NFT Market Resilience: Analyze Key Trends and Future Prospects from the Balthazar Update

As the non-fungible token (NFT) market continues to make headlines, there’s no denying that its impact on the world of digital assets is nothing short of transformative. The March 2023 Balthazar NFT Marketplace Update provides a snapshot of 10 leading NFT marketplaces, revealing some fascinating trends that warrant further exploration.

Are we witnessing a resurgence or a temporary reprieve in a market that has lost its initial momentum? Let’s dive in and find out.

Market Overview: A return to July 2022 levels

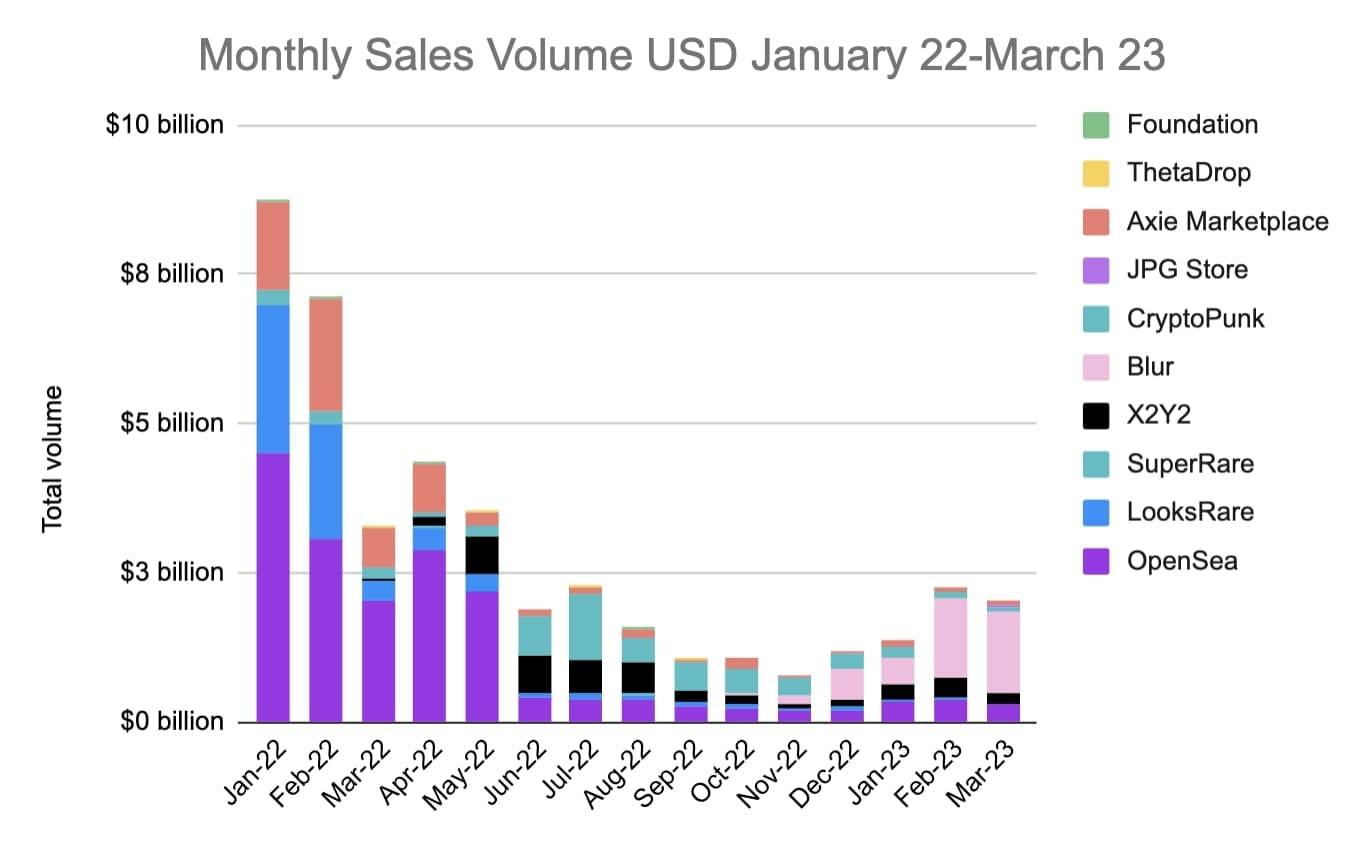

The total trade volume for Q1 2023 was USD 5.67 billion, an impressive increase of 84.2 percent compared to the previous quarter. Although NFT trading volume in March experienced a 9.8 percent decline compared to February, the market has reached levels similar to July 2022. This resurgence signals renewed interest and market sentiment, accompanied by an increasing number of high-quality projects.

Gates Capital Management is reducing risk after rare down years [Exclusive]

Gates Capital Management’s ECF Value Funds have a stellar track record. The funds (full name Excess Cash Flow Value Funds), which invest in an event-driven equity and credit strategy, have produced an annual return of 12.6% over the past 26 years. The funds gained a total of 7.7% in the second half of 2022, surpassing the 3.4% return for Read more

The role of Bitcoin and the rise of ordinals

The recent increase in Bitcoin’s value, which reached USD 30,000 at the time of writing, is positively affecting the overall NFT market. At the same time, Bitcoin Ordinals inscriptions hit over one million, just three months after launch. The emergence of Ordinals, or NFTs, on the Bitcoin blockchain opens up new opportunities for the market and contributes to its long-term sustainability.

In addition, our upcoming launch of Babylon, a software development kit for Web3 game developers, will attract more creators and foster a vibrant ecosystem of NFT-powered applications.

Marketplaces: Winners and Losers

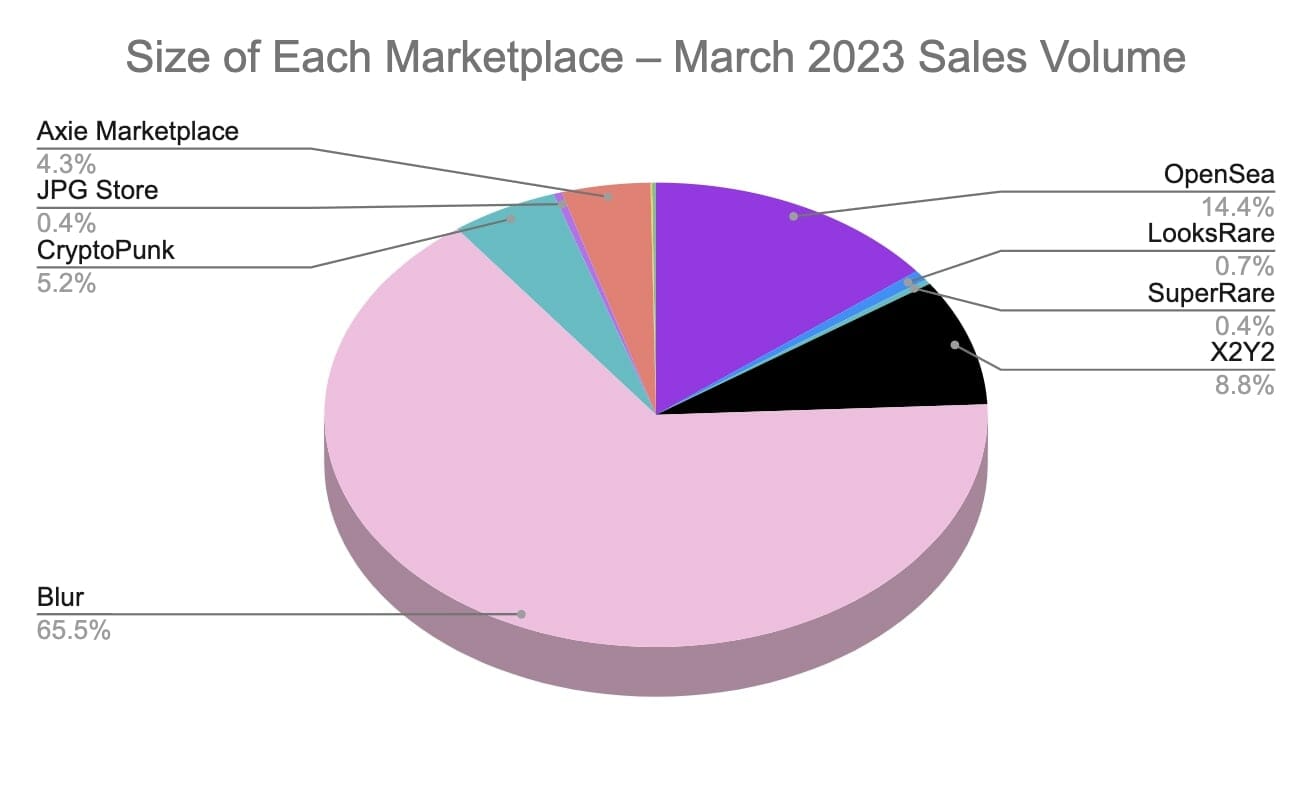

In March, Blur maintained its dominance with the highest trading volume of $1.34 billion, and was one of only two marketplaces to see a month-on-month increase (of 0.5 percent). Axie Marketplace also saw an increase in March compared to February, of 36.6 percent, with USD 88.45 million in trading volume.

In contrast, X2Y2 and LooksRare experienced significant decreases in trade volume, in value and percentage respectively. X2Y2 recorded the sharpest drop in terms of value, falling by USD 153.72 million in March compared to February. While LooksRare faced the most significant percentage-based decline, with a drop of 58.5 percent.

Looking at market share, Blur maintained the lead of the 10 marketplaces, with a 65.5 percent share of trading volume in March 2023, followed by OpenSea with 14.4% and X2Y2 with 8.8%.

Year-over-year comparison

Comparing March 2023 with March 2022, trading volume across the 10 marketplaces fell by a combined 38 percent. Two of the marketplaces, X2Y2 and JPG Store, recorded significant increases, while the remaining eight saw drastic drops in trading volume. LooksRare saw the biggest drop from March 2022, down 95.3 percent.

User trends

With 1.46 million users on the 10 marketplaces in March 2023, we saw a decrease of 7.4 percent from February. But don’t lose hope, as Q1 2023 saw a 6.5 percent increase in user numbers compared to the previous quarter, racking up 4.68 million users.

As for trades, there were 3.78 million of them in March 2023 across the 10 marketplaces combined, which is a drop of 24.4 percent from the previous month. Blur was the lone ranker, as the only marketplace with an increase in trades, while X2Y2 took the biggest hit, falling by 60.5 percent.

As for the average trade size in March, it remained fairly stable at $5,927, falling just 4.3 percent from February. CryptoPunks takes credit for the high average trade size, with a whopping average trade of $30,685 in March. Axie Marketplace had the most significant jump in average trade size, while ThetaDrop faced the biggest drop.

It’s an exciting time to develop innovative technology in this field, as we’re about to unveil Babylon – a software development kit tailored for game developers to create Web3 games. As the NFT market continues to mature and develop, it has enormous potential to foster creativity, innovation and new opportunities, shaping the digital landscape in ways we do not yet fully understand.

About the author

John Stefanidis is the CEO of the NFT gaming platform Balthazar and one of Australia’s leading digital marketing and e-commerce experts. John has developed and scaled several businesses including digital marketing agency, Hidden. As a serial entrepreneur and avid video gamer, John is passionate about the NFT gaming space.