UPST, PYPL or SOFI: Which Stock Is Wall Street’s Most Compelling Fintech Pick?

Continued market volatility can make it difficult for investors to pick the right stocks. It is better to ignore short-term disruptions and focus on secular trends that can drive long-term growth. One such trend is the shift to digital payments, which is expected to drive growth for fintech companies. Using TipRanks’ stock comparison tool, we ranked Upstart (NASDAQ:UPST), PayPal (NASDAQ:PYPL), and SoFi (NASDAQ:SOFI) against each other to find Wall Street’s most attractive fintech stock.

Upstart (NASDAQ:UPST)

Shares in the artificial intelligence-based lending platform Upstart have risen since the company announced its first-quarter results earlier this month. First-quarter revenue fell 67% to $103 million, and the company slipped to an adjusted loss per share of $0.47 from EPS of $0.61 in the prior quarter. However, both calculations were better than analysts’ expectations.

But what really impressed investors was management’s comment that the company secured several long-term financing deals that are expected to deliver over $2 billion to the Upstart platform over the next 12 months. Rising interest rates have increased the risk of potential defaults and have also affected the demand for consumer loans. However, the upstart’s outlook on the way forward improved investor sentiment about the stock.

In addition, the stock rose last week after the company signed an agreement to sell up to $4 billion of consumer loans to global investment management company Castlelake.

What is the target price for UPST?

Last week, Wedbush analyst David J. Chiaverini maintained a sell rating on Upstart stock, saying the financials of the new long-term financing partners remain unclear and credit quality continues to be weak.

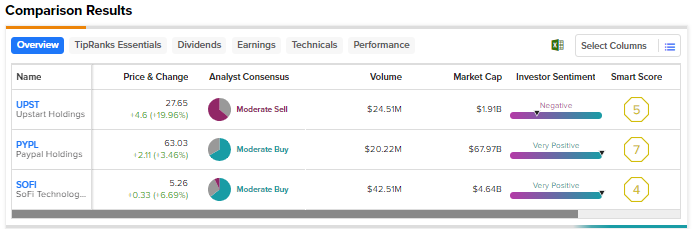

Wall Street has a moderate sell rating on Upstart based on one buy, three holds and seven sells. The average price target of $14.45 implies a downside of 47.7% from today’s level. The shares have risen more than 109% so far this year.

PayPal (NASDAQ:PYPL)

PayPal’s first-quarter revenue and adjusted EPS grew over 8% and 33%, respectively, and both the top and bottom lines beat analysts’ estimates. The company raised its full-year results to reflect the momentum in Q1 and cost efficiency.

However, the stock fell after the first-quarter printout, when the company warned that it expects its adjusted operating margin to increase 100 basis points in 2023 compared to the previous estimate of 125 basis points. The rapid growth of Braintree, PayPal’s unbranded payment processing business, which has a lower margin than its branded business, was responsible for the revised margin guidance.

Macro pressure and increasing competition have affected the company’s branding business. Nevertheless, several analysts remain optimistic about PayPal’s long-term prospects.

Is Paypal a buy, sell or hold?

Following the results, UBS analyst Rayna Kumar reiterated a Buy rating on PayPal, but lowered the price target to $118 from $129 due to the tighter margin forecast.

Kumar believes that while PayPal’s unmarked volume is creating a negative mix shift, it is driving stock gains. Kumar believes PayPal stock is undervalued, as he expects the fintech giant to deliver 20% EPS growth in 2023 and the mid-teens thereafter. He sees any decline in the stock as an attractive buying opportunity.

Overall, Wall Street is cautiously bullish on PayPal stock, with a moderate buy consensus rating based on 18 buys and nine holds. Average price target of $97.70 suggests 55% upside potential. The shares have fallen 11.5% since the start of the year.

SoFi Technologies (NASDAQ:SOFI)

Digital finance company SoFi’s first-quarter revenue rose 43% year over year to $472 million. The company reduced its loss per share to $0.05 from $0.14 in the previous quarter. The company benefited from continued demand for personal loans, which helped offset weakness in mortgage originations due to rising interest rates and a drop in student loan origination volumes due to the federal student loan moratorium.

Despite the improved outlook, the stock fell as investors were disappointed that the full-year guidance upgrade was not on par with the extent to which the company beat expectations for the first quarter.

Are SOFI shares a good buy?

On May 15, Wedbush’s Chiaverini downgraded his rating on SoFi to Hold from Buy and cut his price target to $2.5 from $5. The analyst cited several reasons, including concerns that the fintech’s capital levels may be overstated using fair value accounting, and the company may look to raise capital this year to support growth.

Note that SoFi’s loans are marked to fair value each month based on applicable company-specific and macro factors to reflect an expected sales price at that time.

Last week, Piper Sandler analyst Kevin Barker also lowered his firm’s price target on SoFi Technologies to $6.50 from $8, noting that the company’s significant adjusted EBITDA pace in Q1 was a result of larger-than-expected positive fair value – badges for both private individuals and students. loan.

Barker added that the fair value brands could create an incremental headwind to earnings due to premium write-offs in the absence of significant portfolio sales. That said, the analyst maintained his Buy rating on the stock, as he continues to see value in SoFi stock.

Wall Street’s Moderate Buy consensus rating on SOFI stock is based on nine Buys and four Holds. Average price target of $7.65 suggests 45.4% upside. The shares have risen 14% so far this year.

Conclusion

While Wall Street analysts are cautiously bullish on PayPal and SoFi, they are bearish on Upstart due to a lot of uncertainty and lack of clarity around the business. Analysts see higher upside in PayPal than the other two stocks, with the pullback in the stock providing an attractive buying opportunity to gain exposure to a fintech stock with solid long-term growth potential.

Mediation