The EU is developing its own official blockchain – Trustnodes

[gpt3]rewrite

The EU member states, Norway, Liechtenstein and the European Commission have launched a publicly accessible blockchain.

The regulated and permissioned blockchain is managed by the European Blockchain Services Infrastructure (EBSI).

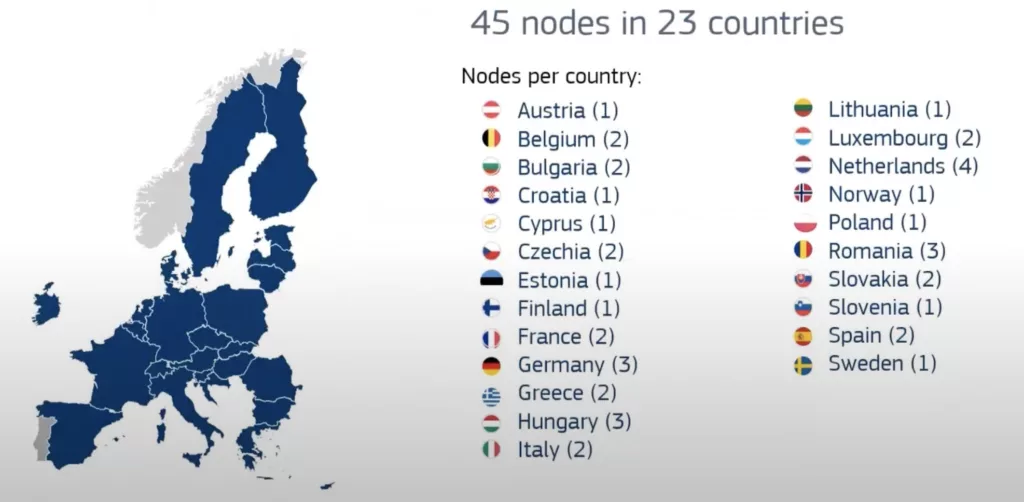

It has 45 nodes in 23 countries as of last year, according to Pierre Marro, an administrator at the European Commission (EC).

Germany has three nodes while France and Italy have two each with the Netherlands having four nodes and pretty much every other EU country having at least one.

As a new development, the initiative has focused specifically on university certificates, verifying them on the blockchain, but Belgium’s digital minister Mathieu Michel hinted that this project may soon increase in importance.

“EBSI is a project that exists right now, but it is the beginning of something. There are some types of tiny applications that try to create some proof of concept.

Belgium will have the European presidency in 2024, and one of my goals during the presidency will be to transform the technical project EBSI into political projects, said Michel.

The EU presidency rotates every six months through the member states and whoever has it can set the agenda. Slovenia, for example, held it recently, and they focused in particular on the EU’s enlargement to candidate countries in the Balkans.

Belgium will clearly have a different focus with the minister saying “we need to build some kind of political project on blockchain.”

However, the focus will still be on documents, with the minister saying:

“I can mention driver’s licenses or the way driver’s licenses can interoperate between countries or identity cards, or passports, or the title to property…

The greatest value [in blockchain technology] to me the data is the data concerning yourself, the property title or driver’s license and so on.”

That makes this a bit more than just another blockchain project. It can primarily be a way to set up a digital infrastructure on a continental level, and if necessary in the future it can also be a financial platform, even if the focus is now on documentation.

The design is simple in a way on the technical level. It is a proof of authority blockchain. You need permission. We toyed with the idea of applying to operate a node, but beyond the forms you need approval from European Blockchain Partnership representatives, ministers and the like in the member states.

As you can imagine, it’s probably quite a lengthy process, but you can also participate by being a wallet provider. Here again you have to go through a kind of screening to be a compliant wallet, as they call it.

Beyond that, it’s not much different than a crypto wallet or blockchain. You replicate the data, you connect to one node to read or write to the blockchain as a wallet, and for any changes or upgrades to the blockchain, the nodes must agree.

That makes this a centralized decentralized framework, especially as nodes are operated by each member state. So they all have to agree if they want to change something outside the normal rules, and in theory there could be forks here too if member states break into different blocks, or indeed a member state can break into its own mini-blockchain, although he has to set up the entire permission checks, which are ultimately a few lines of code.

The code itself is open source as EBSI runs the Hyperledger Besu Ethereum Enterprise Client. This client can be used for the ethereum blockchain itself, for private networks, on Proof of Work or Proof of Authority.

The public can access the blockchain through APIs – which for non-coders are like IPs to communicate between computers or servers. While for coders these are very familiar:

curl --request POST \

--url \

--header 'Authorization: Bearer undefined' \

--header 'Content-Type: application/json' \

--data '{

"jsonrpc": "2.0",

"method": "eth_getBlockByNumber",

"params": [

"123456",

true

],

"id": 1

}'This is how most encoders also work on public blockchains. Especially in ethereum, you get an API from Infura and then write code that ‘talks’ to the node through that API.

You could of course run your own node, but the coding part wouldn’t be much different. You would just change the API key with your own node address and keep the rest the same.

Which on the surface suggests that this project is correct on a technical level as they seem to be doing things mostly right and to expected standards with it sounding pretty robust.

It illustrates just how much the skill level, outside of the cryptographer itself, has evolved over the past four years, as this is basically how a coder would expect a government-level blockchain to work.

Now this is about documents, “harmless stuff”, but it could theoretically be about euro and euro-based… we can’t call it crypto-finance and digital finance wouldn’t be clear enough, so crypto-euro finance.

Such finance is much more complicated politically than permission controls for universities, but it would have some significant advantages in … well here again it would not be decentralized finance (defi), although it could potentially be called open finance (ofi?) because it would be much more open than today’s banking services.

Flash loans are one example of clear superiority in crypto, as are code-based collateral where default is impossible, and thus risk is non-existent beyond code exploitation. Its 24/7 nature is another, instant transfers, or it’s practically free to transact like the only reason crypto isn’t is to keep the nodes small, which won’t quite apply here, not least because they easily can crop.

However, a crypto-euro is a political matter, but until now it was also a technological matter to get the design right.

Now they have the technology, so it’s just a matter of flicking the switch for the euro to become a crypto-euro, although obviously they have to address the political aspects, including what here would be very political: permission controls, both internal and with regard for the nodes and for the API.

For now, this is about documents, and creating a digital framework at a continental level that bridges borders to unify the system can play a different role there.

But it must also be a bit tempting to consider whether an extension to funding, through proper execution, would have a significant benefit to the continent, as it would basically turn money into code, but with the old-style permission checks.

[gpt3]