Shift4 Payments: Understated Growth With Huge Fintech Tailwinds (NYSE: FOUR)

AsiaVision

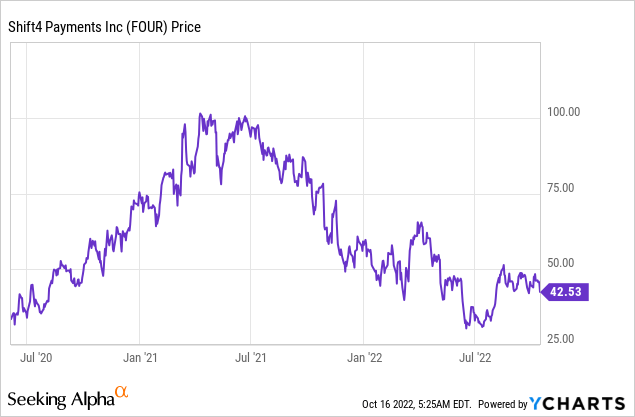

Shift4 (NYSE: FOUR) is a payment company that is often overlooked compared to more well-known payment providers such as Square (now Block). However, Shift4 has best-in-class technology and provides backbone payments for many leading brands from Burger King to Elon Musk’s Starlink. The company was formerly known as “United Bank Card” and was founded in 1999 by a 16-year-old genius named Jared Isaacman. Shift4 finally went public in 2020 when they saw an opportunity to capitalize on the rise in popularity around fintech solutions. Since June 2021, the stock price has fallen by over 54% despite the company producing consistently strong and growing financial results. The company is poised to take advantage of huge payment tailwinds such as the growth in digital payment processing. The global payment processing solutions market was valued at $39.6 billion in 2020 and is projected to grow at a compound annual growth rate of 13.7% [CAGR] reach $146.5 billion by 2030. Therefore, in this post I will share the business model, economics and valuation of Shift4, let’s dive in.

Business model

Shift4 Payments has over 200,000 customers consisting mainly of physical restaurants, hotels, casinos, sports arenas, gyms, etc. The most famous customers include; Hilton, Caesers, DoubleTree, Burger King, Applebees, Popeyes, Dennys, TGI Fridays, LA Galaxy Arena and many more. The company’s value proposition is simple, a seamless end-to-end payment solution that includes; BUCKET [Point of Sale] terminals, payment gateway integration and processing.

Shift4 (Sky Tab)

Shift4 earns its revenue by charging a payment processing fee that is typically a small percentage of payment volume. In an older payment setup, a restaurant may work with multiple suppliers and have a complex system. While Shift4 seamlessly integrates all payments together. The business also provides customer analytics that help track consumption patterns, peak times and optimize employees/stock as a result. The platform also integrates with over 450 software providers from Microsoft Dynamics to Oracle Hospitality.

The business also has an e-commerce payment solution called Shift4 SHOP which is gaining traction. The management’s strategy going forward is to focus on expanding into new industry verticals such as amusement parks, colleges and sports centres. In the second quarter of 2022, for example, the company won the universities of Wisconsin and Alabama. Shift4 also runs the payments for Elon Musk’s Starlink, the satellite internet service. The business started processing payments for Starlink in the last week of Q2.22 and thus the majority of revenue from this customer will start to appear in the third quarter and beyond.

Shift4 is also active in M&A and has announced the planned acquisition of Finaro, a provider of fintech payment solutions. This is expected to help improve the company’s solution globally and more easily enter new verticals.

Growing economy

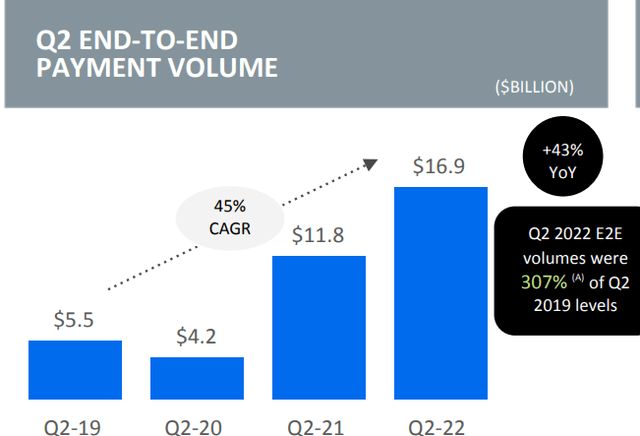

Shift4 generated solid financial results for the second quarter of 2022. End to End payment volume was a staggering $16.9 billion which increased by a rapid 43% year over year. This growth has been mainly driven by pent-up travel demand which has caused an increase in payments to hotel customers. Total hospitality payment volume increased by 170% on a 4 year compound annual growth rate. Restaurant payment volume has also continued to grow strongly with new wins such as Nobu Atlanta.

Shift4 (investor presentation)

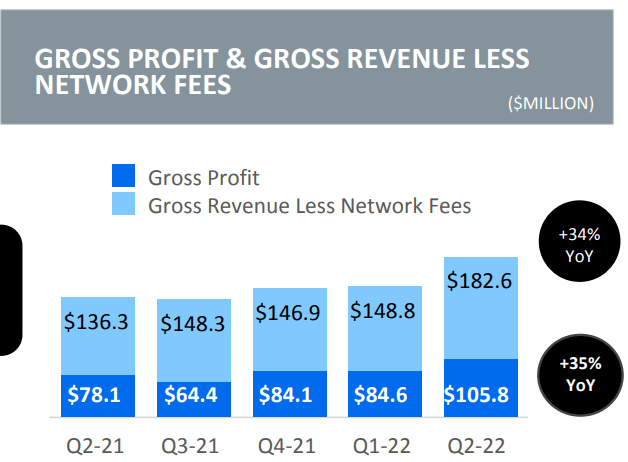

The business generated gross revenue of $506.7 million, which increased by a rapid 44% year over year. With gross profit of $105.8 million, which was up 35% from Q2 2021. This was driven by the aforementioned core growth, but slightly offset by the Gateway Sunset strategy. The company is “solarizing” its legacy gateway-only technology with customers as a way to entice them to move to its new end-to-end platform. For example, Shift4 had been trying to get major motorcycle franchise customers to upgrade for almost 5 years, but without success. But by using the Sunset strategy, the customer has agreed and it will be better for both parties in the long run.

Shift4 (2nd quarter earnings report)

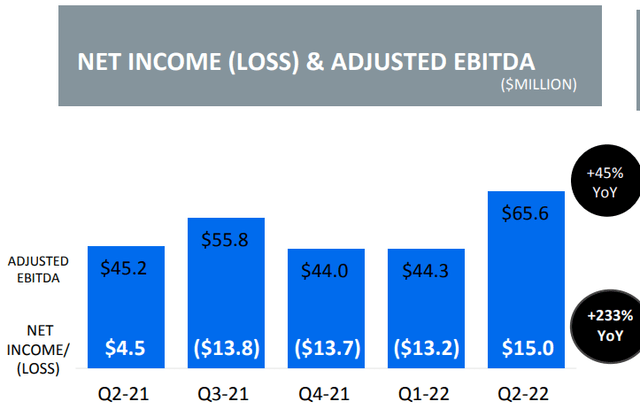

The company generated solid adjusted EBITDA of $65.6 million in Q2.22, which was up 45% year over year. Net income also improved by a significant 233% year-over-year to $15 million, which beat analysts’ expectations.

Shift4 (2nd quarter earnings report)

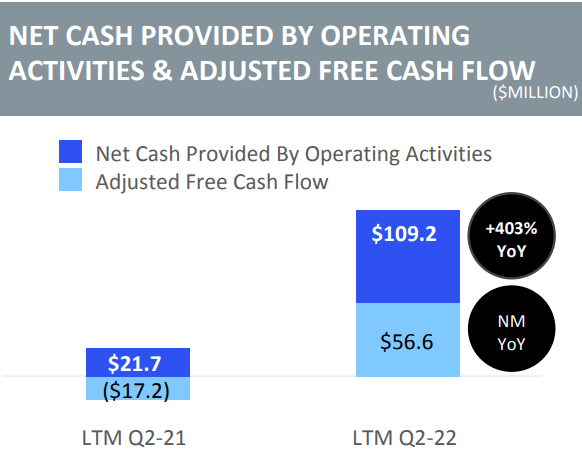

The company generated net cash from operations of $109.2 million, which was up a whopping 403% year-over-year.

Shift4 has an iron-clad balance sheet of over $1 billion in cash and short-term investments. It has total debt of $1.76 billion, but the vast majority of this is long-term debt and thus manageable. Management also bought back 3.6 million shares in the second quarter, and they believe the stock is “meaningfully undervalued,” but I’ll dive into the valuation in the next section.

Skift4 (revenues for the 2nd quarter)

Advanced valuation

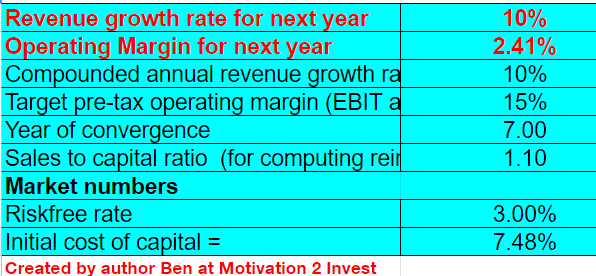

To value Shift4, I plugged the latest financials into my advanced valuation model, which uses the discounted cash flow method of valuation. I have predicted 10% revenue growth per year over the next 5 years. This is extremely conservative given the previous growth rate and new customers coming online such as Starlink.

Shift4 Stock Rating (created by author Ben at Motivation 2 invest)

I have predicted that the business will steadily grow its operating margin to 15% over the next 7 years as the company benefits from economies of scale and acquisition synergies pay off.

Shift4 Stock Rating (created by author Ben at Motivation 2 Invest)

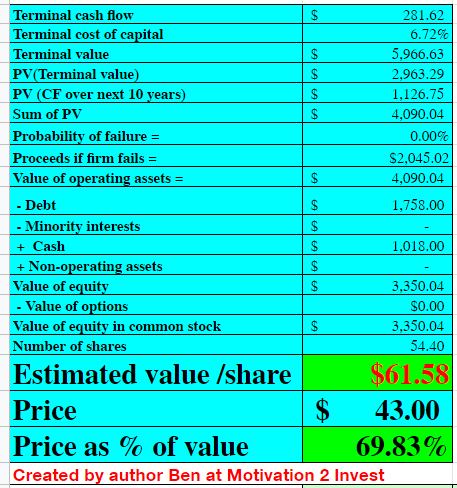

Given these factors, I get a fair value of $61/share, the stock trades at $43 per share at the time of writing and is thus ~30% undervalued.

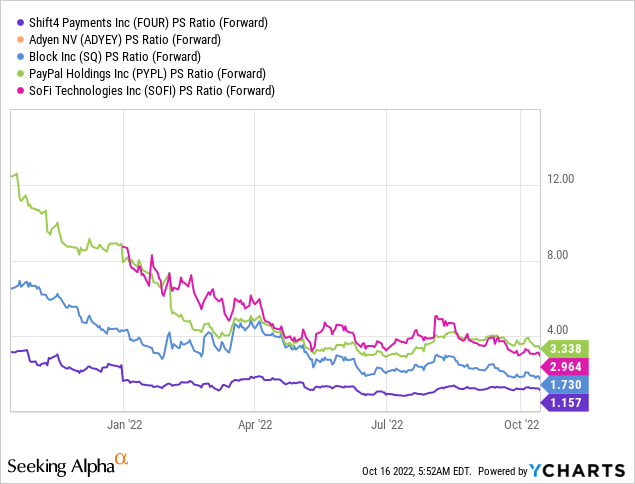

Compared to other fintech payment companies, Shift4 trades at one of the cheapest price/sales ratios = 1.16.

Risks

Recession/lower payment volume

The high inflation and rising interest rate environment has led analysts to predict a recession. This is not good for fintech companies as consumers are likely to make fewer transactions and thus mean lower payment volumes for Shift4. The good news is that I don’t predict a lot of churn as payment products tend to be very “sticky” in nature.

Final thoughts

Shift4 is a leading payments company with a strong track record of consistent execution and winning new business. The value proposition is strong and simple, while the valuation is relatively cheap. I expect some short-term volatility due to the coming recession, but long-term Shift4 will be read to process payments when consumer demand returns.

![Bitcoin [BTC]: Of epoch disadvantages and increasing adoption Bitcoin [BTC]: Of epoch disadvantages and increasing adoption](https://statics.ambcrypto.com/wp-content/uploads/2023/05/po-2023-05-07T105405.747-1000x600.png)