Paysafe Stock: Another Fintech SPAC On The Scrap Heap (NYSE:PSFE)

metamorworks/iStock via Getty Images

People are born with different capacities. If they are free, they are not equal. And if they are equal, they are not free.“- Aleksandr Solzhenitsyn

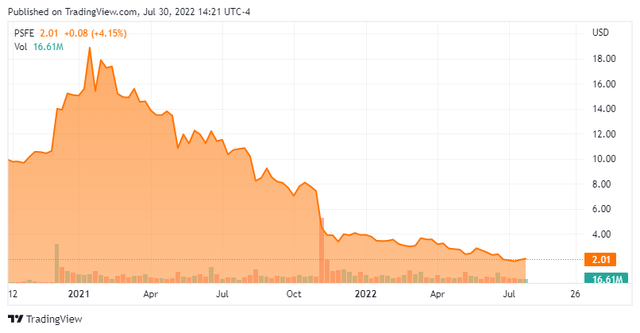

Today we put Paysafe Limited (NYSE:PSFE) in the spotlight for the first time. The proportion of this concern for digital commerce solutions resides deep in “Violation of IPO” territory. Not surprising, given how long it took SPAC route to go public, and as my regular readers know, most of these once high-flying names are now on the scrap heap. If you browse through Seeking Alpha’s news feed, you will find that this company frequently announces new payment processing partnerships across eGaming and other sectors. Unfortunately, that hasn’t translated into shareholder value until now. So will Paysafe continue to be a falling knife, or is it an oversold gem? We attempt to answer that question via the analysis below.

Seeking Alpha

Company overview:

Paysafe Limited is headquartered in London. The company delivers digital trading solutions to online businesses, small and medium-sized businesses and consumers. These include PCI-compliant payment acceptance and transaction processing solutions for merchants and integrated service providers, including merchant procurement, transaction processing, online solutions, fraud and risk management tools. The company also provides data and analytics, as well as point of sale and merchant financing solutions under the Paysafe and Petroleum Card Services brands and offers digital wallet solutions under the Skrill and NETELLER brands. The stock is currently trading at $2 per share and has an approximate market value of $1.45 billion.

Results first quarter:

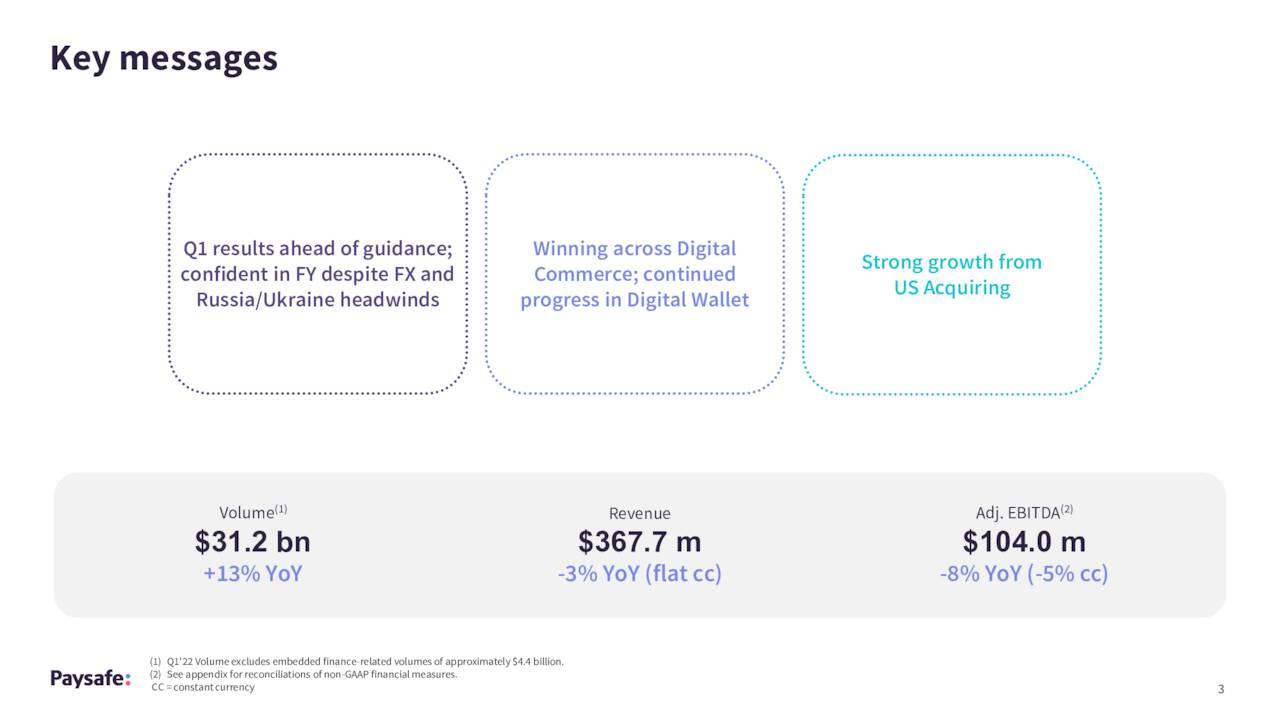

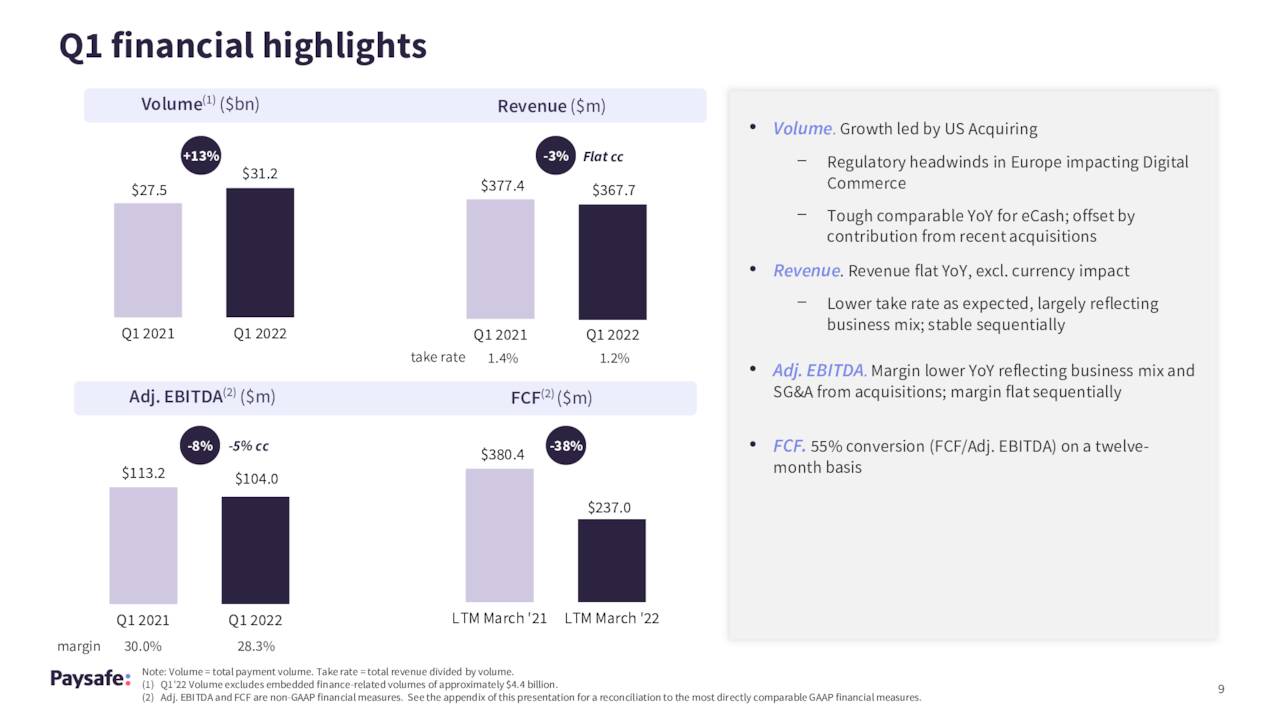

The company published the first quarter number on 11 May. The company had a net loss of $1.2 billion in the quarter, which was entirely attributable to a $1.2 billion non-cash impairment charge. Total payment volume increased by 13% to $31.2 billion from the same period last year, although net income decreased by three percent to $367.7 million. On a constant currency basis, net sales were flat through 1Q2021. Adjusted EBITDA also fell eight percent (five percent on a constant currency basis) to $104 million.

May company presentation

The company guided for $370 million to $380 million in revenue in the second quarter, about $20 million below consensus. The company guided for full-year net sales of $1.53 billion to $1.58 billion, roughly in line with expectations.

May company presentation

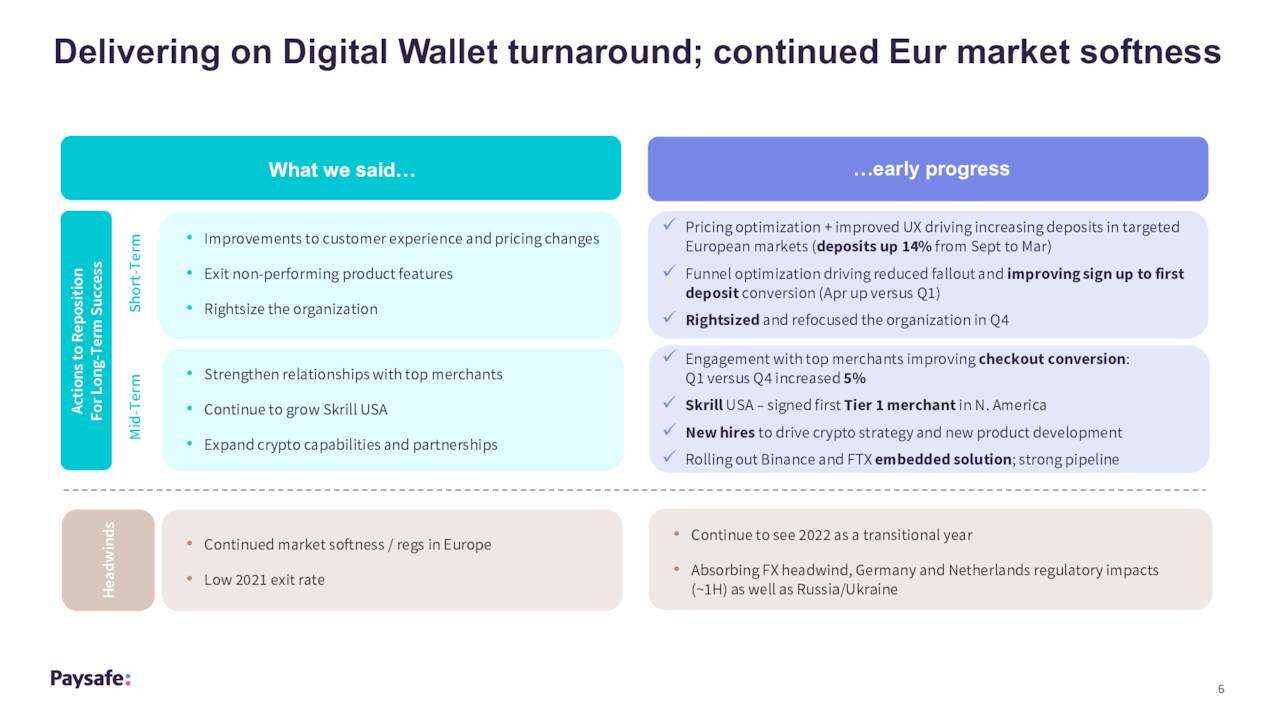

This may have been a bit of a “kitchen sink” quarter given that the company appointed a new chairman in March and a new managing director took over on 1 May. On the earnings call, management seemed pleased with progress in revamping the company’s digital wallet business in Europe, as well as its grip on both the US and European eGaming markets.

May company presentation

Analyst comments and balance sheet:

The analyst community is mixed on Paysafe’s prospects at the moment. So far in 2022, five analyst firms including BMO Capital and Cowen & Co. issued buy or better results on the share. The price targets offered range from $4.00 to $7.00 per share. Credit Suisse ($2.25 price target), Evercore ISI ($4.00 price target) and Bank of America all have Hold or Underperform ratings on the stock.

May company presentation

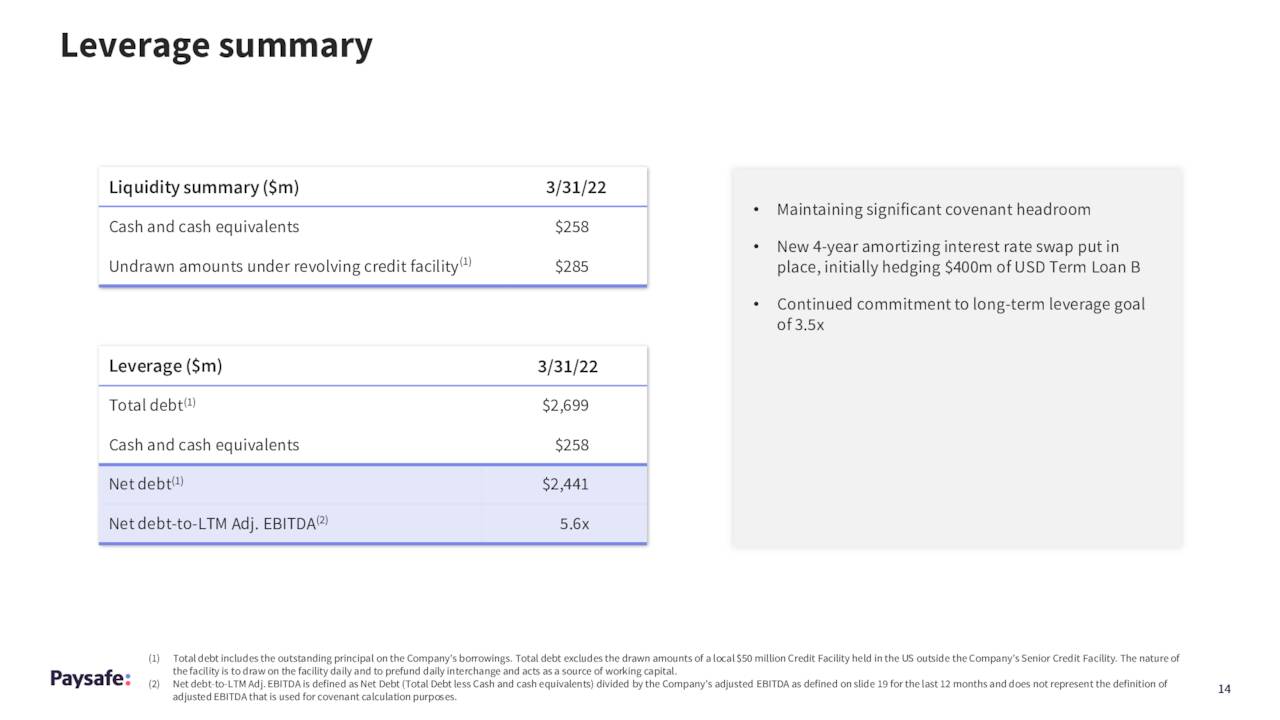

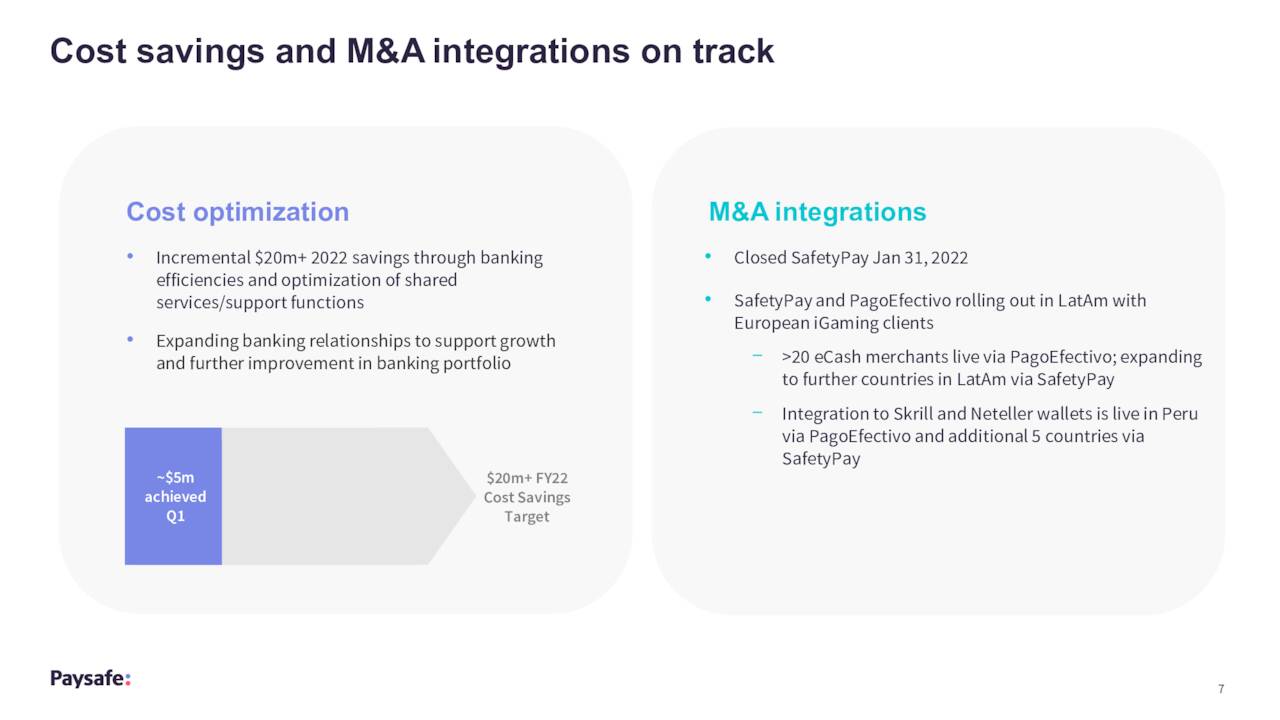

Just over five percent of the outstanding shares are currently short. The company ended the first quarter with just over $250 million in cash and marketable securities against approximately $2.7 billion in total debt. The company aims to save about $20 million in annual cost savings this year via bank efficiencies and other cost-cutting measures.

May company presentation

Verdict:

The current analyst consensus the company has lost over a dollar per share in FY2022 as revenue increases slightly to $1.5 billion. Next year, the analyst community sees the company making a small profit on revenue growth with high single digits.

Paysafe is now selling at less than 20% of the market value at which it went public. This is hardly an outlier in the Fintech space from past SPACs, unfortunately. The Fintech space has become very competitive with countless competitors, and Paysafe seems to have a lot of pots on the stove.

With a possible global recession in the near term, the headwinds are not going to ebb any time soon. The company has a large debt burden, also given its size. Given that, I accept any investment recommendation around Paysafe at this time.

For the common good” is the most common excuse for unusual evil.” ― Jakub Bożydar Wiśniewski