Kevin Helms

A student of Austrian economics, Kevin found Bitcoin in 2011 and has been an evangelist ever since. His interests lie in Bitcoin security, open source systems, network effects and the intersection of finance and cryptography.

all about cryptop referances

Billionaire Elon Musk, CEO of Tesla and Spacex, has warned that the recession will be “significantly intensified” if the Federal Reserve raises interest rates again next week. He added that things “will probably start to look better” in the second quarter of 2024.

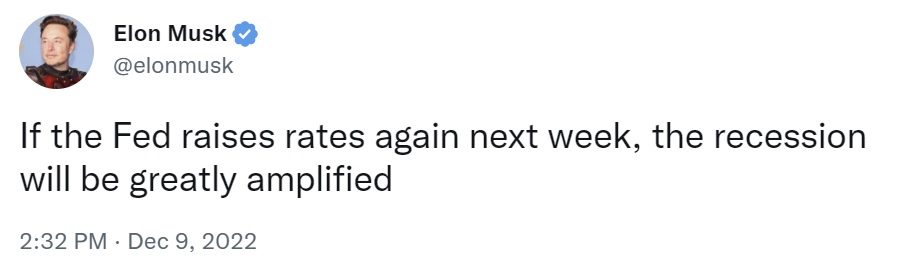

Tesla boss and Twitter boss Elon Musk has repeated his warning about a recession in the US. He tweeted Friday that if the Federal Reserve raises interest rates again next week, “the recession will be greatly intensified.”

Musk was further asked on Twitter how long he thinks the recession will last. The Tesla CEO replied:

Just a rough guess, but things probably start to look better in Q2 2024.

This was not the first time Musk warned about the consequences of the Fed raising interest rates. In late November, the billionaire said the trend was worrying. He urged the Federal Reserve to cut interest rates immediately, stating that the US central bank is “massively increasing the likelihood of a severe recession”.

He agreed with Ark Invest CEO Cathie Wood that the Fed’s actions could lead to a 1929-style Great Depression.

Federal Reserve Chairman Jerome Powell has signaled a rate hike of 50 basis points in December after four consecutive increases of 75 basis points. “It makes sense to moderate the pace of our rate hikes as we approach the level of restraint that will be sufficient to bring down inflation,” Powell said. Fed officials will announce their decision on Wednesday after a two-day meeting of the Federal Open Market Committee (FOMC).

According to gold bug Peter Schiff, “The risk is not that the Fed causes a recession by tightening unnecessarily too much because it thinks a strong economy will prevent inflation from falling.” He explained in a tweet last week: “The risk is that the current recession worsens, causing the Fed to swing prematurely as it mistakenly believes inflation will slow.”

Some people expect a mild recession in 2023, including analysts at Citi Group. The impending recession “won’t be that deep, but it will be meaningful,” said David Bailin, chief investment officer and head of Citi Global Wealth Investments. However, some expect a severe recession, including veteran investor Jim Rogers.

Do you agree with Elon Musk? Let us know in the comments section below.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is directly or indirectly responsible for damages or losses caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.