Media

Bitcoin.com is the premier source for all things crypto. Contact the media team at [email protected] to discuss press releases, sponsored posts, podcasts and other options.

all about cryptop referances

sponsored

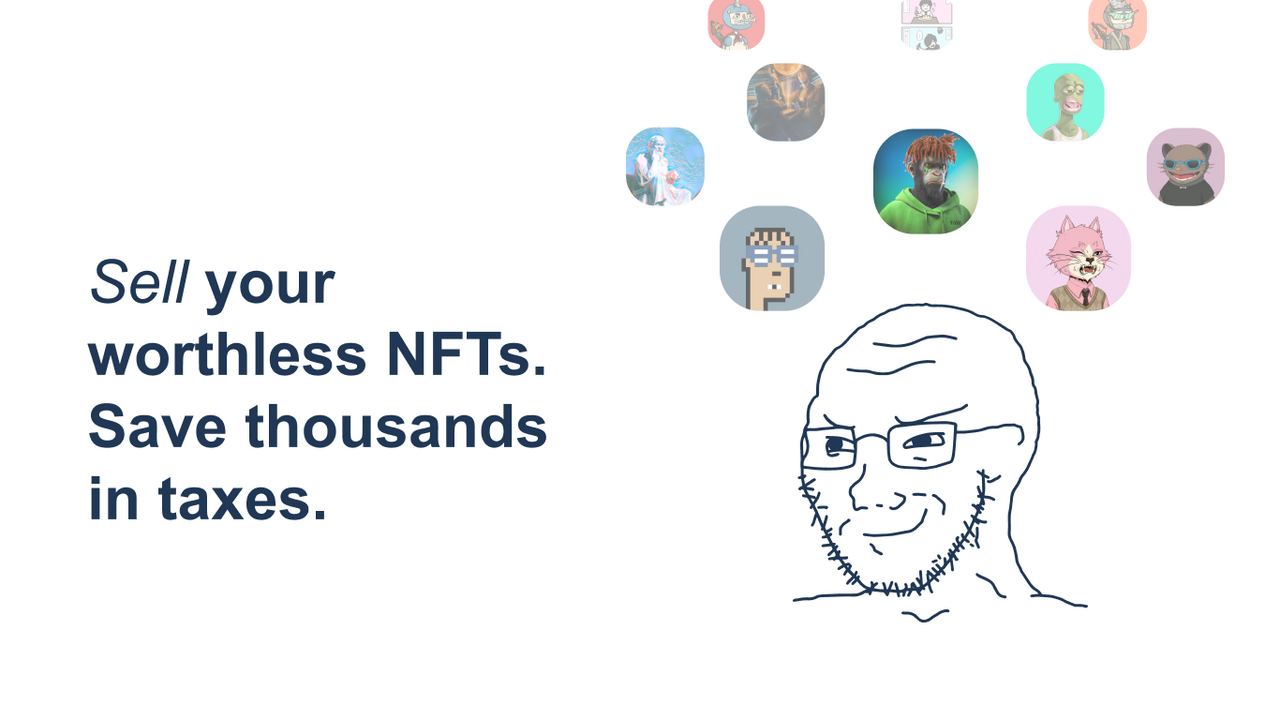

There is a silver lining to the crash in the NFT market – millions of dollars in potential tax savings.

To help NFT investors claim their tax savings before the end of the year, CoinLedger recently launched an NFT tax loss collection tool. Let’s break down how the tool works and how it can help people save money on their tax bill.

What is tax loss harvesting?

Tax loss harvesting is a tax reduction strategy used by savvy investors to reduce their total tax liabilities for the year. By selling assets that have declined in value since they originally purchased them, investors can harvest capital losses and generate tax write-offs.

Imagine the following scenario:

Jane Doe sells part of her bitcoin holdings in February 2022 and realizes $50,000 in capital gains in doing so.

The $50,000 is now income on which Jane must pay taxes. If Jane is a high earner, she may have to pay up to 37%, or $18,500 to Uncle Sam in taxes. Oh!

Let’s say that during the same year, Jane also spent $30,000 on NFTs, which are now worth close to $0.

If Jane harvests the losses from her NFTs, she can realize $30,000 in capital losses and reduce her net capital gain to $20,000.

Now Jane’s tax bill will be just $7,400 for the year (37% of $20,000). By simply harvesting her NFT losses, Jane saves $11,100 on her taxes!

The problem of tax loss harvesting with NFTs

Unfortunately, NFT investors may find it difficult to reap losses when their NFTs do not have liquidity in open markets.

In these situations, investors can be sitting on thousands of dollars in paper losses with no easy way to legally dispose of the NFTs and realize their capital losses.

Enter CoinLedger’s NFT Loss Harvestooor

CoinLedger recently launched a new product, The NFT Loss Harvestooor, to provide a solution for NFT investors who want to harvest losses and save money on taxes.

NFT Loss Harvestooor is a smart contract distributed to the Ethereum mainnet that will buy an NFT for 0.00000001 ETH, even if the NFT has no liquidity!

This allows any investor to realize capital losses and reduce tax.

One NFT investor has already reduced his tax bill by $7,400 using NFT Loss Harvestooor!

How does CoinLedger’s NFT Loss Harvestooor work?

To start harvesting losses, any investor can simply connect a wallet to NFT Loss Harvestooor. After a wallet is connected, they can choose which NFT he or she wants to sell or dispose of.

Once selected, simply click sell and sign the transaction. Any realized losses can be used to lower the tax burden!

Is NFT Loss Harvestooor safe to use?

CoinLedger has been in business since 2018 and has served hundreds of thousands of individual crypto investors since its inception.

The NFT Loss Harvestooor smart contract developed by the CoinLedger team went through a rigorous audit process to ensure it complies with industry standards.

In addition, all the code that runs the contract is completely open and available for the public to verify.

Get started today – use it for free

NFT Loss Harvestooor is completely free to use. CoinLedger does not charge any transaction fees for interacting with the contract other than the gas needed to cover the blockchain processing fees.

Get started by visiting NFT Loss Harvestooor to see how much money users can save on taxes this year!

This is a sponsored post. Find out how to reach our audience here. Read disclaimer below.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is directly or indirectly responsible for damages or losses caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.