Quant explains how Bitcoin NUPL cycles become less volatile over time

Bitcoin NUPL data suggests that crypto’s cycles are becoming less sharp over time as profit and loss bottoms do not follow a horizontal line.

Bitcoin NUPL did not exceed the 0.75 “Greed” mark during this cycle

As explained by an analyst in a CryptoQuant post, the BTC profit and loss cycles should not be treated with horizontal lines.

“Net Unrealized Profit and Loss” (or NUPL for short) is an indicator that tells us whether the market as a whole has a net profit or a net loss right now.

The value of the metric is calculated by taking the difference between the market value and the realized value, and dividing it by the market value.

NUPL = (Market Cap – Realized caps) ÷ Market value

When the value of this indicator is greater than zero, it means that the average investor currently has some profit.

On the other hand, negative NUPL values suggest that the overall market has a net unrealized loss at the moment.

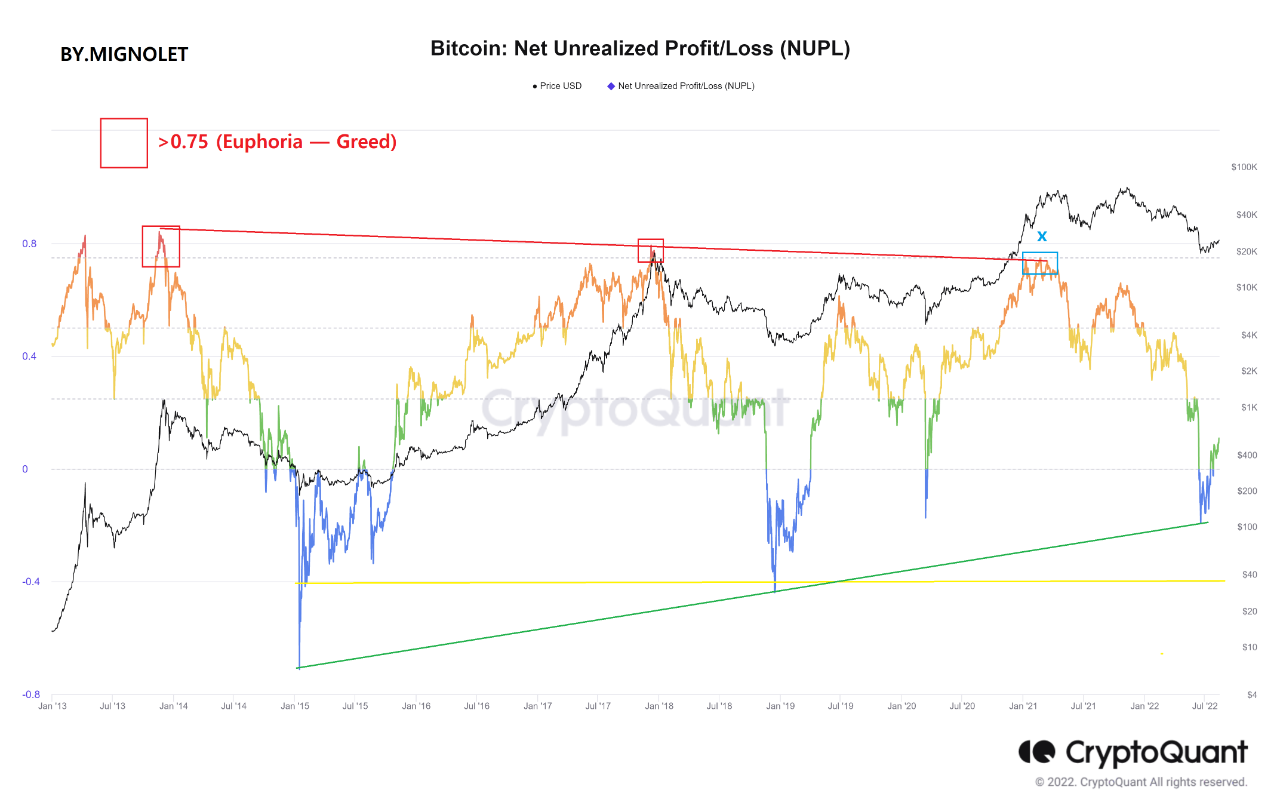

Now, here is a chart showing the trend of Bitcoin NUPL over the history of crypto:

Looks like the value of the metric has surged up and turned positive again recently | Source: CryptoQuant

As you can see in the graph above, the quant has marked the relevant trend zones for the Bitcoin NUPL indicator.

In the past, many traders used to believe that cycle tops form when the value of the metric rises above 0.75, entering the “greed” zone.

Similarly, the bottom was believed to take place when the indicator went below the -0.4 mark, reaching into the “fear” area.

However, the analyst from the post argues that horizontal lines like these should not be used to mark these cycle tops and bottoms.

During the previous two cycles, the peak that followed was lower than the one before. In the current cycle, the metric never crossed into the greed zone and peaked just around the 0.75 level. This can mean that the peaks get lower and lower with each cycle.

Correspondingly, the last two bottoms also had decreasing loss amounts. Just a while ago, the NUPL value fell sharply to negative and then fell back to positive values after forming a potential bottom. However, this lowest level was far from the conventional 0.4 mark.

If this low was indeed the bottom of this cycle, it would lend further credence to the idea that profit and loss swings in the market are becoming less drastic over time.

BTC price

At the time of writing, Bitcoin’s price is hovering around $24.4k, up 5% in the last week.

The value of the crypto seems to have been moving sideways recently | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com