TrueUSD’s Bitcoin trading volume approaches Tether’s on Binance, but traders hesitate to use the token

Join the most important conversation in crypto and web3! Secure your place today

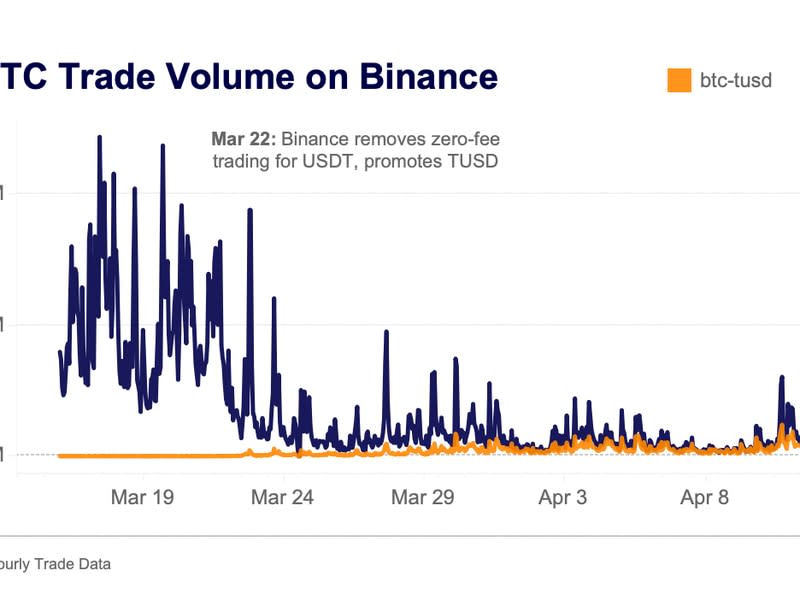

TrueUSD (TUSD) stablecoin’s market share in bitcoin (BTC) trading volume on Binance is catching up to Tether’s USDT following the exchange’s zero-fee trading discount, but data shows traders are still reluctant to use TUSD, according to crypto data firm Kaiko.

Between Binance’s BTC-TUSD and BTC-USDT trading pairs, TUSD’s market share rose to 49%, almost equal to Tether’s.

“This is a massive increase in just a few weeks,” said Clara Medalie, head of research at Kaiko.

However, TUSD’s growth could not offset the rapid decline in the BTC-USDT pair’s trading volume after Binance dropped its zero-fee discount for Tether, according to Kaiko data. Also, larger buy and sell orders are still being entered for the USDT pair, per Kaiko. “This suggests traders are still reluctant to use TUSD despite zero fees,” Medalie added.

TUSD’s rise has come as Binance, the world’s largest crypto exchange by trading volume, chose the token as the successor to its preferred Binance USD (BUSD) stablecoin issued by Paxos Trust.

The exchange resumed trading of TUSD after a six-month hiatus following Paxos’ decision to stop issuing BUSD and granted its zero-fee trading discount to the BTC-TUSD pair and waived the promotion of BUSD and USDT as of March 22.

The $132 billion stablecoin market is undergoing major upheaval stemming from a regulatory crackdown and banking crisis in the United States. In February, the New York Department of Financial Services (NYFDS), the state’s top financial regulator, forced Paxos to stop minting BUSD. third largest stablecoin with a market capitalization of 16 billion dollars. Last month, the collapse of crypto-friendly Silicon Valley Bank, backup partner of the second largest stablecoin USDC, sent shock waves through the market. In the aftermath, the USDC suffered more than $10 billion in outflows.

Tethers USDT and TUSD have emerged as clear winners of the crisis. TUSD has become the crypto market’s fifth largest stablecoin with a market cap of $2 billion. The USDT’s circulating supply has grown by $10 billion in recent months and is nearing its all-time high.

Stablecoins are a crucial element of the crypto ecosystem, facilitating trading on exchanges and acting as a bridge between government-issued fiat money and digital assets.

TUSD is a dollar-pegged stablecoin issued by crypto firm ArchBlock, formerly known as TrustToken. Its value is fully backed by fiat assets, according to blockchain data provider ChainLink’s proof-of-reserve monitoring tool. In 2020, a little-known Asian conglomerate Techteryx bought TUSD’s intellectual property rights, TrustToken said at the time.