last year’s survey results. Moreover, more than 40% of respondents are encouraged to invest more in crypto, if integrated, by banks and other financial institutions.

Needless to say, these institutions have an untapped opportunity if they are exposed to the full potential of cryptocurrencies. That is, to open the portal to offer digital asset custody without restrictions.

Ups and downs for centralized units

Centralized custodians are third-party entities that hold and manage digital assets on behalf of their customers. They are responsible for ensuring the security of the assets and protecting them against theft, loss or other risks. In the cryptocurrency industry, centralized custodians are essential to provide institutional investors and other large entities with a safe and reliable way to hold and manage their digital assets.

However, the reliance on centralized custodians has also been discussed and criticized in the cryptocurrency community. Some argue that relying on third-party custodians goes against the decentralized and trustless nature of cryptocurrencies. It introduces a single point of failure and requires users to trust the custodian’s security measures.

The collapse of FTX, or any other centralized manager, eroded the credibility and trustworthiness of such entities in the eyes of investors and the wider public. However, it is important to note that not all managers are created equal. Many reputable managers have robust security measures and have proven reliability.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.