Pro-Bitcoin El Salvador to buy back $1.6 billion worth of debt

A few hours ago, El Salvador’s president – Nayib Bukele – revealed the country’s plans to buy back $1.6 billion of its dollar bonds. In a historic move last year, the Central American nation adopted Bitcoin as legal tender. Since then, stalwarts leaning towards the traditional side of the financial spectrum have reportedly started making claims out of thin air that the said move would weaken El Salvador’s economy and that it would not be able to clean up its defaults. So now the latest move is set to alleviate standards-related concerns that have been repeatedly flagged.

Terminate the repurchase agreement

In a series of tweets, Bukele announced that he was sending two bills to the National Assembly to provide a “transparent, public and voluntary purchase offer” to all HODLers of Salvadoran government bonds from 2023 to 2025.

The president further revealed that the bonds would be bought back at market prices and the process would begin to lay out the paperwork. Giving an estimate of when to expect the buying operation to start, Bukele revealed,

“The purchase operation will start in 6 weeks (the time it takes to file all the papers).”

At the beginning of this year, the International Monetary Fund had called on El Salvador to strip Bitcoin of its legal status. It cited that adopting crypto as legal tender posed “significant risks” to financial and market integrity, financial stability and consumer protection. It added that the same also had the potential to create contingent liabilities.

Read more: IMF urges El Salvador to strip Bitcoin of its legal tender status

So, has Bitcoin really affected El Salvador’s economy?

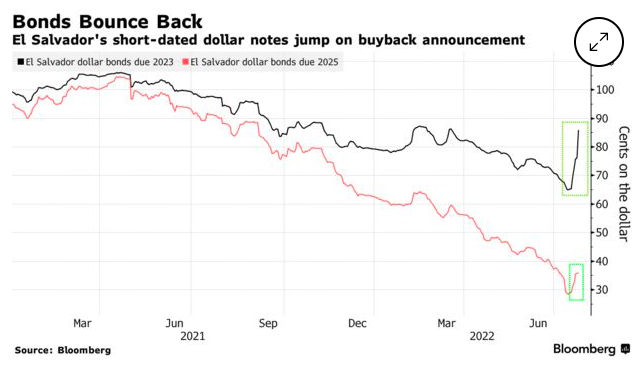

The nation quite blatantly dodged the IMF’s bullet. El Salvador once bought Bitcoin during its dip, expressing its belief in the largest crypto asset. Here it is worth recalling that in May the rating agency Moody’s downgraded El Salvador’s debt and warned that the Central American nation may be forced to default. Indeed, around the same time, El Pais had reported that Salvadoran bonds were trading at about 40% of face value, a sign that traders noted the warning as a serious risk.

Bukele is not on the same page and has claimed that El Salvador has more than enough liquidity to meet its obligations. Regarding the current economic condition of the country, he claimed,

“Contrary to what the media has been saying all this time, El Salvador has the liquidity to not only pay all of its obligations when they fall due, but also buy all of its own debt (until 2025) in advance.”

Bukele further expects that bond prices will “probably move upwards” as the nation begins to buy all available bonds at the market price.

Only after the buyback announcement have El Salvador bonds started to rise in value. A recent Bloomberg report revealed,

“The nation’s dollar bonds due in January 2023 rose nearly 10 cents after the announcement to 86 cents, according to indicative prices compiled by Bloomberg. The 2025 notes, meanwhile, rose 16 cents to trade at 52 cents, the highest since mid-April.”