Research firm details where Bitcoin whales are invested, shows a crypto sector that will herald BTC rally

Analytics platform Santiment reveals how deep pockets Bitcoin (BTC) investors parked their money after the crypto sell-off.

Santiment says crypto whales could have invested in government debt in the US and other countries as a result of interest rate hikes by the Federal Reserve and a gloomy economic outlook.

“One thing that gave traders hope was the fact that major stablecoin market caps grew throughout May this year.

But as Federal Open Market Committee (FOMC) interest rate hikes and recession fears began to really take hold of investors’ speculative decisions, it became much harder for large holders to justify keeping such a large amount of dollar-pegged crypto on the sidelines.

The very likely implication is that these big institutions and whales are keeping their money in US and world treasuries instead. Crypto is simply too unappealing for them (for now) with so much uncertainty going on through 2022.

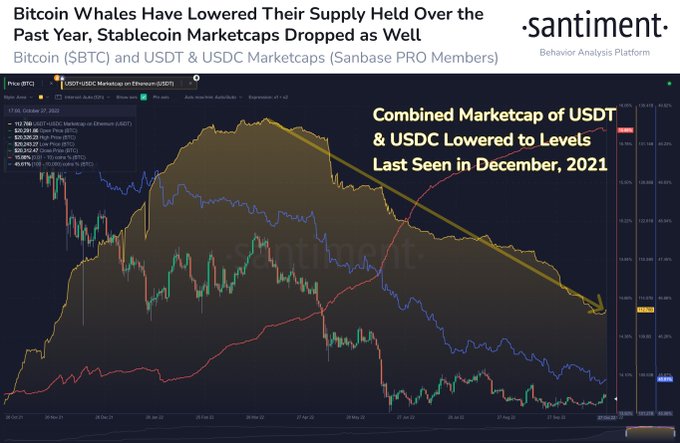

According to Santiment, the combined market capitalization of stablecoins Tether (USDT) and Circle-backed USD Coin (USDC) fell to a 10-month low.

For Bitcoin bulls, the analytics platform says BTC is likely to see an increase in value if the market capitalization of the major stablecoins begins to swell.

“Bulls will want to watch and see if the largest stablecoins start to see increases in market capitalization again.

If they do, Bitcoin and crypto prices may justify an increase even if the whale supply of Bitcoin and Ethereum remains low.”

Bitcoin is trading at $20,616 at the time of writing.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/GelgelNasution