The crypto winter is too harsh for “tourists”

The Bitcoin (BTC) price crash has pushed out “market tourists”, and only long-term owners are currently trading in the asset, a Glassnode report revealed on 5 July.

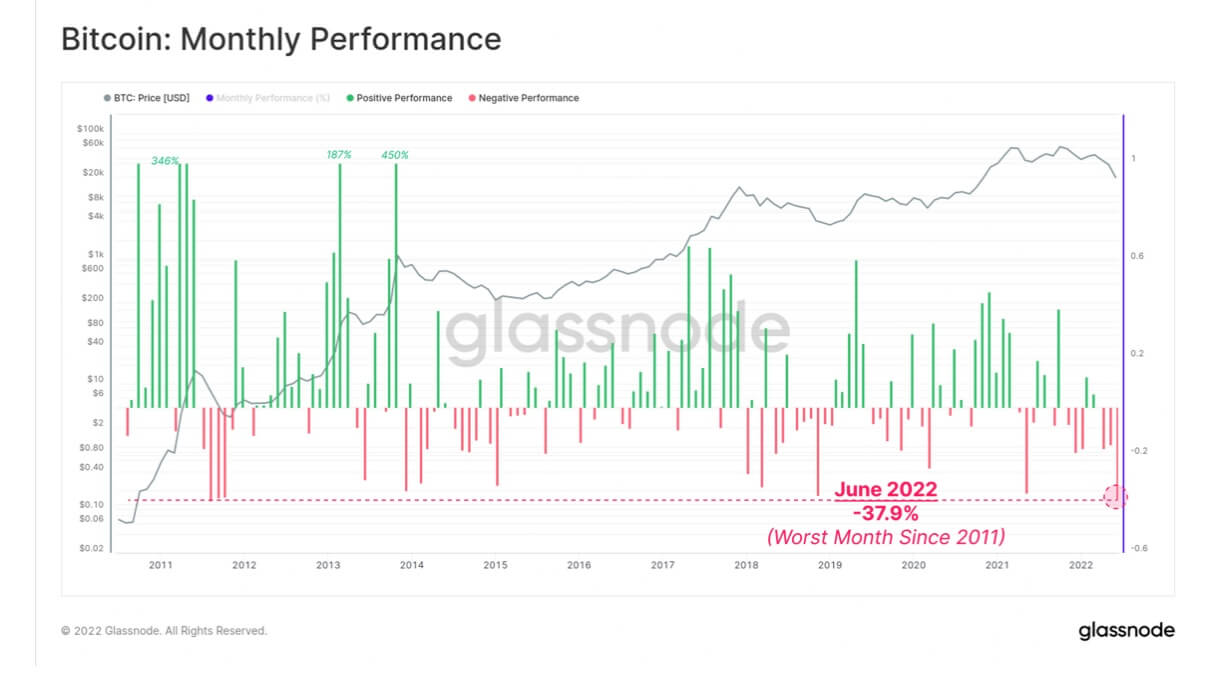

According to the report, Bitcoin registered its worst month since 2011 in June, when it registered a price drop of 37.9%.

Due to the record-breaking crash, there has been a purge of market tourists – short-term Bitcoin investors who were attracted to the asset during the last bull run.

Shrimp accumulate Bitcoin

Glassnode said that chain data show that the balances Whale (investors with 1000 – 5000 BTC) and Shrimp (investors with less than 1 BTC) increased significantly during this period.

For shrimp, the current Bitcoin price makes it attractive and affordable. It continued that this class of hodlers buy at a rate of around 60,500 BTC per month – the “most aggressive price in history.”

The report identified other trends that indicated the end of Bitcoin tourism, including reduced activity in the chain due to lower demand and declining interest from investors.

The number of active addresses was rejected

Since November 2021, there has been a steady decline in active units and addresses. According to Glassnode, address activities fell from over 1 million per day to 870,000, while active units now stand at 244,000 per day.

Glassnode continued that the overall growth rate for market participants has been “weak” as user base growth plunged to 7,000 per day – a rate similar to the lowest of the bear markets in 2018 and 2019.

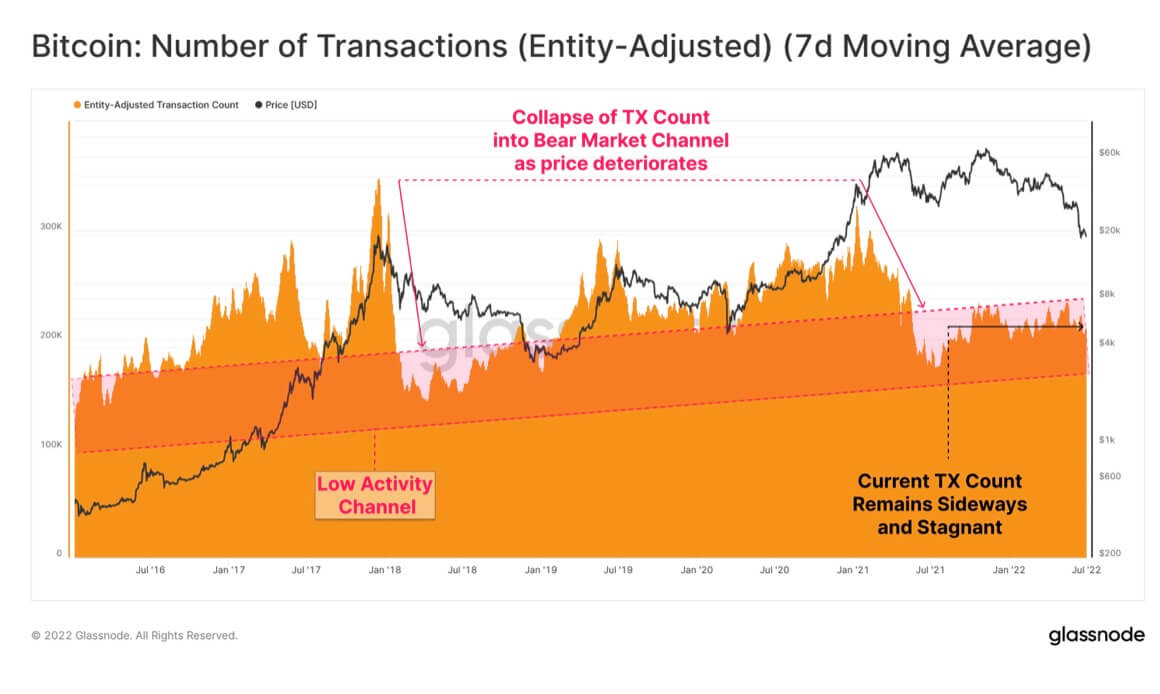

The number of transactions decreases

The number of Bitcoin transactions is “sideways”, indicating that demand for new entries for the asset has stagnated. The report added that this calculation may also mean “a probable retention of a base load of users (hodlers).”

Glassnode noted that with the number of addresses with a non-zero balance reaching a record high of 42.3 million, the decline in the number of transactions also reflected how market tourists had been pushed out.

Self-care on the rise

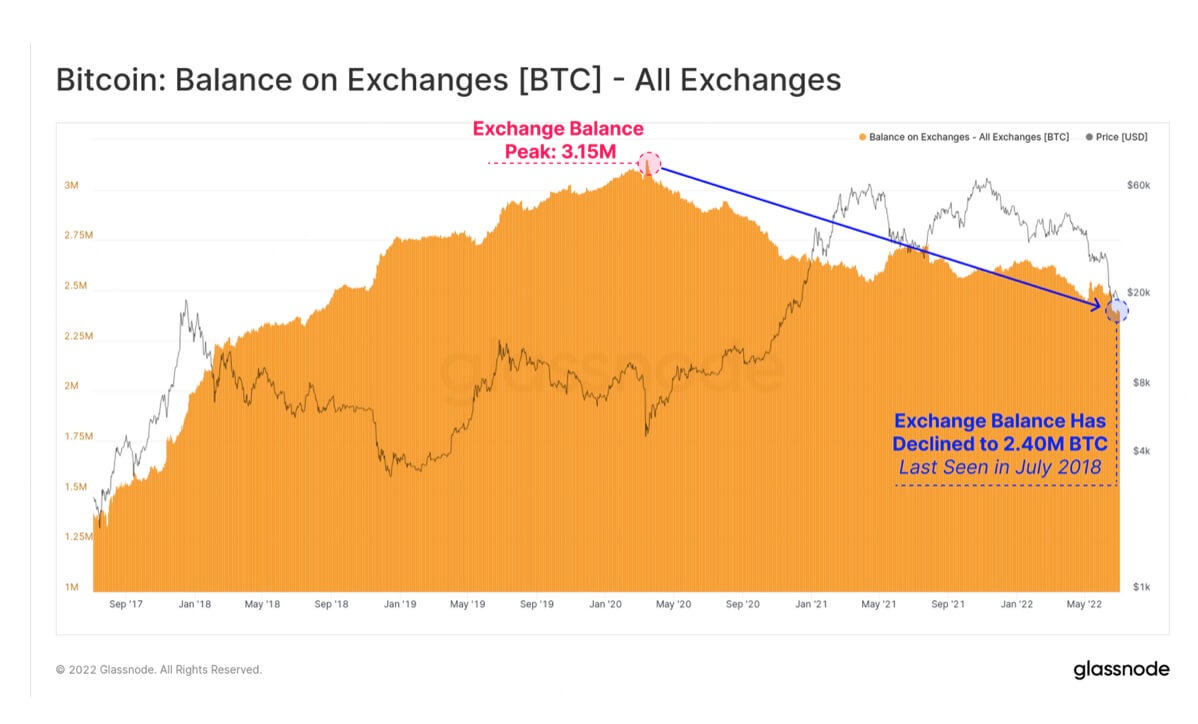

According to Glassnode, crypto exchanges have registered increased withdrawals and reduced deposits due to several lending providers suspending deposits and withdrawals.

The foreign exchange reserves are currently at a low level last seen in July 2018.

However, interest in self-storage has grown as investors withdraw their assets to wallets with no consumption history.