Tags in this story

Top 100 Apecoin holders control over 51% of supply, APE lost 81% in 2 months – News Bitcoin News

Back in mid-March 2022, Bored Ape Yacht Club (BAYC) launched Apecoin DAO and sent millions of apecoin tokens to specific NFT holders. The crypto-asset dedicated to the BAYC ecosystem reached a record high two months ago, reaching $ 26.70 per unit on April 28. However, apecoin has declined more than 81% since that day and despite the fact that 80,744 unique addresses own APE, the top 100 addresses control 51.21% of the circulating supply.

While the price of Apecoin is falling, the concentration of large APE holders remains the same

Just over two months ago, crypto asset apecoin (APE) made headlines after Apecoin DAO distributed millions of apecoin (APE) to NFT owners. APE was sent to BAYC, Mutant Ape Yacht Club (MAYC) and Bored Ape Kennel Club (BAKC) holders.

On March 17, APE switched hands for $ 10.36 per unit or 53% higher than the current price ($ 4.81 per APE). Following the launch, the APE continued to rise in USD value, and by April 28, apecoin reached an all-time high (ATH) of $ 26.70 per unit.

At that time on April 28, APE had a circulating supply of around 284,843,750 tokens and it had the 22nd largest market value of 13,000+ cryptocurrencies. Under ATH, APE’s market value also had a dominance rating of around 0.40%. In addition, APE’s concentration of whale units at that time was quite high compared to most top coins.

Today it is a completely different story, at least for APE’s crypto market performance. Over the past month, apecoin has lost 14.5% against the US dollar, but has seen an 8.2% rise over the past seven days. To date, the APE is down 81% since the cryptocurrency’s ATH, but what has not changed much is the whale concentration.

Bitcoin.com News reported on April 23 that 52% of APEs in circulation were held by 100 addresses. The APE distribution has not changed much since the start of the crypto winter and the value of the crypto economy continues to slide. Statistics from coincarp.com’s APE rich list indicate that the 100 best wallets own 51.21% of the circulating supply.

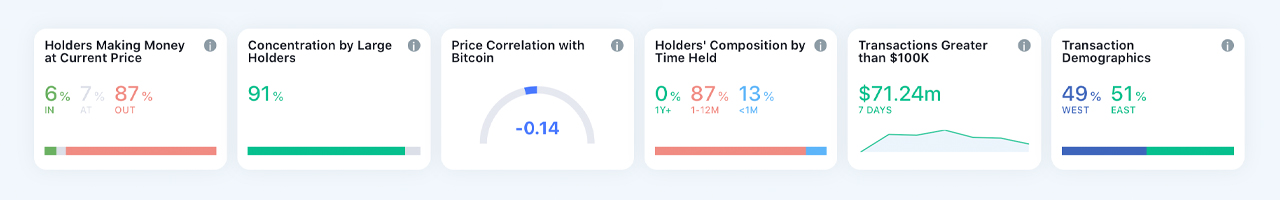

Calculations from intotheblock.com show that apecoin (APE) has a concentration of large owners of around 91% today. It is much more concentrated than the bitcoins (BTC) rating today, which is around 10%.

APE transfers fall, Apecoin search interest falls 95%

Today, the top ten APE owners have 8.01% of the offer, the top 20 addresses have 13.01% and the top 50 APE addresses have 28.01% on July 10th. per day in transfers.

On July 9, 2022, 819 APE transfers were recorded, and over the past week, APE was worth $ 71.24 million in transactions involving transfers of over $ 100,000 per transaction. Search data further show that interest in apecoin (APE) has fallen sharply in the last two months.

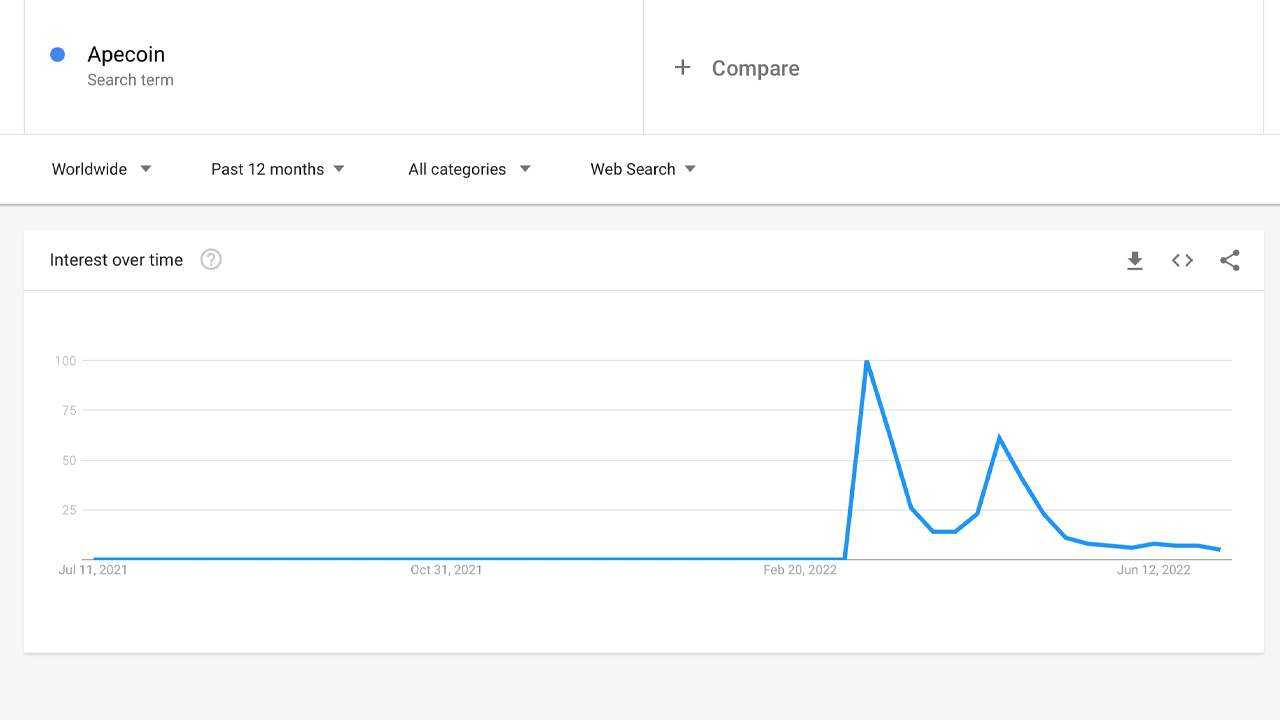

Data from Google Trends (GT) indicates that in the week from March 13 to 19, the keyword “apecoin” received the highest score of 100. This week, the search for “apecoin” has a score of 5, according to worldwide GT calculations on July 10, 2022.

What do you think of apecoin’s market performance over the last two months? What do you think about the whale concentration levels? Tell us your thoughts on this topic in the comments section below.

Photo credit: Shutterstock, Pixabay, Wiki Commons