Sales volume shines, but TVL remains a concern

Cardano NFTs: Despite the “ghost protocol” narratives, Cardano continues to see new highs. The NFT market is is growing fast, while TVL remains muted.

Cardano’s NFT space is growing rapidly despite the general decline for non-fungible tokens (NFT) in 2021 and even 2022.

Actually Cardano’s NFT trading volume surge made it the third largest NFT protocol. They sit right behind the two giants: Ethereum (ETH) and Solana (SOL).

Can the gains be sustained here, or will the bears take advantage?

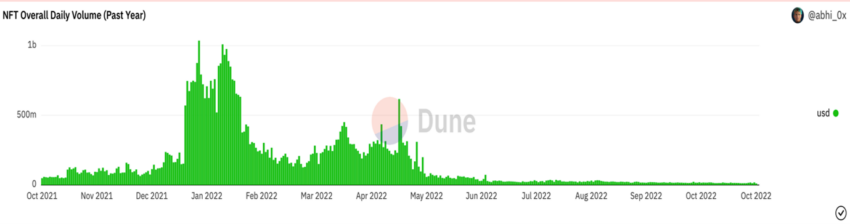

NFT Market: The Darkest Shade of Grey

Trading volumes for “digital art and collectibles registered on the blockchain” or NFTs saw a massive drop. It plummeted (by) 97% from its record high in January this year, registering just $466 million in September.

For reference, NFT trading volume recorded $17 billion at the start of 2022, according to data from Dune Analytics.

According to s Bloomberg report, the waning NFT mania is part of a broader $2 trillion wipeout in the crypto sector, as rapid monetary policy tightening starves speculative assets of investment flows.

OpenSea, the largest NFT trading platform by volume, saw sales drop 75% compared to just two months earlier. This despite the fact that the number of traders has not really fallen much, even though the number of traders has collapsed.

That said, there was some relief for the NFT enthusiasts. As BeInCrypto reported that Redditt NFTs generated over $2 million in sales volume. The peak represented a 1000% increase in sales volume.

Cardano NFTs: My Turn to Shine

Cardano is said to be one of the most developed ecosystems in the crypto market. Despite the FUD, the protocol continues to make headlines during the crypto bear run.

Cardano is the third largest non-fungible token (NFT) protocol by trading volume, according to a report from blockchain and decentralized apps (dApps) research firm DappRadar.

“Cardano is currently one of the top three blockchains by NFT trading volume,” the report added.

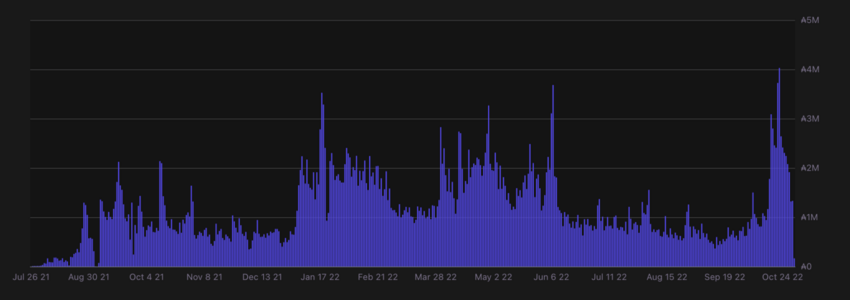

In the last 30 days, the network’s NFT volume reached $191 million, placing Cardano as the third largest NFT protocol behind Ethereum and Solana.

You can clearly see the rise around the period 22-23. October from the NFT marketplace tracker OpenCNFT.

The Ape Society, Cardano’s largest NFT project in terms of fundraising share with 24-hour volume, reached the base price of 10,000 ADA.

The said increase indeed injected much needed relief. Especially after NFT volume on Cardano marketplaces had been quite low in the months between June and early October.

Cardano green pastures

Surprisingly or not, the platform faced backlash in the past. One case that stood out was the accusation that Cardano was a “Ghost protocol.” This was mainly due to the blockchain worth billions, and yet with limited utility.

But as Cardano ushers in a new age, ecosystem evolution into network transactions sees bright spots.

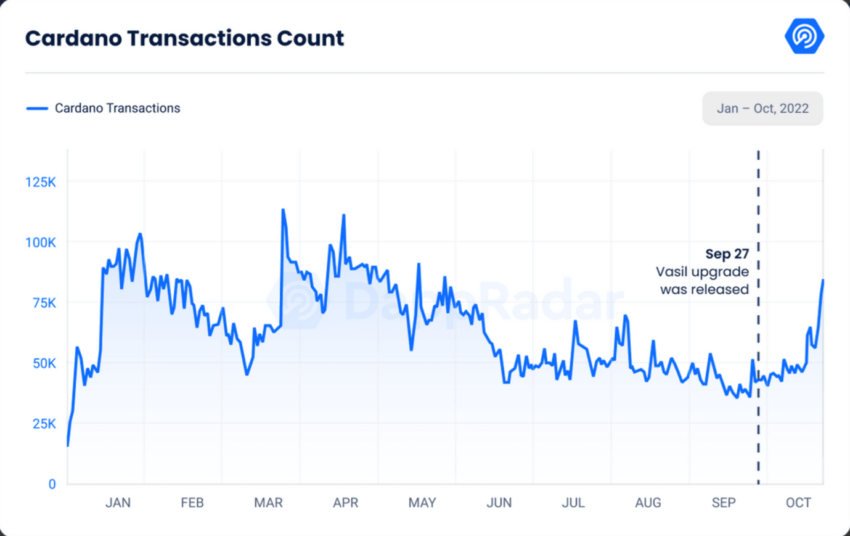

Cardano’s network transactions reached 82,880, the largest number since May. With these numbers, the blockchain network recorded a month-on-month increase of 75%.

In fact, the Cardano (ADA) network has grown to hit 97,959 transactions on October 19, a figure that represents an increase of approximately 75% month-on-month.

Work hard, play hard

Needless to say, the increase in trading volume is linked to the Vasil upgrade, which went live on September 22 despite some delays. The aim of the upgrade was to increase the network’s capacity and at the same time reduce the transaction time.

In addition to this, Cardano’s Layer 2 solution, Hydra, witnessed another update. The respective team highlighted the same on the social media platform which reads like:

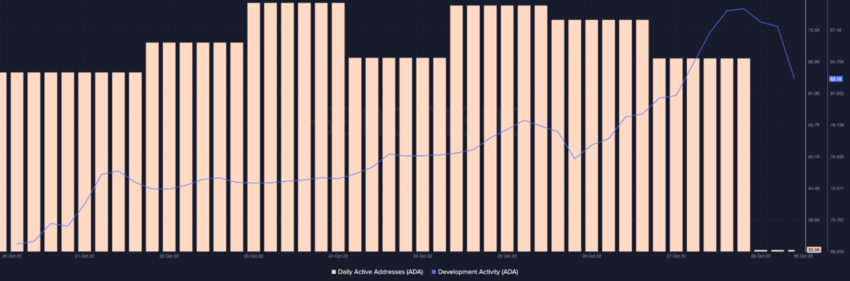

Compiling both of these datasets, Cardano’s development activity grew tremendously in the past week. Meanwhile, the number of daily active addresses increased steadily, currently at around 67,000.

Then again, speculation surrounding its “Ghost” nature may not hold true. Charles Hoskinson, the Cardano founder wasted no time in acknowledging such narratives. Here is one for reference:

Find the missing part

There are two aspects here: ADA price and TVL status check. Both depict a rather bleak scenario.

Speaking of the former, native crypto ADA saw another 3% correction on CoinMarketCap. At press time, ADA remained stagnant around the $0.40 mark despite said developments/upgrades.

Here is the price development in 2022: A bleeding picture to say the least.

Meanwhile, Cardano total value locked (TVL), a common measure of the chain’s size, remained unaffected, it was even reduced. Cardano TVL is down about 20% in the last thirty days to $70 million.

Still minimal compared to rivals Ethereum (ETH) and Solana (SOL).

Things to consider for Cardano NFTs

In general, the Cardano NFT community has flourished recently, but the same cannot be said for the NFT market in general.

Cardano’s TVL raises some doubts about the same. This can partly be attributed to investors’ general negative perception of DeFi.

It is indeed time to pull up the socks.

Have something to say about Cardano (ADA) or something else? Write to us or join the discussion in our Telegram channel. You can also catch us on TikTok, Facebook or Twitter.

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for missing facts or inaccurate information. You comply and understand that you should use this information at your own risk. Cryptocurrencies are highly volatile financial assets, so do your research and make your own financial decisions.

Disclaimer

All information on our website is published in good faith and for general information purposes only. Any action the reader takes on the information contained on our website is strictly at their own risk.