The future of Bitcoin is cloudy after the crash of FTX

solarseven/iStock via Getty Images

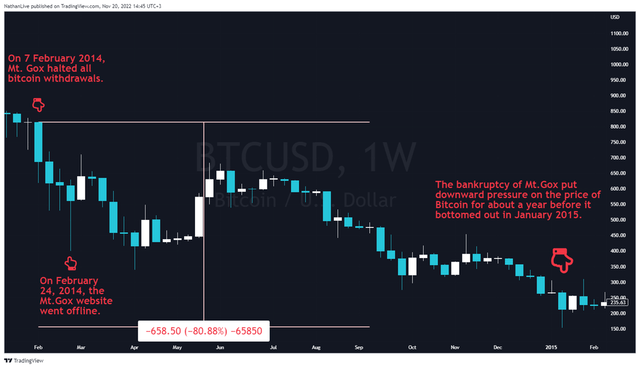

At the beginning of November 2022, the collapse of the FTX (FTT-USD) cryptocurrency exchange began, which with a high degree of probability will lead to massive bankruptcy of the subsidiaries and will directly affect the mining company and others crypto exchanges. The events that the crypto industry has faced have shocked the entire financial world and once again indicated the need for stricter regulation to protect investors. The collapse of FTX recalled the events of February 2014, then Mt. Goxthe largest cryptocurrency exchange at the time, accounting for approximately 70% of all Bitcoin (BTC-USD) transactions, had to suspend its activities as a result of cyber attacks that led to the loss of clients’ assets exceeding 500 million dollars. In the same year, the exchange declared bankruptcy, which only increased the distrust of people who saw cryptocurrencies as an analogue of traditional financial instruments. As a result, the price of Bitcoin fell by more than 80% in less than a year before the bottom was reached for this asset, followed by the start of a new bull cycle, which drew the attention of millions of people to cryptocurrencies around the world.

Source: N_Aisenstadt — TradingView

This article will provide an analysis of the impact of the FTX collapse on the financial position of other cryptocurrency exchanges and on the confidence of long-term investors in BTC, the risk of a domino effect and the current state of mining and Bitcoin at a time of increasing global macroeconomic and geopolitical problems which continues to kill investment interest in high-risk assets.

Before the collapse of the FTX cryptocurrency exchange

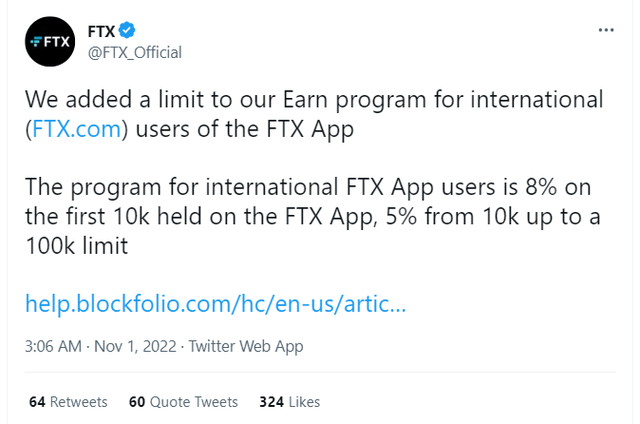

In mid-2021, FTX launched a series of investment products that enabled exchange customers to earn by holding cryptocurrencies or fiat money in their deposit wallets under the “Earn up to 8%” program. Relatively high interest rates on deposits attracted hundreds of thousands of people, some of whom took out loans from banks to take advantage of such a generous offer. Given the increase in interest rates from central banks, rising inflation and a decline in interest in cryptocurrencies since the beginning of 2022, it already became clear that the exchange could not legitimately provide FTX clients with such high returns. One of the last and most significant signals that FTX’s financial situation is far from ideal came eight days before the news of the suspension of withdrawals from the crypto exchange, when the company’s Twitter account announced the introduction of restrictions on the “Earn up to 8%” program.

Source: The Twitter account of the cryptocurrency exchange FTX

As a result of program policy changes, the maximum amount of deposit wallets that customers could earn was limited to $100,000, while the annual interest rate was also reduced from 8% to 5% if the balance exceeded $10,000.

Source: FTX

Many investors and traders were confident in the safety of storing their assets on the FTX crypto exchange, as its reputation was on par with Binance (BNB-USD). Sam Bankman-Fried, as CEO of FTX and one of the leaders of the cryptocurrency community, actively interacted with regulators in the United States and other countries to achieve recognition of cryptocurrency exchanges and the prospect of digital asset transactions.

The current situation with FTX reserves

At the moment, the mechanism that led to the loss of deposits from FTX customers is not fully understood, but many investigations, including those published on Coindesk, indicate that Alameda Research played a key role in this. A significant portion of Alameda Research’s capital was held in FTT, which is FTX’s centralized token. As a result, a company run by Sam Bankman-Freed was able to manipulate the value of this token by increasing its price in order to use it as collateral as part of Alameda Research’s credit policy. However, following the revelation of FTX’s financial difficulties, Binance’s desire to sell its holdings in FTT, and given the token’s low trading volume, resulted in FTT plunging over 90%. As a result of FTT’s price drop, the value of the collateral weakened, causing a liquidity crisis and ultimately creating an $8 billion hole in the FTX cryptocurrency exchange’s balance sheet.

Source: N_Aisenstadt — TradingView

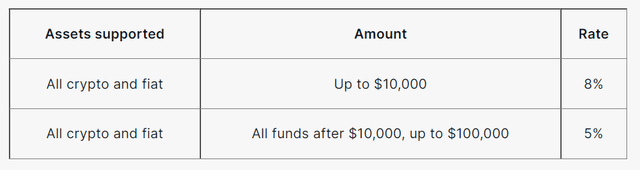

At the end of March 2022, the reserves of the FTX cryptocurrency exchange reached multi-quarter highs of more than 135 thousand Bitcoins. However, in the 2nd quarter of 2022, this indicator showed multidirectional dynamics, either sharply up from the beginning, and then down by 47%. In September, the company’s reserves stabilized only for a short period, as if showing FTX customers that the exchange’s financial position is stable and that it is not worth fearing bankruptcy. The stability of the company was false, and from mid-September the reserves continued to decrease, and after the public disclosure of FTX’s problems, there were only 4,909 Bitcoins on the exchange’s balance sheet. Although there is still no official report from the regulators, however, I believe that the collapse of Alameda Research and the emergence of FTX’s financial problems occurred as a result of the collapse of LUNA (LUNC-USD) in May 2022.

Source: Author’s elaboration, based on Glassnode

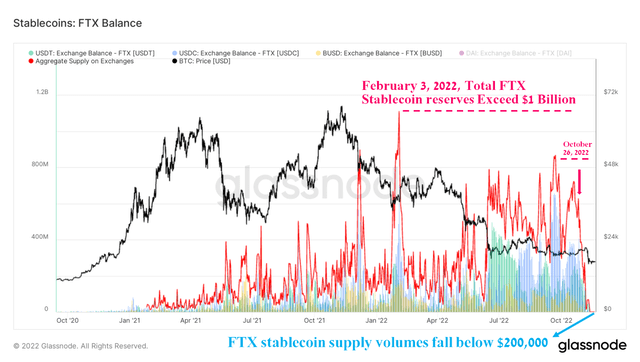

In addition to FTX’s Bitcoin and Ethereum (ETH-USD) reserves, the cryptocurrency exchange also held reserves in stablecoins, the combined value of which exceeded $1 billion at the beginning of February 2022. However, after that, stablecoin balances plummeted, giving the first the signals of some weakening of FTX’s balance sheet, which required the conversion of stablecoins to Bitcoin as collateral for loans. The most recent decline in stablecoin balances occurred at the end of October 2022, when their combined value dropped from $630 million to virtually zero in less than two weeks.

Source: Author’s elaboration, based on Glassnode

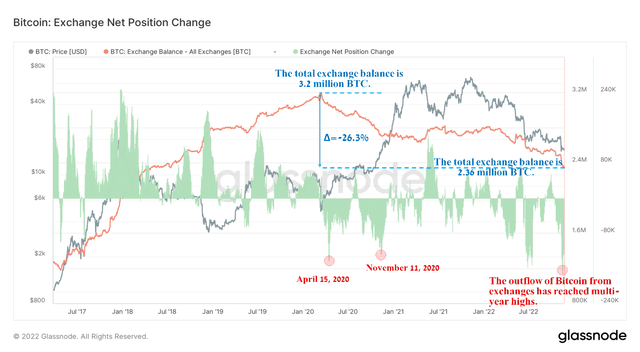

Before proceeding to the analysis of the price of Bitcoin, it is necessary to understand where investors withdraw their coins from FTX. Most market participants in the current period of uncertainty tend to choose a cold wallet as a place to store Bitcoin, Cardano (ADA-USD), Litecoin (LTC-USD) and other cryptocurrencies. The peak of the total balance of cryptocurrency exchanges was reached in 2020 when holders had about 3.2 million Bitcoins on them, but since then the overall balance of BTC has only been decreasing. Over the past two months, there has been a huge rate of withdrawals from exchanges as investors and traders seek to reduce the risks associated with holding digital assets on platforms, most of which do not conduct rigorous peer reviews of their accounts and financial statements. As a result of the collapse of FTX, the decline in the total balance of BTC continued to renew multi-year highs, and in my opinion, the market situation will continue for at least the next 2-3 quarters until the US regulators start conducting a tougher policy towards cryptocurrency exchanges.

Source: Author’s elaboration, based on Glassnode

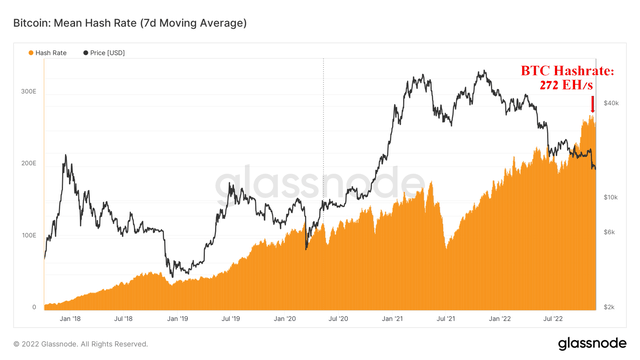

However, despite the financial problems of the cryptocurrency exchange and the decline in interest from investors, the Bitcoin hash rate continues to make new highs and is currently over 270 Exahash per second.

Source: Author’s elaboration, based on Glassnode

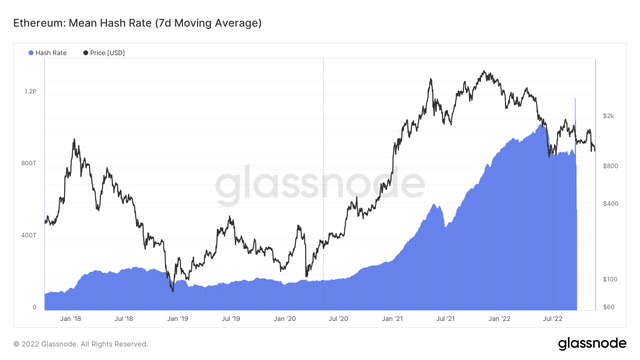

The pressure on the crypto industry is exerted by the fact that Ethereum mining stopped at the end of the 3rd quarter of 2022, thereby reducing the interest of potential market participants in investing in cryptocurrencies. As a result, I expect the outflow of investment interest from the industry to continue, which will also negatively affect Nvidia (NASDAQ:NVDA) and AMD (NASDAQ:AMD), whose video cards were massively used to mine the second most important cryptocurrency.

Source: Author’s elaboration, based on Glassnode

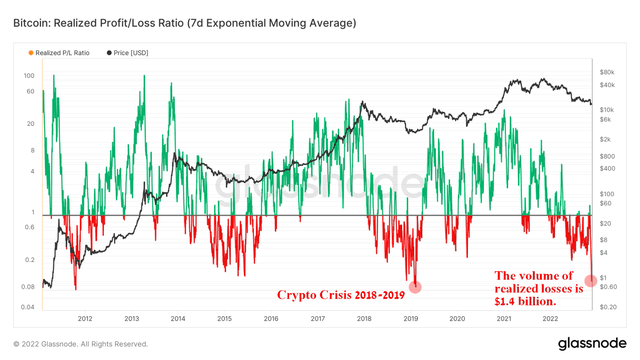

With BTC’s current price of $16,000, the largest investors who have more than a thousand Bitcoins in their accounts experienced unrealized losses of more than $1,800 per Bitcoin for the first time since 2020. As a result, this is unprecedented for the industry and may reduce their desire. investing in cryptocurrencies until the macroeconomic situation improves. On a larger scale, the financial problems of smaller investors also continue to worsen, which is reflected in the sharp jump in realized losses over the past three years. So this week there was a peak daily realized loss of over $1.4 billion. As a consequence, this indicates that investors continue to close their losing positions and withdraw their money from the market.

Source: Author’s elaboration, based on Glassnode

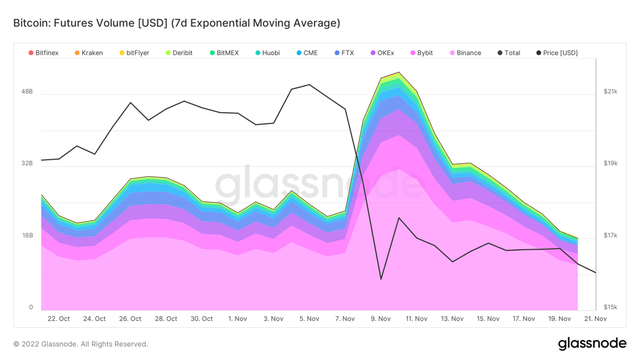

Also, one can observe a decrease in Bitcoin trading volumes in the futures markets, which have reached multi-year lows and currently stand at $16 billion per day. As a consequence, this signals low liquidity in the trading environment, which could increase downward pressure on the price of BTC with momentum to the price range indicated in my bearish article immediately.

Source: Author’s elaboration, based on Glassnode

Conclusion

Since the end of October 2022, when my article on the outlook for the crypto industry was published, the price of Bitcoin has already fallen by more than 25%, which is somewhat higher than my expectations for the decline and the main reason. for this is the collapse of the FTX cryptocurrency exchange.

The collapse of FTX dealt a heavy blow to the industry and attracted the attention of US regulators, who will try to tighten regulatory guidelines to make such situations less and less common. Unfortunately, this terrible incident undermined the confidence of potential investors in cryptocurrencies. Until all the details of FTX’s relationship with Alameda Research are revealed, this will continue to poison the entire industry and the recovery period will take longer than in previous crises.

During the current crypto crisis, I expect that many exchanges, including Coinbase (COIN), will continue to lose customers, which will lead to a decrease in trading volume with a subsequent deterioration of their financial situation in the coming quarters. As a consequence, the collapse of FTX will not only have a negative impact on the crypto industry, but will also directly affect Cathie Wood’s Ark Invest, which has invested in crypto companies.

From the point of view of technical analysis, the price of Bitcoin is in a bearish trend and continues to move within the correction wave IV. The current price of “digital gold” has a negative impact on mining companies such as Riot Blockchain (RIOT), Hut 8 Mining (HUT), which in my opinion will very likely resort to issuing new shares to finance their operations and purchase equipment to maintain the current volume of bitcoin mining. The reasons for this are that the sale of mined coins by these companies has occurred at a price below the price of Bitcoin for more than two months, and at the same time network problems continue to grow due to increased competition in the mining industry.