MENA’s 10 most funded fintech startups

RIYADH: The entrepreneurial ecosystem has been on the rise in the Middle East and North Africa region for some time, with technology-based sectors beginning to dominate the business landscape.

Financial technology, popularly known as fintech, has been a promising sector for business people and investors alike, with startups entering and exiting the industry like never before.

The numbers speak for themselves. Startup funding increased by 540 percent in the first quarter of 2022 compared to the same time last year, Dubai-based MAGNiTT, a startup research platform, reported.

To get a sense of the action in the fintech domain, Arab News has compiled a list of the 10 most funded fintech startups in the MENA region.

Foodics

Founders Ahmad Al-Zaini, Musab Al-Othmani

Financing 198 million dollars

rounds: 5

Investors 17 investors including STV, Sanabil and Prosus

Headquarters Saudi Arabia

Foodics offers a point-of-sale management system for restaurants that allows business owners to keep track of all operations, from the kitchen to employees and sales.

The company offers many facilities that support restaurant operations, including microloans and payments to food and beverage outlets.

In its latest funding round, Foodics secured $170 million in a Series C round, enabling the company to grow its fintech arm and microloans.

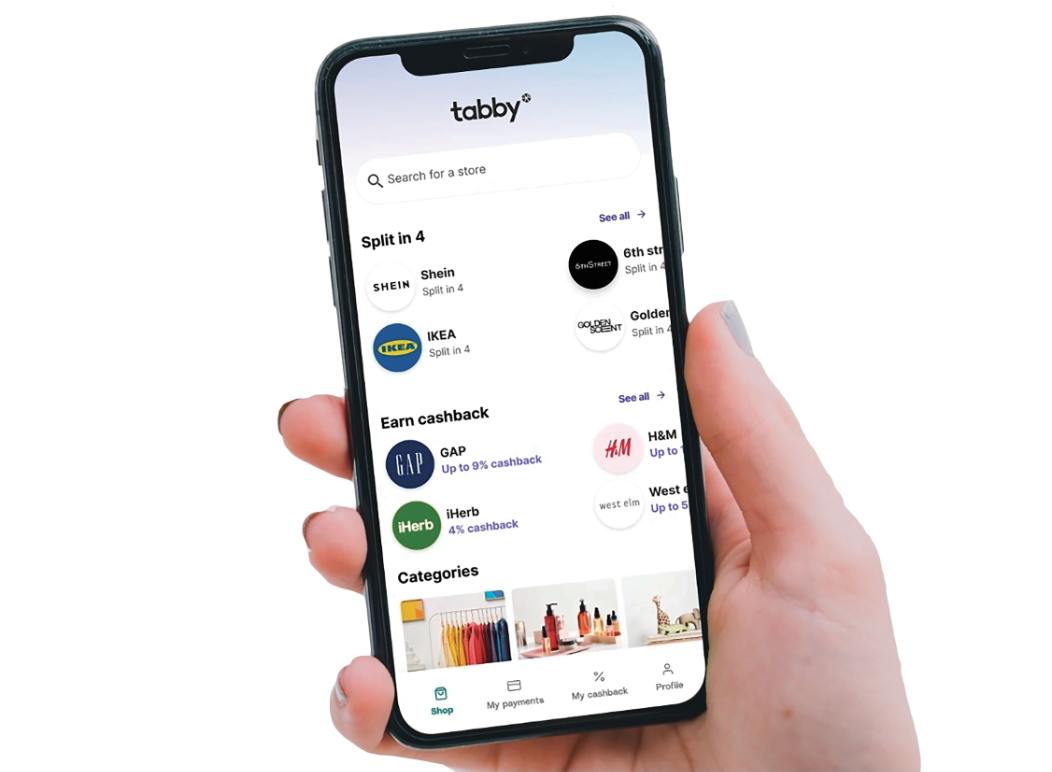

Tabby

Founders Hosam Arab, Daniil Barkalov

Financing 186 million dollars

rounds 7

Investors 19 investors including STV, Global Founders Capital and Raed Ventures

Headquarters UAE

One of the leading buy-now-pay-later platforms in the region, Tabby aims to provide financial freedom to buyers by offering solutions without interest or debt fees.

With a focus on retail, the company wants to improve the shopping experience of its loyal customers by offering a flexible payment experience.

Tabby raised $54 million in its latest Series B round, and it aims to use it to expand its product offerings.

Tamara

Founder Abdulmohsen Al-babtain, Abdulmajeed Al-sukhan, Turki Bin Zarah

Financing 116 million dollars

rounds 4

Investors 9 investors including Impact46, CheckOut.com and Nama Ventures

Headquarters Saudi Arabia

Another pioneer in the buy-now-pay-later market, Tamara is a Saudi-based fintech that offers its solutions to both sellers and buyers.

The company aims to create a seamless experience for customers by offering a zero interest fee for its services.

In 2021, Tamara raised $110 million in a Series A round, making it a record-breaking round last year.

Paymob

Founder Islam Shawky, Alain El-Hajj, Mostafa Menessy

Financing 68.5 million dollars

rounds 4

Investors 10 including PayPal Ventures, Nclude and A15

Headquarters Egypt

Paymob, one of the players that changed the game in the Egyptian market, is a complete fintech solution for emerging markets and SMEs.

The company offers a complete digital payment solution for businesses to accept payments online and in store.

Founded in 2015, Paymob raised $50 million in a Series B funding round in May 2022, which was used in product development and market expansion.

Late payment

Founder Tariq Sheikh

Financing 63.5 million dollars, according to Forbes

rounds Undisclosed

Investors Tap on Ventures and AfterPay

Headquarters UAE

Founded in 2019, Postpay is a flexible payment company that offers customers to pay in three monthly interest-free installments in its partner stores.

The company works with leading global brands such as H&M, Footlocker, Dermalogica and domestic merchants such as The Entertainer and Squat Wolf.

Last June, the company secured $10 million in equity investment; the funds will be used to drive the expansion plans across the MENA region.

HyperPay

Founder Muhannad Ebwini

Financing 50.5 million dollars

rounds 4

Investors 8 including Mastercard and AB Ventures

Headquarters Saudi Arabia

HyperPay offers a payment gateway for online businesses to accept and manage

online payments with flexibility and security.

Founded in 2014, the company has an extensive network of partners with banks across the Middle East and North Africa to better facilitate online payments in local currency.

In its latest funding round, HyperPay secured $36.7 million in June 2022 to enable the company to expand its team and introduce new payment solutions.

Khazna

Founder Omar Saleh, Ahmed Wagueeh, Fatma Shenawy

Financing 47 million dollars

rounds 7

Investors 12 including Quona Capital, Khawazimi Ventures and Nclude

Headquarters Egypt

Another Egyptian fintech startup topping the list, Khazna, is a financial super app that offers a wide range of solutions for underserved individuals.

The company aims to give

the 20 million underserved Egyptians with banking and financial options via their smartphones.

Founded in 2019, the company raised $38 million in March 2022, allowing it to replace cash-driven options across Egypt.

BitOasis

Founder Daniel Robenek, Ola Doudin

Financing 30 million dollars

rounds 6

Investors 15 including Wamda and Jump Capital

Headquarters UAE

A new type of fintech added to the list, BitOasis is a cryptocurrency trading platform that offers a digital asset wallet.

Founded in 2015, the company allows users to buy, sell, trade and exchange crypto assets in the UAE.

BitOasis raised $30 million in its latest funding round, gaining approvals from the Abu Dhabi General Market and partnering with law enforcement units to combat crypto fraud.

Tel

Founder Khalil Alami

Financing 28.9 million dollars

Round 4

Investors 4 including Cashfree Payments and iMena Group

Headquarters UAE

Telr is an award-winning payment gateway provider, with offices in Singapore, UAE, India and Saudi Arabia.

The company offers businesses a set of application programming interfaces and tools to enable them to accept and manage online payments.

Telr raised $15 million in a 2021 funding round of India-based Cashfree Payments to better facilitate cross-border payments.

Payment tables

Founder Abdulaziz Al Jouf

Financing 25.3 million dollars

rounds 2

Investors Saudi Aramco

Headquarters Saudi Arabia

Another award-winning startup, Paytabs, is a B2B online payment solutions provider that aims to provide merchants with digital payment capabilities on their websites.

The company provides application programming interfaces to facilitate transactions in multiple currencies and other markets.

Founded in 2014, Paytabs is a Saudi Aramco-backed company that currently operates in the UAE, Saudi Arabia and Egypt.