According to data from the Bank for International Settlements (BIS), published in the latest BIS Bulletin No. 69, researchers estimated that most users lost money on average on their investments over the past seven years. Onchain data, calculations from exchanges and cryptocurrency application download statistics compiled by BIS researchers suggest that most median crypto investors lost money from August 2015 to the end of 2022.

BIS report shows that the majority of retail Bitcoin investors have lost money over the past seven years

After publishing recommendations from economists at the Bank for International Settlements (BIS) regarding three guidelines for global regulators, the BIS published a report exploring “cryptoshock and retail losses.” The report basically covers the Terra/Luna collapse and the FTX bankruptcy, where the researchers observed a significant increase in retail activity.

At the time, BIS researchers noted that “large and sophisticated investors” were selling, while “smaller retail investors” were buying. In the section titled “In stormy seas, ‘the whales eat the krill'”, it is detailed that “a striking pattern during both episodes was that trading activity on the three major crypto trading platforms increased markedly.”

BIS researchers note that “larger investors likely paid out at the expense of smaller owners.” The report adds that whales sold a significant portion of bitcoin (BTC) in the days following the initial shocks from Terra/Luna and the FTX collapse. “Medium-sized owners, and even more so small owners (krill), increased their holdings of bitcoin,” the BIS researchers explain.

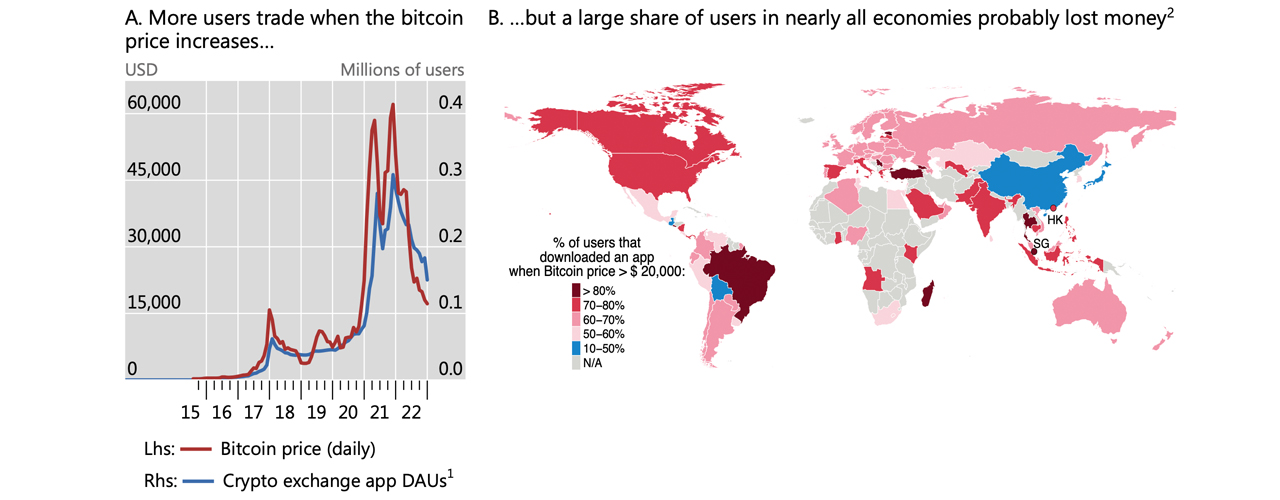

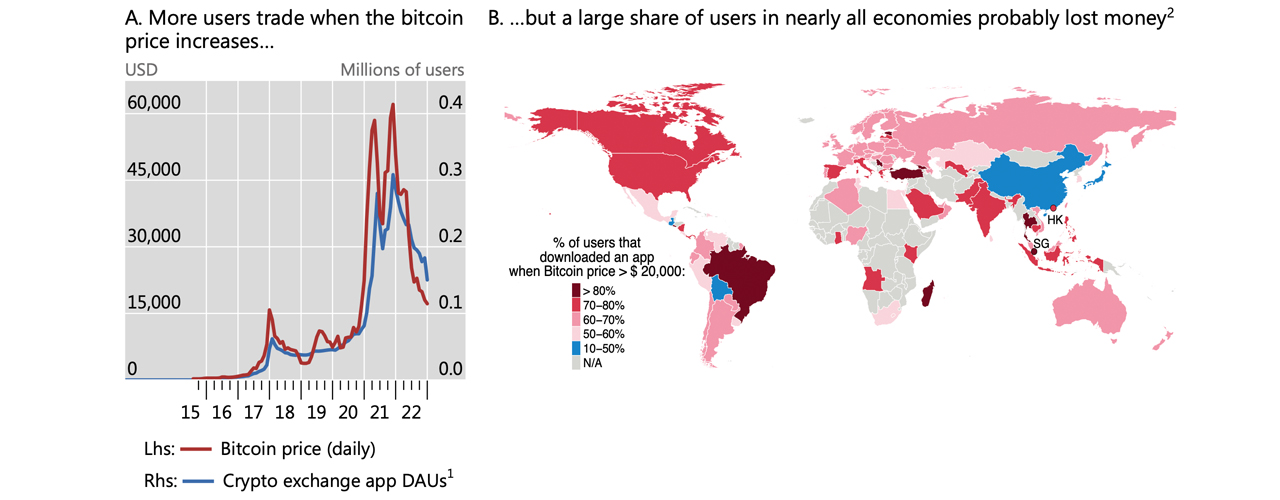

In the second part of the report, BIS calculated metrics from onchain data, overall application download statistics and exchange data to assess whether most average cryptocurrency investors have made or lost money over the past seven years. The data was collected from August 2015 to mid-December 2022, in a section titled “Retail investors have chased prices, and most have lost money.”

The BIS conducted a series of simulations, for example dollar-costing an average of $100 in BTC per month, and concluded that over the seven-year period “a majority of investors probably lost money on their bitcoin investment” in almost all economies in the researcher’s sample. Despite the activity stemming from the Terra/Luna fiasco, the FTX bankruptcy and statistics indicating that the median cryptocurrency investor has lost money over the past seven years, BIS researchers insist that “cryptocrashes have little impact on broader economic relationship.”

The retail losses and patterns still suggest to BIS researchers that there is a need for “better investor protection in the crypto space.” While the analysis shows that there was a “precipitous decline in the size of the crypto sector”, it has “not had ramifications for the wider financial system so far.” However, BIS researchers argue that if the crypto-economy were more “intertwined with the real economy”, crypto shocks would have far greater consequences.

Tags in this story

Analysis, Bank for International Settlements, BIS, BIS Bulletin, BIS report, BIS research, BIS researchers, BIS study, Bitcoin, crypto sector, crypto shock, crypto space, crypto trading platforms, cryptocurrency application, cryptocurrency market, Digital Assets, economists, Economy, financial conditions , financial stability , FTX bankruptcy , global regulators , Investments , investor protection , larger investors , market swings , Onchain data , retail crypto investors , retail losses , smaller holders , Terra/Luna collapse , trading activity , broader financial system

What do you think of the BIS report on crypto shock and retail losses? Let us know your thoughts in the comments section below.

Jamie Redman

Jamie Redman is the news editor at Bitcoin.com News and a financial technology journalist living in Florida. Redman has been an active member of the cryptocurrency community since 2011. He has a passion for Bitcoin, open source and decentralized applications. Since September 2015, Redman has written more than 6,000 articles for Bitcoin.com News about the disruptive protocols emerging today.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is directly or indirectly responsible for damages or losses caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.