Cryptocurrency is an undeniably controversial form of asset. While some love the crypto space and have invested thousands in the industry, others steer clear of crypto altogether, believing it to be nothing but bad news. So, what are the pros and cons of cryptocurrency? Should you avoid it?

The 6 benefits of cryptocurrency

1. Privacy

Cryptocurrency exists on a blockchain, which is a secure technology by nature. Blockchains hide data from prying eyes and do not reveal the names and contact information of those carrying out transactions. In a typical bank transaction, the sender’s and recipient’s names are visible to the bank, which immediately highlights the identity of both parties.

On a blockchain, only the wallet addresses of those involved in the transaction are displayed. However, cryptocurrency is usually not anonymous. Rather, it is pseudonymous. This is because your cryptocurrency wallet address and transactions can be traced back to your identity. But privacy coins like Monero, ZCash, and Dash are designed to overcome this problem and completely anonymize transactions.

2. Decentralization

Decentralization is at the heart of cryptocurrency. While cryptocurrencies can be traded on centralized platforms, cryptoassets exist on decentralized blockchains. A decentralized blockchain distributes its information across multiple devices or nodes, ensuring that no one person or group can control the network at any given time.

Decentralization can drastically reduce the chances of malicious takeovers, technical crashes and network corruption. It offers a fairer financial system where users themselves can contribute to the network and even vote on how it develops (via a mechanism known as governance).

3. Network is secured

Cryptocurrency blockchains use consensus mechanisms to create new blocks and secure the network. The most commonly used consensus mechanisms are proof of work and proof of stake. The proof-of-work mechanism uses miners to confirm blocks and circulate new coins. Miners verify the legitimacy of blocks, securing the network.

On the other hand, the proof of stake mechanism uses validators to verify transactions and create new blocks. This maintains the security and transparency of blockchains.

4. Many currencies to choose from

While fiat currencies are limited in use from country to country, you can use thousands of cryptocurrencies worldwide. For example, if you’re in the UK, you can just use GBP as a traditional tender. However, if you use a UK crypto exchange, you can buy and sell thousands of different assets. Furthermore, your Bitcoin is the same to use in all countries, no matter where you are.

However, cryptocurrencies are not available in all countries, which we will discuss later.

5. DeFi continues to grow

Decentralized finance (DeFi) is a type of finance that uses decentralized services and assets. While typical financial institutions use a centralized model, with a small group of decision makers at the top of the pyramid having all the control, DeFi works primarily on the basis of no authority. Instead, the platforms are controlled and maintained by the users.

The DeFi industry has grown and diversified, and you can now perform many typical financial functions on the platforms within it. For example, you can lend assets, take out loans and even open a savings account using DeFi services using a wide range of cryptocurrencies.

6. Cheaper international transactions

A major problem that many foreign workers experience is the process of sending money back to family members, as they can incur high fees. On top of this, sending money to friends, colleagues or businesses abroad can be a costly ordeal, with exchange rates sometimes exacerbating the problem.

The good thing about cryptocurrency is that it can be sent from country to country without incurring additional fees. Although you may incur blockchain or exchange fees when trading or sending, these will not increase based on location. However, some exchange platforms charge extra for international transactions, so check for this before sending money.

The 6 Disadvantages of Cryptocurrency

1. Constant price fluctuations and crashes

One of the biggest downsides to the cryptocurrency market is that prices rarely stay the same for long. The price of a typical cryptocurrency will fluctuate several times every minute. And although these fluctuations are often small, this is not always the case.

Unfortunately, crashes are common in the crypto industry, with so many well-known assets suffering large price drops over a short period of time. Bitcoin, Ethereum, Litecoin, Dogecoin and hundreds of other cryptocurrencies have experienced crashes recently, sometimes in isolation and sometimes with the rest of the market. Investors are always exposed because of this.

2. Fraud

Criminals certainly haven’t missed the growing popularity of cryptocurrency in recent years. Unfortunately, many who invest in cryptocurrency are not fully aware of how easy it is to fall victim to crypto scams, making it much easier for criminals to take advantage.

Various tactics are used to steal cryptocurrency, including phishing, malware, keyloggers, and more. For example, many people have had their crypto exchange credentials stolen in phishing scams, giving cybercriminals direct access to their accounts and their funds.

Many crypto-crimes remain unsolved and unpunished because authorities often have trouble tracking and identifying the culprit. Although this is improving, thousands of people are still at risk every day of losing their crypto holdings due to a scam or attack, and there are many crypto scams to watch out for.

3. Little or no regulation

Unlike traditional money, there is little regulation in the crypto space. Because the mainstream use and trading of cryptoassets is still fairly new, lawmakers have yet to create a solid set of rules around this market. While certain governments are taking steps to regulate cryptocurrency, be it by listing cryptocurrencies as securities or restricting their use, many open ends still affect users in many different ways.

However, some see crypto’s lack of regulation as a good thing. Crypto enthusiasts are often supporters of unregulated currency, as it precludes the possibility of the government and traditional financial institutions manipulating the market or the assets themselves. But weak regulation can also create problems when it comes to fraud, theft and insider trading.

Furthermore, those with enough crypto, known as crypto whales, can still manipulate the market, so there is no real escape from market manipulation, despite what some crypto advocates would tell you.

4. Crypto is illegal in some countries

While cryptocurrency is legal in most nations, certain governments have restricted or banned its use. Examples of such countries include China, North Korea, Egypt and Turkey. So if you want to trade crypto but live in a nation where it is restricted or banned, you will be in a difficult situation.

5. Scaling Limitations

In crypto, scaling refers to expanding a project, platform, or blockchain. When the demand for something increases, the stress on the network increases with it. Think of it as a once-quiet road filled with a line of cars, each moving at a snail’s pace. When a blockchain or platform gets overwhelmed, everything slows down.

Take the Bitcoin blockchain, for example. Although the Bitcoin blockchain was initially very quiet, Bitcoin’s immense popularity led to a flood of new users joining the network, making thousands of transactions every hour. To confirm a transaction, miners must confirm its legitimacy and add it to the next block. When thousands of transactions are waiting to be confirmed, the miners have a much higher workload, which means that each user has to wait longer for their transaction to be processed, and transaction fees also increase.

Each Bitcoin block can only hold 1MB of transactions, which means it is difficult to scale up to accommodate a higher transaction number per block. This is also the case on other blockchains, although Bitcoin’s popularity makes it one of the most notable cases.

6. Energy consumption

A major concern related to cryptocurrency is its effect on the environment. Not only do popular blockchains require huge amounts of electricity to operate, but mining cryptocurrency can also add up to huge energy bills.

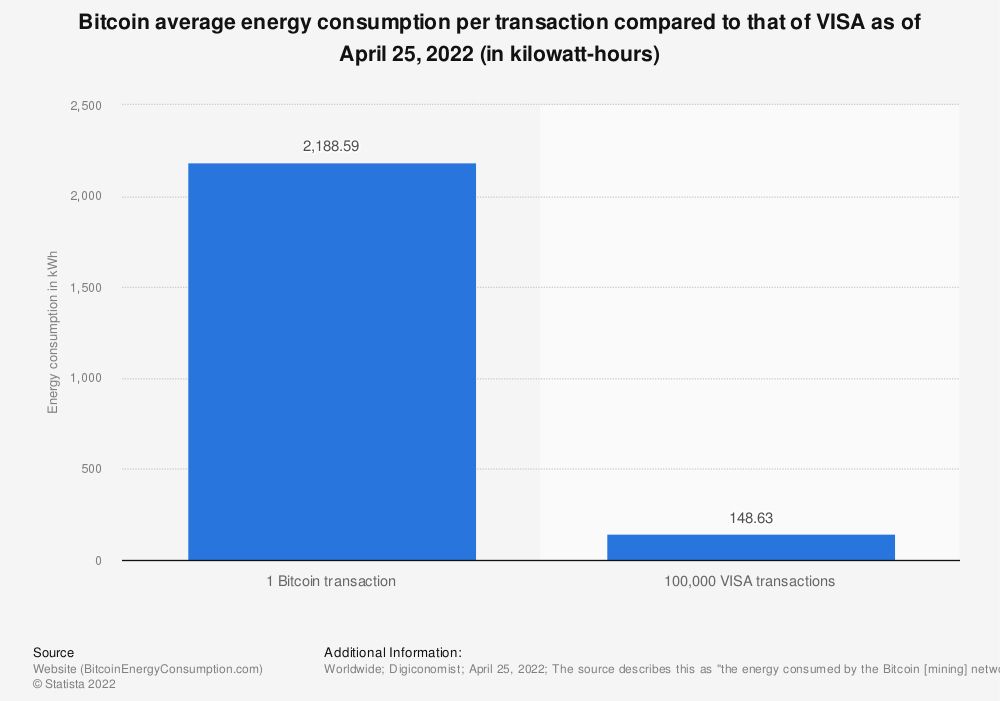

When the energy requirements of crypto and traditional money are compared, the full extent of the former’s requirements emerges. For example, just one Bitcoin transaction uses 2,188.59 kWh of electricity, while it only requires 148.63 kWh to perform 100,000 Visa transactions (as found by Statista).

The huge power consumption poses a risk to our planet, as most of the power used for cryptocurrency comes from non-renewable resources. However, power consumption for crypto mining depends on where the mining takes place. In countries such as Norway and Iceland, renewable energy is used for cryptomining.

Cryptocurrency is a mixed bag

While cryptocurrency has many advantages, it presents just as many problems. It is important to be aware of the pros and cons of cryptocurrency before investing in crypto.