Not Your Keys: Monthly Bitcoin Exchanges Hit New ATH

Data shows that the monthly Bitcoin exchange has reached a new all-time high, as investors have rushed to get their coins into personal wallets, the keys they own.

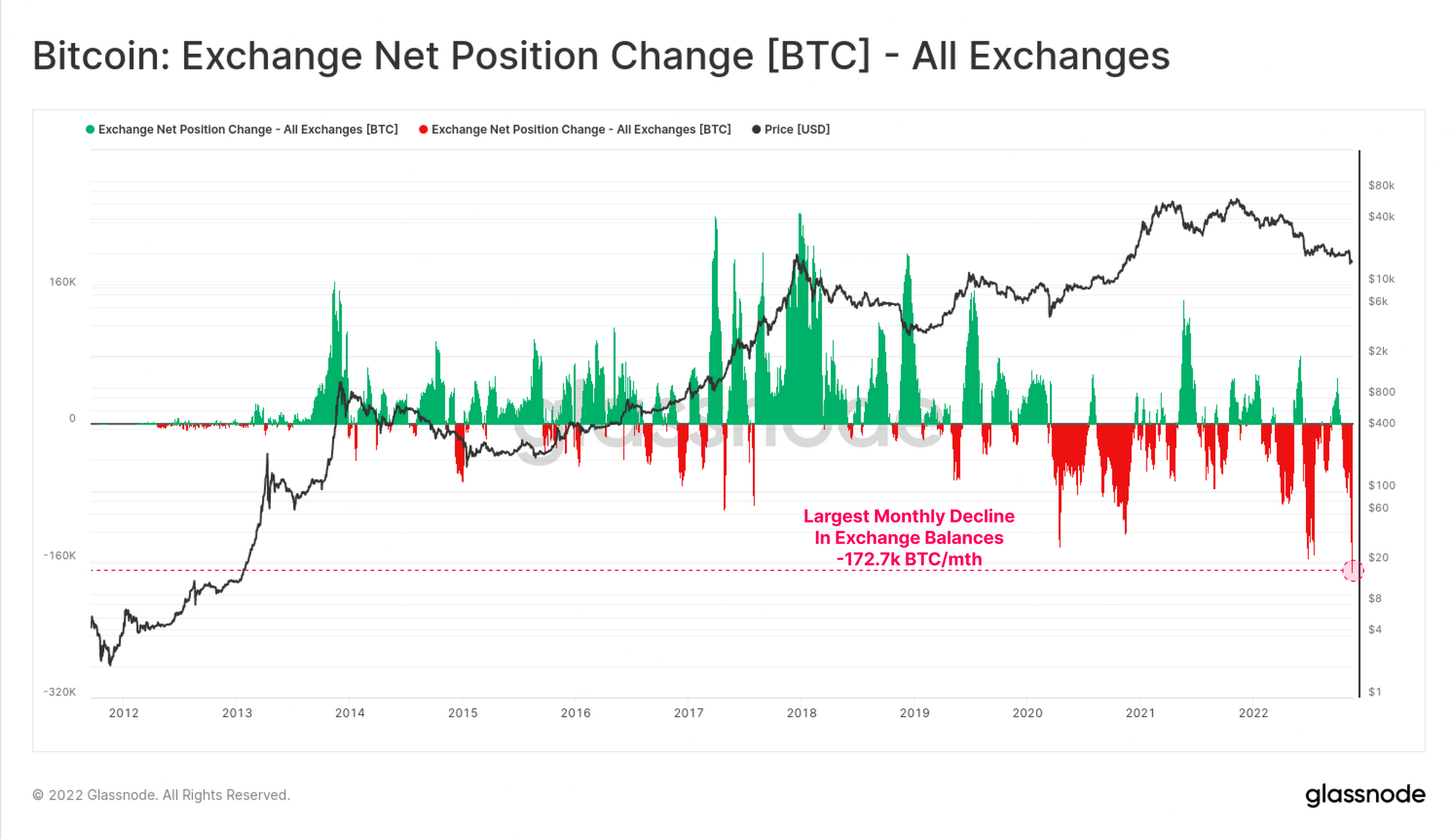

Security in self-storage: Historical number of Bitcoin exit exchanges

According to the latest weekly report from Glassnode, BTC is currently closing exchanges at a rate of 172.7k BTC per month, the highest ever.

The relevant indicator here is the “exchange’s net position change”, which measures the net amount of Bitcoin entering or exiting the wallets of all centralized exchanges per month.

When the value of this metric is positive, it means that investors have deposited their coins on exchanges in the last month. Since investors may have moved to exchanges for selling purposes, this type of trend could have bearish implications for the price.

On the other hand, negative values suggest that holders have withdrawn a net amount of BTC recently. Such a trend, when extended, can be bullish for the price of the crypto, as it can be a sign of accumulation by investors.

Now, here’s a chart showing the trend in Bitcoin exchange net position change over crypto history:

Looks like the value of the metric has been highly negative in recent days | Source: Glassnode's The Week Onchain - Week 47, 2022

As you can see in the graph above, the Bitcoin exchange’s net position change has been deep red over the past couple of weeks.

After the recent plunge, the indicator now has a negative value of 172.7k BTC per month, the highest decline that exchanges have seen in the entire history of BTC.

The main reason behind these record exits can be traced back to the collapse of cryptocurrency exchange FTX.

FTX’s fall and the resulting contagion have once again renewed investor fears about keeping their coins in the custody of exchanges, where they do not own the keys to the wallet.

Because of this resurgent need for self-storage, Bitcoin holders are now withdrawing their coins at unprecedented levels from all sorts of centralized platforms so that they can keep them in their personal wallet.

BTC price

At the time of writing, Bitcoin’s price is hovering around $15.7k, down 6% in the last week. Over the past month, the crypto has lost 18% in value.

The chart below shows the trend in the price of the coin over the last five days.

The value of the crypto seems to have plummeted during the last couple of days | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com