The BTC Blockchain processed over $8 trillion in transactions last year

Something big just happened on the Bitcoin blockchain. Cryptoanalysis company CoinMetrics noted that $8 trillion worth of transactions have been made on the crypto king’s blockchain. This means that more and more people are using Bitcoin for everyday transactions more than ever.

But does this mean that widespread adoption is already underway?

What does this milestone mean?

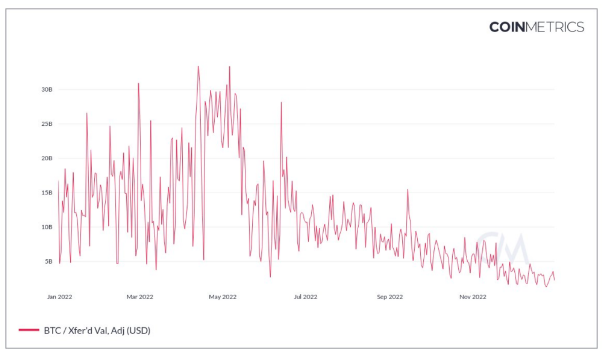

The $8 trillion transaction calculation may not be as big a deal as some hope. The figure was generated during 2022, a period which was strongly bearish against the entire financial system as a whole. A quick look at diagrams shows that at the start of 2022, Bitcoin has already fallen from its all-time high back in November 2021.

Bitcoin blockchain transaction chart for 2022. Source: CoinMetrics

Since then, several high-profile bankruptcies and implosions erupted in the latter half of 2022 – from Terra Luna and UST depeg to FTX collapseinvestors and traders can safely say that they lost confidence in the crypto industry as a whole.

Although some are certainly positive that Bitcoin will have a bigger role in the financial area, like how NBA team Dallas Mavericks owner Mark Cuban argued that people who have gold than BTC are “stupid”, at the end of the day crypto is still a speculative asset.

With fear of an incoming recession affecting the broader financial market, investors will place their capital in safe havens to hedge their portfolio against risks that gold or bonds.

BTC total market cap at $324 billion on the daily chart | Chart: TradingView.com

BTC Hit A Milestone, Now What?

Currently, Bitcoin investors and traders are following along January’s financial calendar for a glimpse of current macro trends. But the recent news that BTC reached $8 trillion worth of transactions certainly had an effect on the market.

At the time of writing, CoinGecko noting an increase of 0.7% on the daily time scale with 0.9% on the weekly. This may indicate that investor sentiment gained renewed strength after the news. However, the strength of this bullish sentiment will be tested when the Federal Open Market Committee (FOMC) meeting minutes conclude.

Image: Zipmex

While there are fears of a recession, so are the broader financial markets hopeful that the macro trends have improved. Bitcoin is one of the main years associated with the traditional financial space, and improving macro means gains for the top crypto that will pull the entire crypto industry upwards.

Right now, BTC is changing hands at $16,820, just a tad shy of the target $17,000 resistance level. Investors and traders should wait for the FOMC meeting minutes to unravel before making major decisions.

If the Fed is still hawkish on the market and the macroeconomic situation, expect more pain in the coming weeks or months.

Meanwhile, Bitcoin’s recent $8 trillion transaction milestone should provide a welcome respite from the doubts that still haunt the broader crypto market and the bitter aftertaste of the bad stuff that marred 2022.

– Featured Image: Esports.net