Surviving Lower NFT royalties 💪

Metaversal is one Bankless newsletter for weekly levels on NFTs, virtual worlds and collectibles

Dear Bankless Nation,

As the NFT ecosystem continues to evolve and zero- or low-cost marketplaces continue to emerge, many creators are facing lower royalty payments from secondary sales.

The challenge is therefore to generate sustainable income streams in this new environment where royalties are increasingly unpaid.

The good news here is that there is several strategies that NFT creators can use to compensate for these declining royalty revenues.

In this article, I will share four such avenues that creators can turn to to better position themselves in this changing landscape of NFT royalties.

-WMP

🙏 Sponsor: Kraken — the most reliable and secure crypto exchange in the world✨

As DCinvestor has explained before, NFTs are best understood as “permissionless, censorship-resistant media.” In other words, NFTs are decentralized digital things that can be moved directly between individuals without the intervention of centralized intermediaries.

As the NFT space has struggled with the recent decline in royalty payments, which of late has been largely driven by the NFT market battle between Blur and OpenSea, a number of approaches – such as blocking transfers, burning tokens from non-royalty-paying holders, and marketplace blocklists—have been put forward as potential ways to stem the decline in revenue.

The problem with the approaches mentioned above is that they all are centralize strategies that erode the fundamental value proposition of NFTs, i.e. being decentralized bearer assets.

All that said, NFT creators still have a number of options to consider when it comes to compensating for declining royalties. Here are four increasingly popular paths you should keep in mind.

The first and most basic approach a creator or collection team can consider here is to hold back some of the NFT project’s supply for themselves.

The idea? As a project grows, this retained supply can later be used for primary sales, either drip-wise over time for additional funding or all at once as Larva Labs’ Mach 2022 Sale of CryptoPunk Supply to Yuga Labs as part of a broader IP deal.

There are two general variations of this tactic, which hold back unassembled offerings (think mint-on-demand collections like Chromie Squigglesof which +250 NFTs can still be minted for special occasions out of the collection’s max. 10k supply) or withhold imprinted supply (eg Larva Labs minted the first 1000 NFTs from CryptoPunk’s smart contract and sold from that batch over time).

Of course, just because a project keeps some of the supply for itself doesn’t mean it can’t try to collect royalties as well, downtrend as they may have been lately.

For example, the creators of Terraforms took the 0% royalty approach and chose to only hold back unmined supplies for later primary sales and to align themselves long-term with their community, but unlike when the goblintown.wtf team did their free coin in May In 2022 they kept 1000 NFTs and started with a 7.5% royalty on secondary sales (they have since moved to their own tailored marketplace where a 5% royalty is enforced.)

In the NFTfi scene, there is a growing wave of NFT automated market maker (AMM) protocols that creators or pools can issue NFTs to in order to earn trading fees from swaps.

So the bottom line is that a project can add its NFTs to a liquidity pool (liquidity injection, aka LPing) and then earn a cut every time people buy or sell through the team’s liquidity. An interesting benefit of this strategy is that it allows a team to earn revenue from their NFTs without conduct primary sales.

For example, the Sappy Seals team bought 50 of their own NFTs and then started playing with those NFTs on sudo swap in August 2022. Since then, the team has earned many thousands of dollars in revenue thanks to merchandising fees. Other projects that have used this LPing strategy with similar success include Based Ghouls, Finiliar and Allstarz.

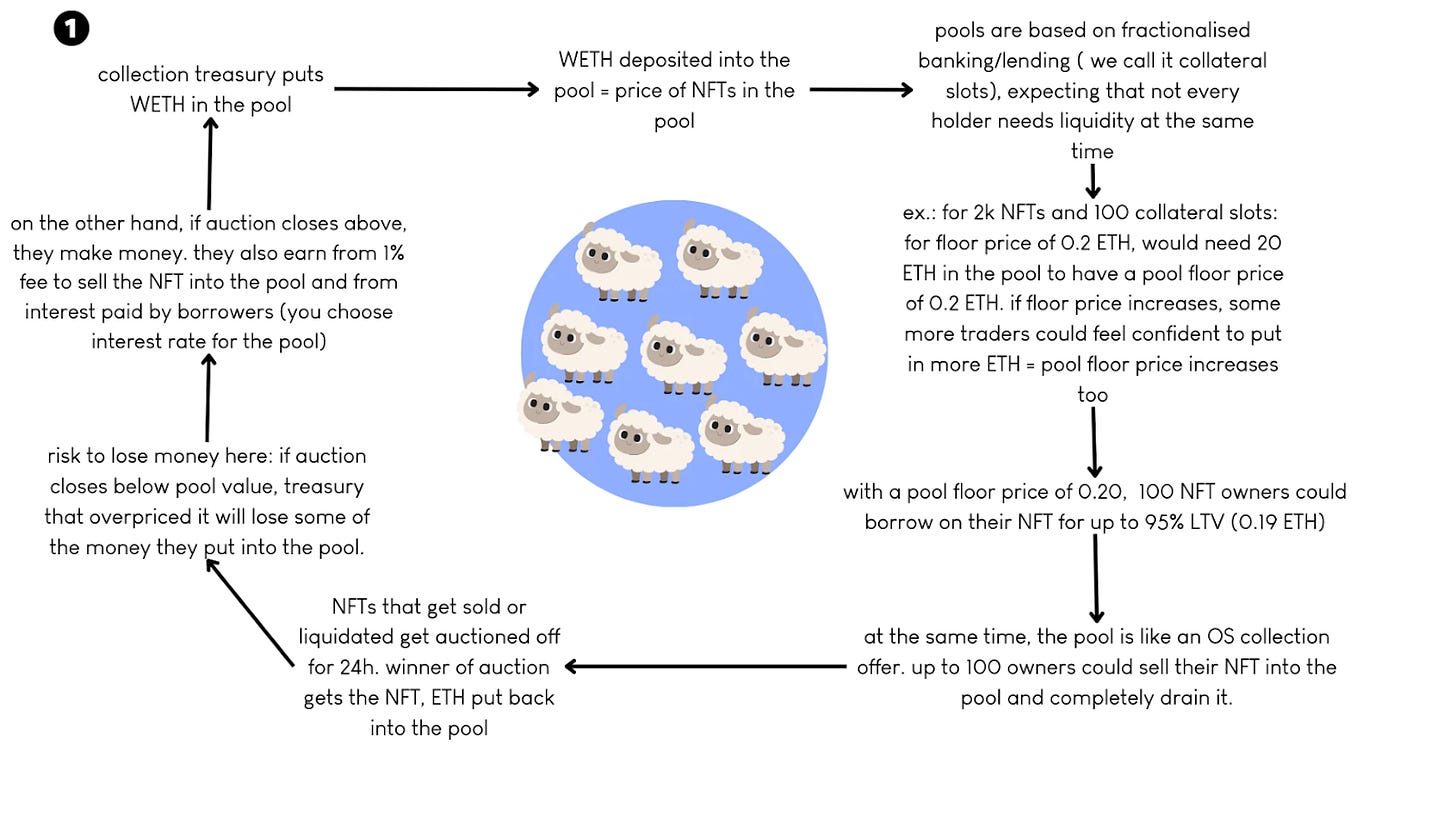

Another more advanced variation of this approach that we haven’t seen yet is LPing in an Abacus spot pool. Abacus is a new NFT valuation protocol focused on pricing NFTs. The team has proposed a new way of NFT LPing that involves a project linking some of its treasury funds to its own liquidity pool on Abacus to generate income and accurately price all the NFTs in the pool. Learn more about this concept here.

Sometimes when you need something done, you have to do it yourself. In the modern NFT market scene, projects looking to enforce royalties are increasingly rolling out their own native marketplaces and focusing activity there to draw trades away from Blur, OpenSea, etc. where royalties are currently unreliable.

Fortunately, NFT likes infra projects Reservoir makes it increasingly easy for creators and collections to deploy their own custom, royalty-friendly marketplaces of aggregated NFT listings.

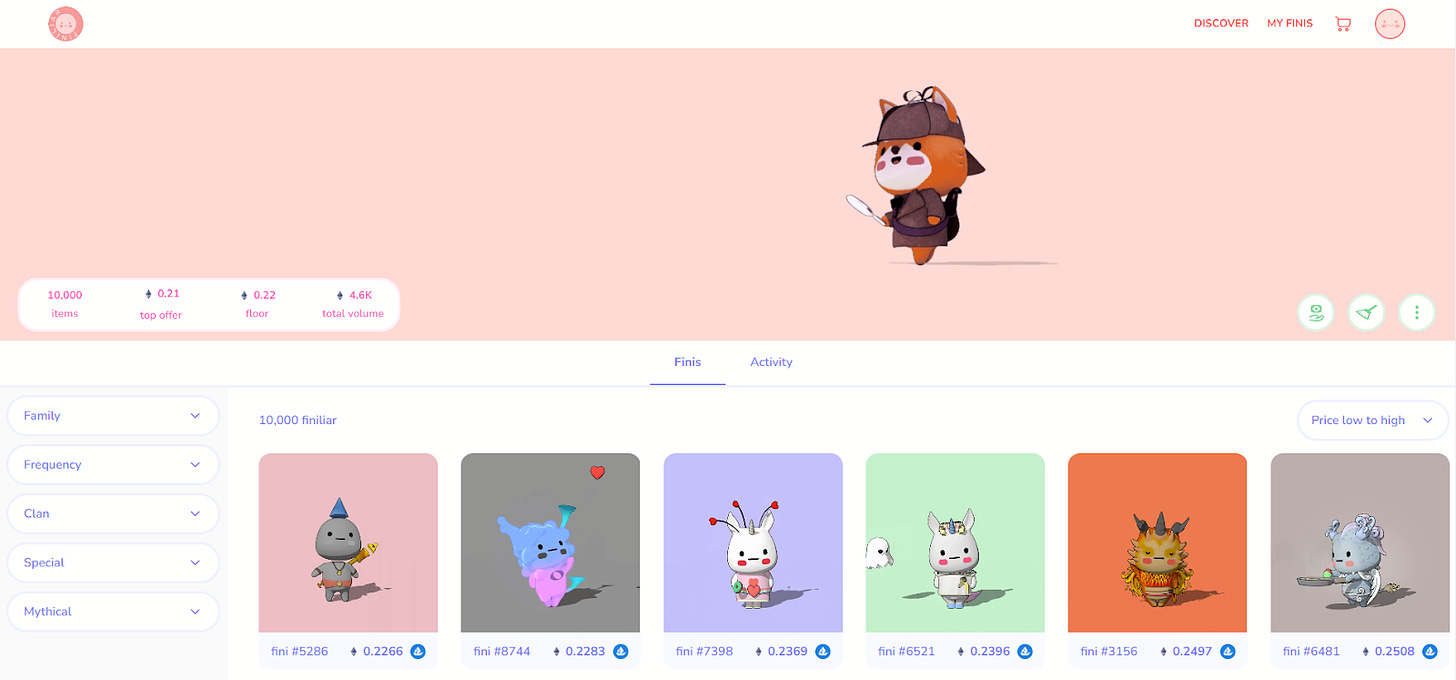

For example, Finiliar is one such collection that uses Reservoir to underpin its original marketplace system finiliar.com. They’ve set up the front end the way they want, and then Reservoir takes care of all the actual market action under the hood, so to speak.

Just because royalties are generally down in NFTs lately doesn’t mean we have to give up all hope for them. In fact, an available approach is to double down on royalties by directly stimulating them.

There are a number of different ways in which this incentivisation can be achieved. Perhaps an NFT team uses an indexing system to identify all of their collectors who have honored royalties in the past year, and then roll out unique perks for those pro-royalty collectors, like approval lists, NFT airdrops, token-gated chats , leaderboard competitions, and more.

This path is interesting because it can easily be used with other approaches above (eg withholding supply, focusing attention on a DIY marketplace), and it steers NFT holders towards being more active and helpful community members!

-

Study your options: if you are working on your own NFT project, consider how you can succeed in this evolving royalty landscape!

-

Learn about MetaMask x Unity: see my previous article on MetaMask’s arrival to the Unity Asset Store!

William M. Peaster is a professional writer and creator of Metaversal– a bankless newsletter focused on the rise of NFTs in the crypto-economy. He has also recently contributed content to Bankless, JPG and more!

Subscribe to Bankless. $22 per month. Includes archive access, Inner circle & Divorced.

Kraken NFT has been built from the ground up to make it one of the most secure, user-friendly and dynamic marketplaces available. Both active and new collectors benefit from zero gas fees, access to multiple chains, payment flexibility with fiat or 200+ cryptocurrencies, and built-in rarity rankings. Learn more at Kraken.com/nft

👉 Visit Kraken.com to learn more and open an account today.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell assets or make financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Mediation. From time to time I may add links in this newsletter to products I use. I may receive a commission if you make a purchase through one of these links. In addition, the Bankless authors have crypto assets. See our investment information here.