This Y Combinator-backed fintech provides loans to small businesses in Africa. Take a look at the 10-slide pitch deck Numida used to raise $12.3 million.

-

Y Combinator-backed Numida has raised $12.3 million in debt and equity funding.

-

The fintech startup, founded in 2015, provides loans to small and medium-sized businesses in Uganda.

-

The startup’s new funding round was led by Serena Williams’ Serena Ventures.

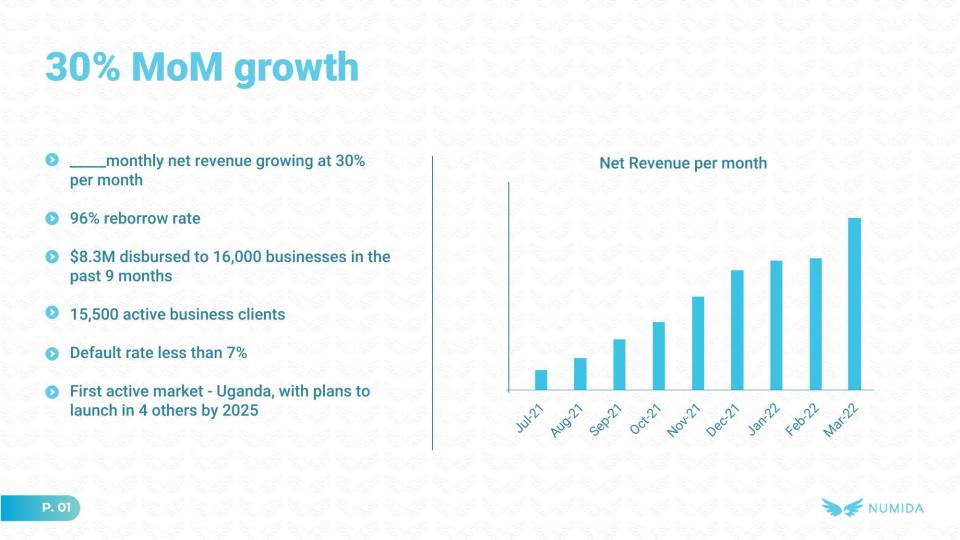

Numida, a Ugandan fintech offering credit to small businesses, has raised $12.3 million in new funding.

Founded by three Canadian Y Combinator graduates in 2015, the startup wants to expand access to working capital for businesses across Africa. Numida believes there are 20 million small and micro businesses that lack working capital, an opportunity it values at around $5 billion.

“Our initial process was simple: How do we provide the best form of working capital to excluded people?” Mina Shahid, Numida’s CEO and co-founder told Insider.

“It’s important because these people have been forgotten by traditional financial services, and the biggest challenge to economic development is financing for businesses.”

Shahid co-founded the business with Catherine Denis and Ben Best. The trio worked in sub-Saharan Africa for a number of years before creating Numida. Much of the challenge comes from a lack of a centralized credit scoring system, but also a general lack of documentation with transactions often done in cash, they said.

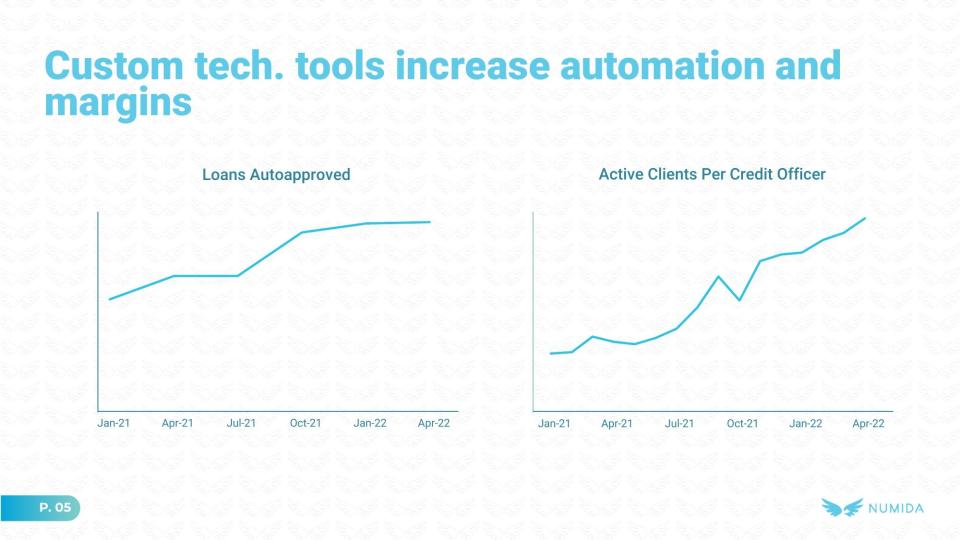

Numida’s platform offers loans of between $100 to $5,000 via its mobile app with its proprietary technology used to make credit scoring decisions.

“It’s been a fascinating experience building a technical product for people who have never used a computer before,” said Shahid. “Anyone can understand an interface in the valley, but we’ve had to relearn what a user interface is and have spent a lot of time improving our user experience and customer journey.”

Serena Williams’ fund Serena Ventures is leading a $7.3 million share of equity funding alongside Breega, 4Di Capital, Launch Africa, Soma Capital, Y Combinator and MFS Africa. The rest of the funding comes in the form of $5 million in debt from Lendable Asset Management.

Numida claims to have advanced more than $20 million in funding since April 2021 and is expanding its team to cater for future growth. The company’s team is split between Kampala, Uganda and various remote locations on the West Coast of the United States. The funding will go towards further hiring Numida’s product development team in Uganda along with a CFO and potentially a head of credit risk, Shahid said.

Further expansion to another African market such as Nigeria, Ghana, Egypt or Kenya is also under consideration.

Check out Numida’s 10-slide pitch deck below:

Read the original article on Business Insider