Tired monkeys approaching mass liquidation on BendDAO, could this crash the entire NFT market?

A large number of Bored Apes Yacht Club NFTs are approaching liquidation on lending platform BendDAO, could this fall into a crash of the entire non-fungible token market?

Bored Apes NFTs are at risk of liquidation as floor prices fall more than 50% since all-time high

BendDAO is a platform that lends Ethereum loans to users against NFT securities. Typically, users can avail up to 30-40% of the floor price of the non-fungible token they post on the platform.

However, if the floor price of the digital collectible in question falls to a certain level, the platform forcibly auctions the token.

This liquidation level is determined by the “health factor” of the NFT-backed loan. When the value of this metric falls below 1, the token automatically enters a 48-hour liquidation protection state where the owner can choose to pay off the debt and reclaim the token.

If the user fails to clear the loan, the non-fungible token is auctioned off and the highest bidder can claim it.

Now, what’s happening with Bored Apes is that many BAYC holders have borrowed ETH using the BendDAO lending service, and a significant number of those users are at risk of liquidation at the moment as the floor prices of the pool have dropped in recent weeks .

As the BendDAO health factor alert list shows, a large amount of BAYC-backed debt is very close to going below the 1 threshold:

Looks like many of these tokens are near to being locked into the 48-hour period | Source: BendDAO

An analyst at Twitter has suggested that a possible consequence of these BAYC liquidations could be a crash in the entire NFT market.

When these Bored Apes loans with health factor values close to 1 start going under, the resulting liquidations will drive floor prices even lower. This will mean that more BAYC-backed debt will be drawn down in liquidation.

This way, the liquidations could collapse and damage the entire Bored Apes Yacht Club ecosystem.

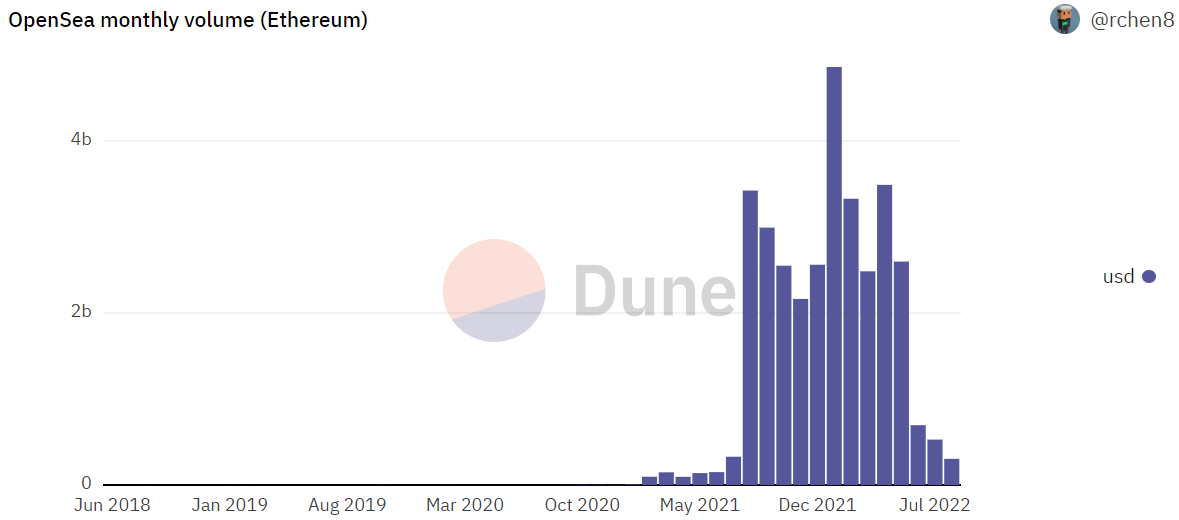

As the analyst points out, monthly volume on OpenSea, the most popular marketplace for non-fungible tokens, has been at a recent 12-month low:

The volume in Ethereum has been quite low on the OpenSea platform in recent days | Source: Dune

This volume is low enough for the entire NFT market to feel a cascading effect of these large liquidations of the Bored Apes loans on BenderDAO.

BTC price

At the time of writing, Bitcoin’s price is hovering around $21.4k, down 12% in the last week.

The value of BTC has plunged down | Source: BTCUSD on TradingView

Featured image from Markus Spiske on Unsplash.com, charts from TradingView.com, Dune.com