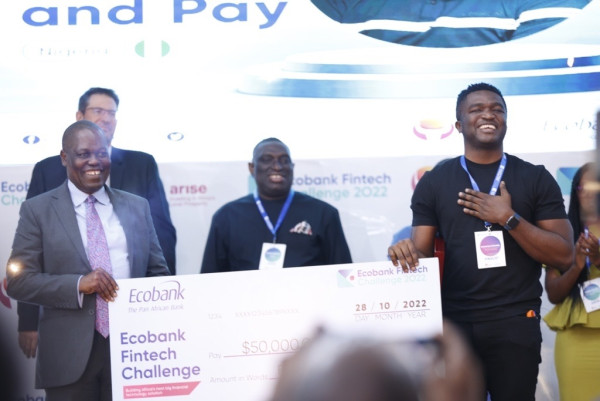

Touch and Pay wins $50,000 Ecobank Fintech Challenge 2022

Ecobank Group (www.Ecobank.com) is proud to announce that Touch and Pay a Nigeria-based fintech has won the 2022 edition of the Ecobank Fintech Challenge. This announcement was made at the Grand Finale, today at Ecobank’s headquarters in Lomé, chaired by HE Cina Lawson, Minister of Digital Economy and Transformation, Republic of Togo. Touch and Pay took home a $50,000 cash prize, the largest free fintech cash prize in Africa.

Touch and Pay processes microtransactions across Africa, such as paying for bus travel. Today, Touch and Pay has over 2 million users helping 500,000 people pay every day.

The winner and the other five finalists were also inducted into the Ecobank Fintech Fellowship – a unique program that gives Fintech Fellows the opportunity to explore potential commercial partnerships with the bank, such as integrating with Ecobank’s pan-African banking platforms and scaling their fintech businesses. across Ecobank’s 33 African markets.

The other five finalists for the 2022 edition are:

- Cauri Money, Senegal

- DizzitUp, Togo

- MaishaPay, Democratic Republic of Congo

- Moni Africa, Nigeria

- Paycode, South Africa

- Touch and Pay, Nigeria

Ade Ayeyemi, CEO of Ecobank Groupand congratulating the finalists, said: “This year’s six finalists have set the bar high at this Grand Finale. Their innovations are revolutionizing the financial payments landscape in Africa and promoting financial inclusion. Ecobank Group is honored to partner with them and jointly transform the financial landscape of our continent.” Mr. Ayeyemi also expressed Ecobanks “big thanks to all our partners, especially Arise, the gold sponsor of the 2022 Challenge, as well as to the jury who worked tirelessly to evaluate the finalists and select the winner.”

Gavin Tipper, CEO of Arise, a gold partner and co-sponsor of the challenge, said: “Arise congratulates the finalists and the winner for their creativity and innovation. The Ecobank Fintech Challenge has become an important platform to support fintech innovators and encourage bold solutions to promote financial inclusion in Africa. The talent that offered in this year’s pool of finalists once again exceeded expectations and we look forward to seeing how the various products transform financial services on the continent.”

Oluwole Michael, CEO of Touch and Pay expresses deep satisfaction in winning the Fintech Challenge, commented: “We at Touch and pay (TAP) are excited about the opportunity we have been given to work with Ecobank, a pan-African bank that operates across Africa. This feeds into our vision to help 250 million Africans process cash-based transactions digitally, making them truly cashless and providing true credit facilities for merchants, retailers and customers.”

In addition to the pitch by each of the six finalists and a keynote speech by HE Cina Lawson, highlights of the Grand Finale included panel discussions on ‘Sustaining and deepening investor interest in African Fintech in the face of the global economic crisis: what should investors, Fintech companies and governments do?‘ and ‘Securing Fintech-friendly regulations that accelerate startup growth and maturity: what’s the best way forward for Africa.’

Almost 4,000 start-ups have participated in the five editions of the Ecobank Fintech Challenge since it was launched in 2017. Since then, 52 Fintechs have been inducted into the Ecobank Fintech Fellowship. The 2022 Challenge was supported by partners including Arise, Konfidants, Tech Cabal, Africa Fintech Network and ALX Ventures.

Distributed by APO Group on behalf of Ecobank.

Names, countries and websites of the six finalists and 2022 Ecobank Fintech Fellows

Media Contacts:

Christiane Bossom

Corporate Communications Manager

Ecobank Group

Email: [email protected]

Tel: +228 22 21 03 03

Internet: www.Ecobank.com

Zeenat Parker,

Head of Communications

Arise

Email: [email protected]

Tel: +27 81 248 2801

About Ecobank Transnational Incorporated (‘ETI’ or ‘The Group’):

Ecobank Transnational Incorporated (‘ETI’) is the parent company of Ecobank Group, the leading independent pan-African banking group. Ecobank Group employs around 13,000 people and serves over 32 million customers in the consumer, commercial and corporate banking sectors in 33 African countries. The group has a banking license in France and representative offices in Addis Ababa, Ethiopia; Johannesburg, South Africa; Beijing, China; London, United Kingdom and Dubai, United Arab Emirates. The group offers a complete suite of banking products, services and solutions, including bank and deposit accounts, loans, cash management, advisory, trading, securities, wealth and asset management. ETI is listed on the Nigerian Stock Exchange in Lagos, the Ghana Stock Exchange in Accra and the Bourse Régionale des Valeurs Mobilières in Abidjan. For more information please visit www.Ecobank.com

About Arise:

Arise is a leading African investment company working with sustainable, locally owned financial and non-banking institutions in sub-Saharan Africa. The company was founded by several cornerstone investors, namely Rabobank Partnerships, Norfund, NorFinance and FMO, and currently manages assets in excess of USD 1 billion. (www.AriseInvest.com).

This press release has been issued by APO. The content is not monitored by the editors of African Business, and the content has not been checked or validated by our editors, proofreaders or fact-checkers. The issuer is solely responsible for the content of this announcement.