South African challenger TymeBank raises $77.8 million from Norrsken22 and Blue Earth Capital

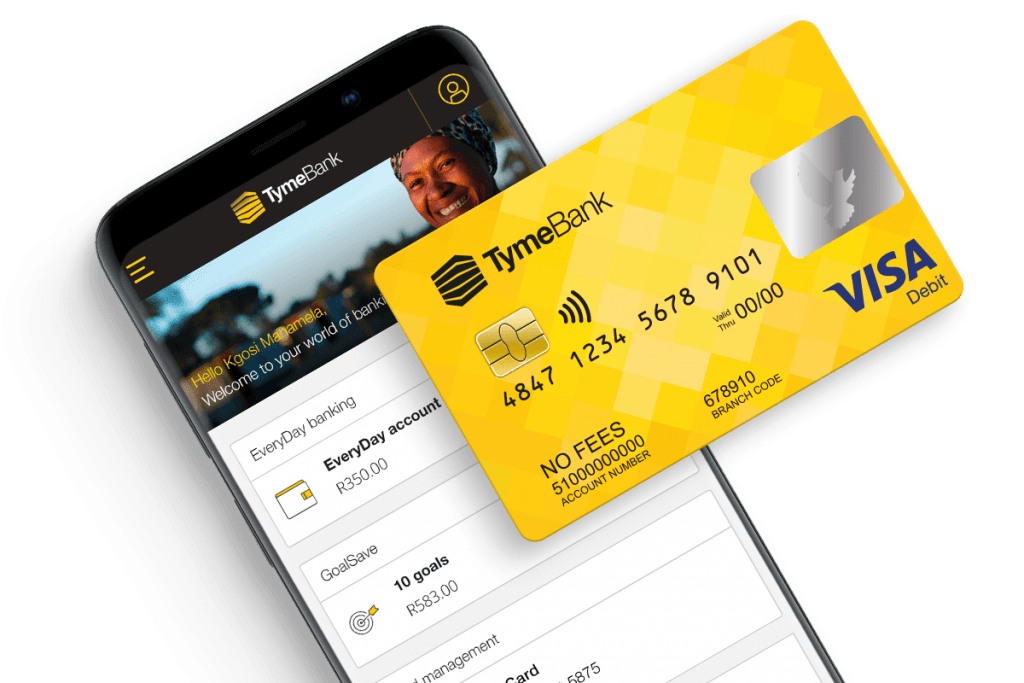

Image credit: TymeBank

South African digital banking platform Thyme has raised $77.8 million in a pre-series C round led by African-focused growth stage fund Norrsken22 and Swiss global investment firm Blue Earth Capital. TymeBank expects to close its Series C round later this year, it said in a statement.

Tencent, lead investor in the fintech’s $70 million Series B expansion in December 2021, participated in this pre-Series C round and increased its stake to become TymeBank’s third largest shareholder. TymeBank is majority owned by Patrice Motsepe’s African Rainbow Capital (ARC); the South African fintech is backed by other investors including British International Investment (BII), Apis Growth Fund II, JG Summit Holdings (JG Summit), African Fig Tree (AFT) and Ethos AI Fund.

However, TymeBank is not indigenous to South Africa. It is a member of the Tyme group of companies headquartered in Singapore. The holding company, Tyme, focuses on designing, building and operating digital banks for emerging markets. Tyme’s brand in South Africa is TymeBank – and GoTyme in the Philippines, the first market in Asia that fintech launched last October in collaboration with Gokongwei Group.

TymeBank was launched in February 2019 and employs a hybrid model of digital banking and physical service operation. It offers one transaction bank account with zero or low monthly fees and a savings product for customers, most of whom are onboarded via brick-and-mortar locations, including national retailers Pick n Pay and Boxer, top fashion retailer The Foschini Group (TFG) and one of the largest churches in South Africa, Zion Christian Church. The challenger bank has also seen a significant number of accounts opened online and a shift from cash deposits to electronic transfers. Some of its competitors include Bank Zero, Discovery Bank and Lula.

In early February 2021 when we covered Tyme Bank’s $110 million Series B round, the fintech founded by Coen Jocker was on track to reach 3 million customers. Tthe company now claims to have reached a milestone of 7 million customers this month (in South Africa alone), according to a recent statement shared with TechCrunch. These numbers are set to increase as fintech, llast year moved into commercial banking by acquiring Retail Capital, a fintech that has provided over R5 billion in working capital to more than 43,000 business owners in South Africa.

“Tyme has continuously pushed the evolution of banking. Tyme was the first bank in South Africa to operate entirely from a cloud-based infrastructure network and now makes it possible to open a fully regulated bank account in less than five minutes, which can be done online or from a TymeBank kiosk.It also takes nine seconds to send money to any mobile phone in South Africa using TymeBank’s SendMoney app, the statement said.

TymeBank claims to have a turnover of over $100 million annually as its business across South Africa and the Philippines grows at a rate of 300,000 new customers monthly. The company says exponential growth in customer numbers is proof of how “it truly serves the needs of consumers and after entering as a disruptor in the industry, it is now entrenched as the credible alternative to legacy banks in the country.”

TymeBank intends to use this new capital, which takes its total money up to over $260 million, for further operations in South Africa and the Philippines as well as for future expansion in Southeast Asia. Tyme’s global footprint includes its product development and engineering center in Vietnam and a headquarters in Singapore leading its strategy, business development, data, analytics and artificial intelligence (AI).

“We are delighted to invest in Tyme. The company offers a unique product with great customer appeal, which has led to rapid and sustained growth. We have analyzed a lot of fintech from across the continent, and Tyme stands out with its impressive growth, its differentiated product and its unique ability to reach and serve new customer groups, said Natalie Kolbe, managing partner of Norrsken22, on the investment. “The exceptional leadership team has already built one of the greatest challenger banks in the world, and we look forward to being part of the next phase of their journey.”