Minu knows that finances and employee well-being are connected, so it built 30 gamified benefits • TechCrunch

Minu, a Mexico-based employee wellness company, raised $30 million in new funding as it continues to build out its gamified and rewards features, including saving or completing financial education courses, while improving retention for employers.

Company co-founder and CEO Nima Pourshasb told TechCrunch that 80% of Mexicans live paycheck to paycheck without saving, while a third often need to take out loans to cover basic, recurring expenses.

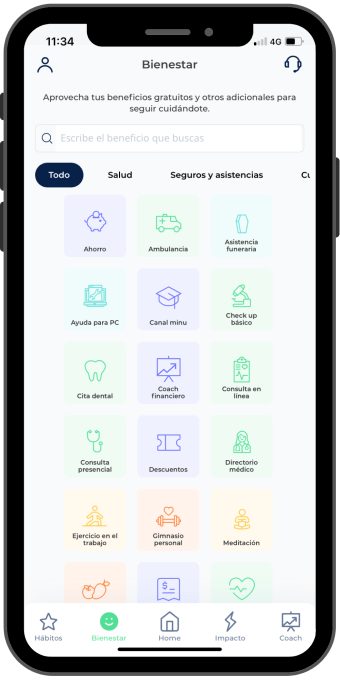

Minus apps for finances and employee well-being Image credit: Minutes

“The pandemic was a big part of that more humanistic approach to taking care of employees,” Pourshasb said. “We saw a market movement toward employee wellness and the use of technology to improve the quality of life — the financial, physical and mental health of employees.”

He also explained that Mexican regulations helped: The country passed legislation, known as Nom 35, which requires companies to monitor the stress of their employees and have mechanisms in place to help them.

“The main source of stress is often financial, so that’s been a really big booster,” Pourshasb added.

The new capital is a combination of $10 million in a bridge round from Coppel Capital, Besant Capital and Enea Capital, as well as existing investors FinTech Collective, QED and Salkantay, and $20 million in debt from Accial Capital. In total, Minu collected 50 million dollars.

Pourshasb declined to disclose Minus’s valuation, but said that with the new funds, the company has a runway of 22 months.

In 2021, my colleague Mary Ann Azevedo profiled Minu when it raised $14 million in Series A funding. At the time, the pay-on-demand company, founded by Pourshasb, Rafael Niell and Paolo Rizzi, worked with 100 corporate clients and had only one product, Earned Pay Access, which provides instant access to employees’ earned wages for a flat $2 withdrawal fee.

Almost two years later, Minu has over 300 corporate clients, such as Grupo Modelo, Coppel and Cinemex, and revenues grew more than five times between 2021 and 2022.

Also new is a SaaS subscription model where half of revenue is now generated, paid for by employees, so it’s free for employees to take advantage of the now over 30 benefits that include access to health and mental health via telemedicine, insurance discounts, financial education, bill payment and virtual training sessions.

In addition, Minu has a new credit union-as-a-service that enables employers to offer savings starting at 8% for fully liquid deposits and cheap flexible loans. It can be compared to 400% annual percentage rate for a loan in a traditional Mexican bank.

Employees who use financial education or training and outreach content can receive rewards, such as increased savings rates and life insurance amounts.

In the meantime, the company intends to use the new capital to continue distribution among customers and continue the development of its employee wellness platform to include more modules for human resources and finance managers. Minu will continue its focus on Mexico, expanding to Monterrey, Guadalajara and Yucatan.

“Mexico is where we see great opportunity,” Pourshasb said. “The biggest opportunity for us is to continue to expand geographically in Mexico with companies of all sizes, continue to take advantage of the tremendous inertia and positioning that we have in the market.”