Property rights in NFTs are in the spotlight | Wiley Rein LLP

Interest in non-fungible tokens (NFTs) – unique digital assets created and sold on blockchains – has exploded in the past year. Buyers have paid many millions for these digital goods, and online marketplaces have evolved together to allow consumers to shop and buy a wide variety of NFTs. But the full extent of property rights that come with buying an NFT is far from settled – although recent decisions by courts in the UK and Singapore may bring more clarity to the matter.

Notably, Singapore’s Supreme Court recently recognized that non-fungible tokens (NFTs) were protectable digital assets and a form of legal property. The decision marks one of the first cases globally dealing with questions of property rights in NFTs and may have important consequences for future disputes.

Background

NFTs are unique units of data created or “stamped” on a blockchain. At their core, NFTs are non-fungible – i.e, they are irreplaceable, unique and non-exchangeable. Blockchain technology provides a highly reliable method of proving ownership – and tracking the transfer of ownership – because it prevents NFTs from being edited or deleted, and it allows interested buyers to verify both ownership and the identity of the asset. And because most blockchains used for NFTs are public, this allows interested buyers and third parties to assess and verify NFT ownership and accurately track transactions.

Some recent uses for NFTs include NFT characters being used for major television shows, using NFTs as deeds to purchase digital real estate, and video game players purchasing NFTs in-game, such as unique items. Others register their NFTs as collateral to secure loans. Law firms have even leveraged NFTs to perform service. Regardless, the use cases for NFTs continue to evolve in real time.

NFT Property Rights in Singapore

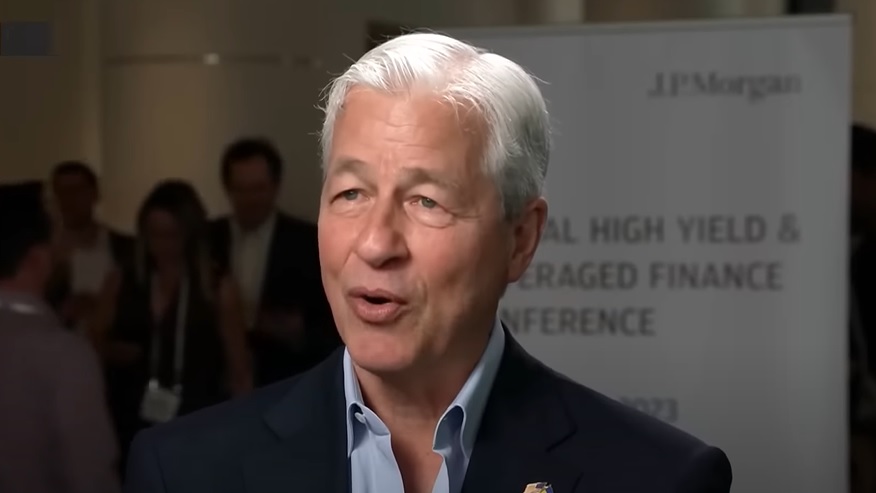

A recent decision by the Singapore Supreme Court was the first major Supreme Court in the world to explicitly recognize NFTs as a protected digital asset and a form of legal property in a purely commercial dispute. The plaintiff was a Singaporean NFT owner who sued an unknown NFT collector to block the sale of an NFT that the claimant claimed he rightfully owned. The plaintiff and the defendant had entered into a loan agreement secured by an NFT, BAYC no. 2162, as security for the loan. BAYC No. 2162 is a unique symbol and part of the Bored Ape Yacht Club (BAYC) series. Each token in BAYC depicts a cartoon monkey with distinct characteristics such as a unique outfit, expression and background. And BAYC NFTs are highly sought after, often selling for well over $200,000.

In the event that the plaintiff failed to repay the loan on time, the terms of the agreement prohibited the defendant from taking ownership of BAYC NFT and required the defendant to give the plaintiff a reasonable extension to make repayment. After premature foreclosure of the loan, the defendant claimed ownership of the rare NFT. The plaintiff then claimed to be the rightful owner of the NFT and sought an order to compel the defendant to accept repayment of the loan and return BAYC No. 2162.

The court granted relief to the plaintiff and ordered the defendant to return the NFT. In doing so, the court recognized NFTs as protectable digital assets and a form of legal property. Singapore is a common law jurisdiction, like the US and the UK, and is increasingly seen as a global legal hub, so the holding is likely to be persuasive for future decisions.

Comparison with other common law jurisdictions

The Singapore decision comes on the heels of two recent holdings by the UK High Court which found blockchain-based assets constitute “legal property” subject to asset freezing orders. IN AA v. Persons Unknown, the Supreme Court held that Bitcoin and other cryptocurrencies can be considered property under English law subject to an injunction. Most recently, i Lavinia Deborah Osbourne v. (1) Persons Unknown and (2) Ozone Networks Inc. trading as OpenSeaextended this reasoning to NFTs, finding that NFTs could qualify as property under English law and upholding an injunction freezing two NFTs stolen from a woman’s digital wallet and later found in other digital wallets.

In the United States, recognition of NFTs as distinct digital assets remains an unresolved issue, although courts have separately addressed how other blockchain-based tokens may be treated. To begin with, state and federal statutory regimes largely treat bitcoin as property. Recently, i Shin v. ICON Foundation, tokens on a blockchain were recognized as “capable of being possessed.” The court used a three-part test from the Ninth Circuit to establish a property right in blockchain assets: “First, there must be an interest that can be accurately defined; second, it must be capable of exclusive possession or control; and third, the putative owner must have established a legitimate claim to exclusivity.” The Shin the decision applies common law property principles to blockchain technology, recognizing an owner’s ownership interest in tokens registered on the blockchain.

Another lawsuit filed in February 2022 may shed more light on how the courts apply these principles in the context of NFTs. IN McKimmy v. OpenSea (Civil Action No. 4:22-CV-00545), filed in the Southern District of Texas, a man who unknowingly sold his BAYC NFTs for what he claims is well below market value is suing a major NFT online marketplace (OpenSea) for refund of NFT and/or damages in excess of 1 million dollars. If this case does not resolve, it could add important context to how the courts analyze these types of questions.

Looking forward

Characterizing NFTs as a distinct form of legal property and digital asset is a significant development for several reasons.

For starters, the Singapore ruling establishes NFTs as valuable property, distinct from just a record on a blockchain – they are digital assets with associated rights that owners can assert in court and that courts recognize as collateral. However, as the Singapore decision highlights, contracts involving these assets should be scrutinized and particular attention should be paid to any terms relating to the extent of property rights being transferred.

Furthermore, the Singapore decision underscores the need for NFT holders to take precautions when allowing the use of their tokens. The purchase of an NFT gives ownership over the token itself, including the registration of the token’s ownership and the right to exclude others from claiming ownership over the token. However, NFT owners must be wary of the intellectual property rights and control they relinquish to third parties.

In the US, there are actually several cases pending in lower courts regarding NFT ownership and intellectual property rights. NFT ownership does not necessarily imply ownership beyond the token itself, and NFT ownership often excludes ownership of the intangible rights of the underlying asset. For example, NFT coins can maintain copyright of the token while giving the buyer a limited display right. Nevertheless, contracts and purchase agreements can transfer intellectual property rights. For example, the terms and conditions of the BAYC NFTs that were the subject of the Singapore decision stipulate that the right to exploit intellectual property rights in the NFT’s image follows the NFT. Actor Seth Green, who developed a show around a BAYC NFT, recently had to halt production on the show when he lost the NFT and the associated intellectual property rights to an online fraudster. In July 2022, the United States Patent and Trademark Office and the United States Copyright Office announced the launch of a joint study of the intellectual property rights issues in NFTs.

At bottom, the courts will continue to be faced with new questions regarding ownership, ownership interests and intellectual property rights protection for digital assets such as NFTs.

Eliza Lafferty, a Wiley 2022 Summer Associate, contributed to this blog post.

[View source.]